This put up is a part of a sequence sponsored by TSIB.

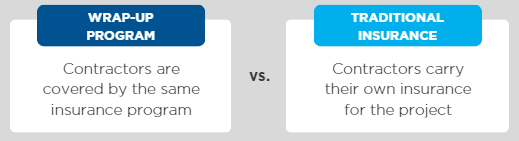

A key issue when contemplating a CIP or Wrap-Up is having the dealer conduct a feasibility examine for the Wrap-Up Sponsor. A feasibility examine is a instrument that’s used to check the prices between implementing a

Right here we’ll focus on the significance of feasibility research within the analysis of a possible Wrap-Up, the information used to create them, and steering on what to search for in a potential Wrap-Up undertaking.

Apart from being a fantastic danger administration instrument, a serious promoting level for utilizing a Wrap-Up is for these tasks assembly a sure criterion, the value to insure the undertaking with a Wrap-Up is normally cheaper than the standard insurance coverage technique.

Insurance coverage Prices

With conventional insurance coverage, the associated fee is a straightforward calculation. That is the sum of the insurance coverage every contractor contains of their contract worth, plus any funding for deductibles that apply to these insurances.

Wrap-Up prices are measured equally. The prices are the premiums paid to this system carriers, plus the price of losses inside the Wrap-Up deductible and any collateral that could be required.

The feasibility examine estimates these prices, permitting the Wrap-Up Sponsor to check them and make an knowledgeable resolution on whether or not to maneuver ahead with a Wrap-Up program. Because of the essential position feasibility research have within the decision-making course of, the information that goes into them is equally essential.

Knowledge Factors

When conducting a feasibility examine, a number of information factors are collected, together with:

- price range estimates for the undertaking

- undertaking schedule

- payroll estimates are damaged down by WC class codes

- insurance coverage value charges for the assorted trades concerned within the undertaking

- Wrap-Up charges

- estimates for undertaking loss picks

- collateral value estimates

Sadly, most of this info isn’t one thing you’ll be able to merely lookup. Not all Brokers or Consultants have this information both. That’s why it’s essential to work with a Dealer who has the breadth of information, precise expertise with Wrap-Up placements, and Wrap-Up administration in a number of jurisdictions. It’s particularly essential to work with a Dealer who has carried out/managed a Wrap-Up program in the identical jurisdiction your undertaking is in. A great Dealer/Advisor is not going to solely have high quality information to make use of within the feasibility examine however will have the ability to consider good Wrap-Up prospects.

Undertaking Standards

Not all tasks are an excellent match for a Wrap-Up program. Originally of the method, an excellent Dealer will consider the undertaking to ensure it’s a good match for a Wrap-Up. This prevents stakeholders from being too invested in this system and losing their time/cash on a program that doesn’t make sense for his or her undertaking.

When evaluating this, it’s essential to have a look at the Wrap-Up selection as there are 2 fundamental varieties: single undertaking packages and rolling packages.

Single Undertaking Packages

Single undertaking Wrap-Ups are likely to yield one of the best monetary outcomes for tasks which can be over $250M in development quantity. Bigger tasks have a higher economic system of scale the place carriers get to cost increased premiums, making the location extra enticing to them. Nonetheless, their value is way extra prone to nonetheless be cheaper than what the contractors would cost for their very own insurance coverage.

On smaller tasks, the Wrap-Up carriers would probably run into minimal premium necessities probably making their program value equal to or increased than the standard value of insurance coverage.

The one exception to this rule can be when using a GL-Solely Wrap-Up. These packages are positioned nearly completely within the Extra and Surplus traces market and may accommodate single undertaking packages as small as $50M in nearly any jurisdiction.

Rolling Packages

Rolling packages are the reply to that “smaller undertaking downside.” Wrap-Up Sponsors with a gentle move of labor however usually smaller tasks can go for rolling all of their work right into a Rolling Wrap-Up. These work finest for tasks below $150M with a complete annual enrollment of not less than $350M.

Whether or not you’re a undertaking proprietor, common contractor, or dealer that wants assist deploying a Wrap-Up in your consumer, TSIB might help. TSIB has positioned Wrap-Ups with a mixed complete of $120B in development quantity and enrolled over 39K contractors into our Wrapworks portal. We’re a extremely specialised insurance coverage providers agency that focuses on the development trade and Wrap-Up placement. We have now the market fame and expertise to help you with any Wrap-Up prospect you’re contemplating.

Keen on studying how partnering with TSIB might help your upcoming undertaking? Converse with one in all our Wrap-Up Consultants and schedule a free feasibility examine.

A very powerful insurance coverage information,in your inbox each enterprise day.

Get the insurance coverage trade’s trusted e-newsletter