The most important cyberattack on Allianz Life on the finish of July 2025 will likely be damaging to insurance coverage as a result of scale of the assault and a piece of shoppers’ considerations round sharing private information. Reportedly, the assault impacted nearly all of Allianz Life’s US prospects and staff. This makes it one of many largest reported cyberattacks in insurance coverage, as Allianz Life has round 1.4 million prospects within the US.

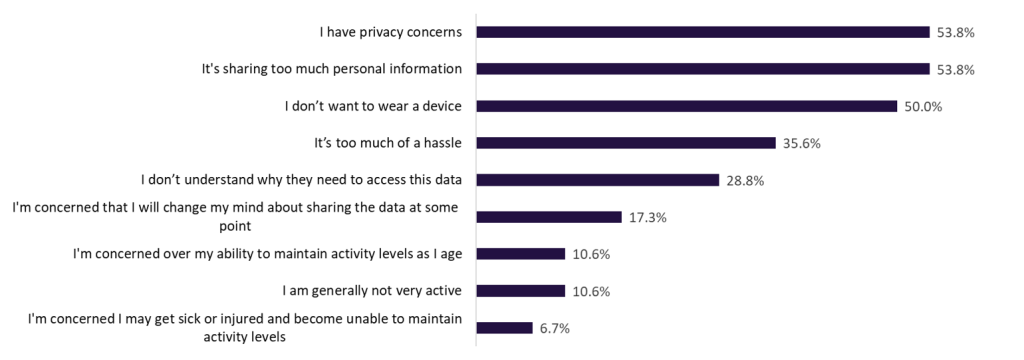

GlobalData’s 2024 Rising Tendencies Insurance coverage Client Survey discovered that one of many fundamental points shoppers have with sharing private information is privateness considerations. Of the US shoppers who wouldn’t be keen to share health and wellness data with their life and well being insurer through an Web of Issues system, 53.8% mentioned it was as a result of it concerned sharing an excessive amount of data. Due to this fact, one of the crucial damaging points of this story to the broader insurance coverage trade could also be diminished belief in sharing private information with insurers. Well being and medical information is very delicate, which is why this will likely be particularly damaging.

Why would you not be keen to put on an exercise (or biotech accent) and sharing the outcomes with a life or personal medical insurance coverage firm? (US, 2024)

The dimensions of this assault has made it a world information story reported not simply within the insurance coverage press however by mainstream publications such because the BBC, FT, and others. This may also elevate the profile of the chance of cyberattacks for companies, and particularly insurers.

GlobalData’s 2025 UK SME Insurance coverage Survey discovered that 26.2% of SMEs within the UK purchased their cyber insurance coverage coverage owing to media experiences about different companies dealing with cyberattacks, whereas 19.3% have a coverage particularly as a result of a competitor of theirs fell sufferer to an assault.

General, the story is significantly damaging for Allianz Life. It must pay giant fines and is already dealing with a category motion swimsuit. The dimensions of the story can be prone to be damaging to the broader insurance coverage trade by way of shoppers’ willingness to share private information. There may also be reputational injury to Allianz Life particularly, particularly within the US the place the incident occurred. Private information is important to life and well being insurers to assist tailor insurance policies and enhance behaviours to cut back threat. One small optimistic for the bigger insurance coverage trade is that it’ll elevate consciousness of the threats that even the most important and greatest run companies can face, and this can be a good instance of why companies ought to have a complete cyber insurance coverage coverage in place.