The authorized occupation has skilled many transformations over the previous yr, however maybe none as dramatic as the basic shift in how authorized professionals method insurance coverage protection. In a shocking reversal from earlier years, 45% of authorized professionals are actually upgrading their insurance coverage insurance policies, a staggering leap from simply 14% who had such plans in 2024. Whereas different regulation agency developments have shocked us this yr, this one could take the cake.

This shift displays a reimagining of how authorized professionals view safety, threat, and strategic enterprise planning. The regulation agency developments from our 2025 Authorized Danger Index reveal a occupation that’s shifting from reactive protection buying to proactive threat administration, treating insurance coverage not as a obligatory operational expense however as a strategic enabler of development and innovation.

From Underinsured to Strategic

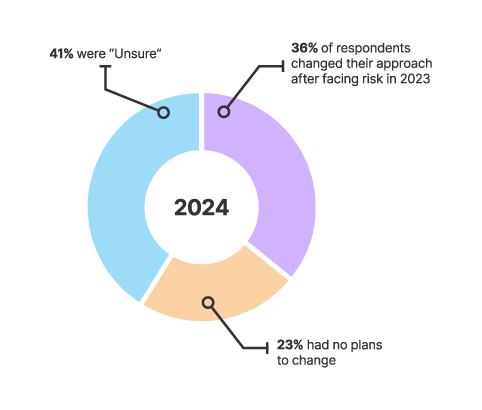

The shift is outstanding when considered in opposition to the backdrop of earlier years. Authorized professionals traditionally reported feeling underinsured whereas concurrently missing concrete plans to handle protection gaps. The trade appeared caught in a cycle of understanding they wanted higher safety however struggling to translate that consciousness into motion.

That cycle is displaying indicators of breaking. The threefold enhance in professionals upgrading their insurance policies indicators a serious change in how authorized professionals perceive the connection between safety and alternative. This seems to be pushed by the popularity that complete insurance coverage protection doesn’t constrain enterprise development; it permits it.

The arrogance degree accompanying this shift is equally putting. A powerful 77% of authorized professionals now categorical confidence that their present insurance coverage insurance policies cowl their biggest enterprise dangers, representing a dramatic enchancment in each protection adequacy {and professional} consciousness of what that protection truly gives.

The Excellent Storm of Consciousness

So, what drove this pattern? It seems to be a mixture of things that created each urgency and alternative for protection enhancement.

The fast adoption of AI applied sciences, leaping from 22% to 80% utilization amongst authorized professionals, launched new legal responsibility exposures that present insurance policies could not have adequately addressed. As corporations started integrating AI instruments into their day by day operations, the potential for skilled legal responsibility claims associated to over-reliance on know-how or information privateness breaches grew to become actual issues quite than theoretical dangers.

Concurrently, the shift in inside threat priorities from monetary pressures to reputational and employment-related challenges highlighted protection areas that many corporations had beforehand neglected or undervalued. Employment practices legal responsibility insurance coverage, for example, gained new significance as workplace-related claims tied for the highest inside threat at 47%.

The financial stabilization that allowed authorized professionals to focus past instant monetary survival additionally created the muse for strategic insurance coverage planning. With inflation issues dropping from 52% to twenty-eight% as a major fear, corporations might redirect consideration and assets towards complete threat administration quite than crisis-driven value reducing.

Cyber Insurance coverage: From Non-compulsory to Important

Maybe nowhere is the insurance coverage awakening extra evident than in the evolution of cyber insurance coverage protection. The information reveals a dramatic shift in each consciousness and implementation of cyber safety, with uncertainty about protection dropping considerably throughout the occupation.

In earlier surveys, 23% of authorized professionals admitted they didn’t know if their present insurance coverage insurance policies would cowl in opposition to information breach dangers. That determine has plummeted to only 3% in 2025, indicating not simply improved protection however enhanced understanding of what safety corporations even have in place.

The share of corporations with out devoted cyber insurance coverage has additionally dropped, from 22% to 14% year-over-year. Extra considerably, the variety of authorized professionals who imagine their insurance policies would absolutely cowl in opposition to cyber dangers has elevated from 26% to 33%, whereas these assured in partial protection jumped from 30% to 50%.

This displays the authorized occupation’s recognition that cyber threats aren’t hypothetical future issues however present-day operational realities. The combination of AI instruments, elevated digital operations, and the delicate nature of authorized data have made cyber insurance coverage as basic to regulation agency operations as malpractice protection.

Does your regulation agency use AI?

On this webinar with Reminger Legislation Agency and Everest, we discover the use-cases of AI in authorized follow, the most effective instruments for the job, the dangers, and the advantages for attorneys.

The Danger-Taking Paradox

One of the crucial intriguing elements of this pattern is its correlation with elevated risk-taking conduct amongst authorized professionals. Somewhat than being defensive reactions to perceived threats, protection upgrades look like enabling bolder enterprise methods.

The information reveals that 37% of authorized professionals now view threat as a development alternative, greater than doubling from the 18% who held this angle only one yr prior. This shift towards embracing threat coincides straight with the growth of insurance coverage protection, suggesting that complete safety is offering the arrogance basis that allows strategic risk-taking.

This dynamic represents a complicated understanding of threat administration that goes past easy loss prevention. In consequence, authorized professionals appear to more and more view insurance coverage protection as a strategic asset that allows them to pursue alternatives they could in any other case keep away from as a result of potential draw back publicity.

The correlation extends to AI adoption as properly. The dramatic surge in AI utilization from 22% to 80% occurred alongside the insurance coverage protection growth, with many corporations probably recognizing that new applied sciences require new protections. Somewhat than avoiding AI as a result of legal responsibility issues, authorized professionals look like addressing these issues by way of enhanced insurance coverage protection whereas continuing with strategic implementation.

Strategic Protection Planning

This insurance coverage pattern has created alternatives for authorized professionals to method protection planning extra strategically than ever earlier than. The bottom line is understanding that insurance coverage buying choices ought to align with enterprise technique quite than merely assembly minimal necessities or trade requirements.

Profitable protection planning begins with complete threat evaluation that goes past conventional classes to incorporate rising threats like AI legal responsibility, reputational injury, and evolving employment practices exposures. This evaluation ought to contemplate not simply present operations however deliberate enterprise developments and development methods.

The correlation between insurance coverage protection and risk-taking conduct means that protection choices needs to be built-in into strategic planning processes quite than handled as separate administrative features. Corporations planning to broaden AI utilization, enter new follow areas, or pursue aggressive development methods ought to guarantee their insurance coverage applications can help these initiatives.

Common protection evaluations have grow to be important given the fast tempo of change in each authorized follow and threat publicity. The authorized professionals who’re thriving within the present surroundings are those that deal with insurance coverage as a dynamic enterprise instrument quite than a static safety mechanism.

Legislation agency developments 2026: Wanting Ahead

This pattern positions authorized professionals to navigate future challenges with larger confidence whereas pursuing alternatives that may beforehand have appeared too dangerous to try. The corporations which have embraced this are constructing aggressive benefits that stretch far past easy loss safety.

The correlation between enhanced insurance coverage protection and elevated enterprise confidence means that the awakening will proceed to drive optimistic enterprise outcomes for authorized professionals who perceive insurance coverage as a strategic enabler quite than a obligatory value.

This shift represents only one aspect of how authorized professionals are basically reimagining their relationship with threat, remodeling safety methods whereas embracing unprecedented alternatives for development and innovation.

Learn the entire Authorized Business’s 2025 Danger Index to entry complete insights, detailed protection evaluation, and strategic suggestions for navigating the evolving authorized panorama with confidence and aggressive benefit.