Almost half of UK customers are open to buying a journey insurance coverage coverage that pays out routinely, GlobalData surveying has discovered. On the identical time, main airports—together with Heathrow, Dublin, and Brussels—proceed to face important disruption following a cyber assault over the weekend.

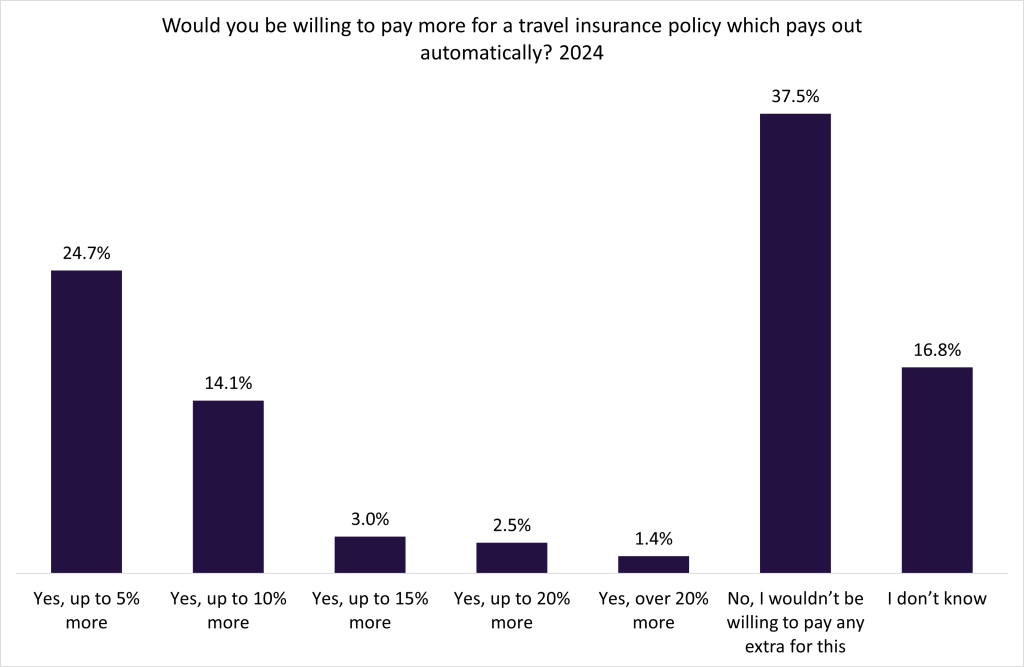

In accordance with GlobalData’s 2024 UK Insurance coverage Shopper Survey, 45.7% of UK customers could be keen to pay extra for a journey insurance coverage coverage that pays out routinely. Of those, 24.7% would settle for a rise of as much as 5%, whereas 14.1% would pay as much as 10% extra. In distinction, 37.5% stated they’d not be keen to pay further and 16.8% have been not sure.

The cyber assault throughout Heathrow, Dublin, Brussels and different European airports has led to dozens of flight cancellations, tons of of delays, and lengthy queues as workers have been pressured to depend on handwritten tags and guide redeployments. In such instances, parametric journey insurance coverage could be particularly invaluable because it triggers automated payouts when predefined occasions happen, reminiscent of delays or cancellations. This eliminates prolonged claims processes and offers travellers with quicker monetary aid throughout surprising disruptions.

The incident additionally highlights the rising risk of cyber assaults throughout industries. As digital vulnerabilities proceed to escalate, the necessity for strong safety is changing into extra pressing. GlobalData’s 2025 UK Industrial Insurance coverage Dealer Survey discovered that 53.6% of brokers cited cyber insurance coverage as the brand new or rising product with the best development potential; reflecting rising demand from companies searching for to safeguard towards operational and monetary disruption.

For insurers, the disruption underscores the necessity to higher promote parametric journey insurance coverage as an answer for travellers going through mounting dangers of cancellations and delays. On the identical time, there’s a rising must place cyber insurance coverage not simply as monetary safety, however as a preventative software that permits airports, airways, and different companies to detect, mitigate, and reply to assaults extra successfully. This twin focus highlights the significance of accelerating efforts to lift consciousness and uptake of each parametric and cyber protection; guaranteeing they’re seen as important safeguards for companies and travellers navigating an increasingly-hostile digital atmosphere.