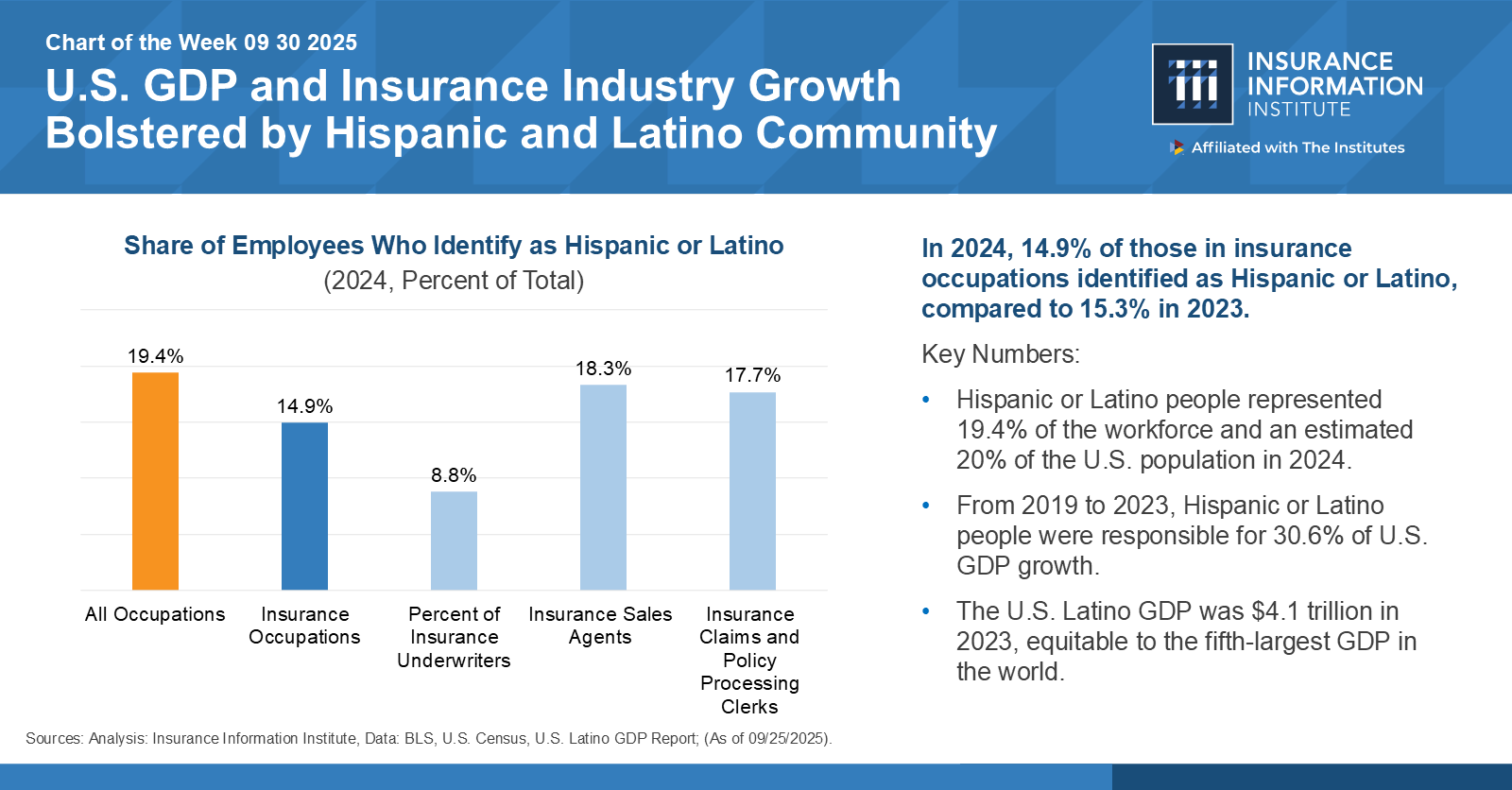

At the same time as Latinos proceed to play an important function within the U.S. economic system, Latino illustration of insurance coverage business employees fell barely in 2024, to 14.9 %, from 15.3 % in 2023, in accordance with a current Triple-I “Chart of the Week”. The best illustration of this demographic was 18.3 % of insurance coverage gross sales brokers, with claims and coverage processing clerks following carefully, at 17.7 %. The bottom illustration was amongst underwriters, at 8.8 %.

The chart — “U.S. GDP and Insurance coverage Trade Progress Bolstered by Hispanic and Latino Group.” — relies on knowledge from the Bureau of Labor Statistics and the U.S. Latino GDP report.

From 2019 to 2023, Latinos drove 30.6 % of U.S. GDP progress regardless of making up solely about 20 % of the general U.S. inhabitants (by 2024) and 19.4 % of the workforce. Latinos generate a GDP of $4.1 trillion by 2023 (up from $3.7 trillion in 2022), enough to rank alone because the fifth-largest GDP on this planet. The Latino shopper market, with $2.7 trillion in consumption in 2023, has a shopping for energy bigger than the economies of powerhouse states equivalent to Texas ($2.58 trillion) and New York ($2.17 trillion).

The Nationwide Affiliation of Hispanic Actual Property Professionals predicts that Latinos would be the largest group of homebuyers within the nation by 2030. Homeownership for this group is 9.8 million households, with 238,000 new Latino proprietor households added in 2023 alone —the biggest enhance of any racial or ethnic group for the second consecutive 12 months. Knowledge evaluation signifies there could also be greater than 30 million new Latino drivers hitting the roads by means of 2050. Latinos are additionally the fastest-growing group of entrepreneurs, in accordance with the Stanford Latino Entrepreneurship Initiative.

Successfully participating this formidable market creates immense alternative for the insurance coverage business. Nonetheless, solely simply over half of the respondents to a survey performed by Marsh and the Latin American Affiliation of Insurance coverage Businesses (LAAIA) mentioned they believed their corporations have been invested in attracting Hispanic prospects. Practically two-thirds of respondents mentioned insurers don’t make use of sufficient Latinos. Solely 14 % thought insurers employed an enough quantity. Furthermore, 84 % agreed that Latinos are underrepresented within the senior administration of most insurance coverage corporations.

Efforts to create a various and inclusive workforce can drive better shopper satisfaction and loyalty. As Amy Cole-Smith, Government Director for BIIC/ Director of Variety at The Institutes, has identified, “this isn’t nearly fairness —it’s about unlocking progress and staying aggressive in a altering market. When the insurance coverage workforce displays the variety of the market, we’re in a stronger place to construct merchandise that meet individuals the place they’re.”