A GlobalData ballot has discovered that embedded insurance coverage is rising because the main distribution channel for private traces over the subsequent 5 years. Automakers and different client manufacturers that combine cowl on the level of sale or into possession journeys will likely be finest positioned to seize new prospects, enhance conversion, and enhance retention.

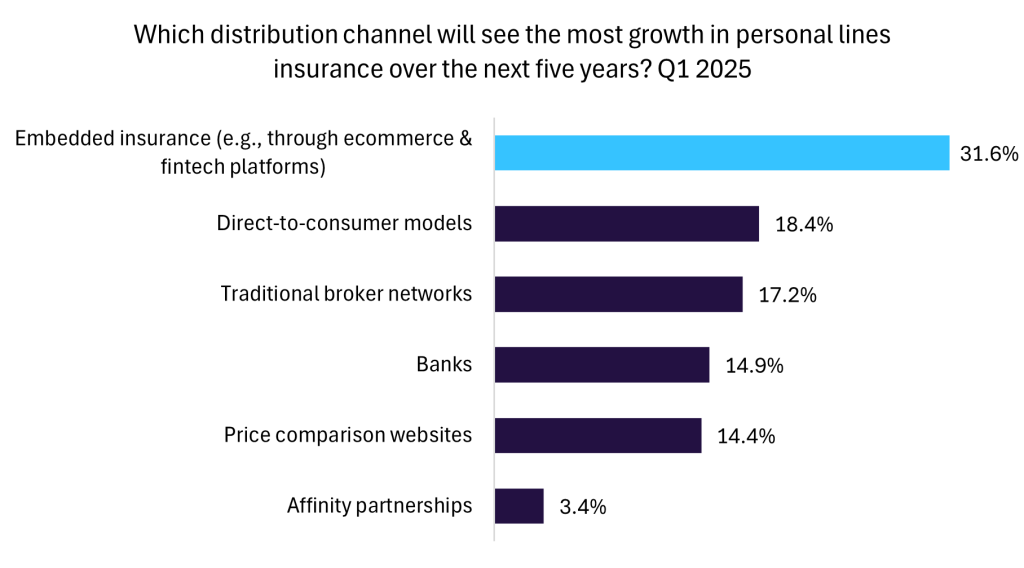

The ballot, carried out in Q1 2025 amongst trade professionals, discovered that 31.6% count on embedded insurance coverage to see probably the most progress in private traces, outpacing direct to client fashions (18.4%), conventional dealer networks (17.2%), banks (14.9%), worth comparability web sites (14.4%), and affinity partnerships (3.4%). That margin signifies a significant shift in distribution channels and client expectations towards seamless, contextual buying.

Suzuki’s latest multi-year partnership with UK embedded insurance coverage platform Wrisk gives a transparent instance of how a automotive producer can operationalise this strategy. Wrisk will ship the core digital platform and middleman companies to allow a month-to-month rolling motor insurance coverage subscription for UK Suzuki prospects, embedding insurance coverage into buy and possession touchpoints resembling at sale, alongside financing, or via submit sale portals and apps. By providing steady cowl with simplified onboarding, versatile billing, and simpler renewals or cancellations, Suzuki goals to ship a friction-reduced, brand-aligned buyer expertise that reduces leakage to third-party suppliers and helps greater lifetime worth via subscription revenues and cross promote alternatives.

The benefits of embedded insurance coverage assist clarify why motor traces are seen because the almost definitely to be disrupted by embedded insurance coverage, as discovered by a 2023 GlobalData ballot. Embedding cowl reduces friction on the level of sale, simplifies coverage choice and servicing, and leverages present model belief. It additionally permits richer knowledge flows, from automobile telematics to utilization and buying conduct, which might enhance pricing and product personalization.

Companies that transfer early to combine insurance coverage into the client journey, whereas guaranteeing operational robustness and regulatory compliance, will likely be finest positioned to capitalise on this shift. Insurers ought to pursue partnerships with automotive producers and spend money on APIs, modular product design, and real-time underwriting to allow compelling embedded provides.