Residents Property Insurance coverage Company retains insisting that its use of the Division of Administrative Hearings (DOAH) arbitration system is designed to learn policyholders by rushing up declare decision and avoiding courtroom delays. However inside information I lately reviewed tells a special story. Residents claims managers are centered on reducing Residents’ personal prices, not serving to owners recuperate sooner or extra totally.

The inner figures evaluate litigated claims that went by means of DOAH with those who didn’t. The important thing metric used was labeled “Incurred Loss ALAE.” In insurance coverage accounting, “ALAE” stands for Allotted Loss Adjustment Bills. These prices are the direct, claim-specific prices of dealing with and defending a person file. Consider funds to protection attorneys, knowledgeable witnesses, engineers, or unbiased adjusters. These are bills of the dispute, not the indemnity {dollars} really paid to the policyholder for his or her loss.

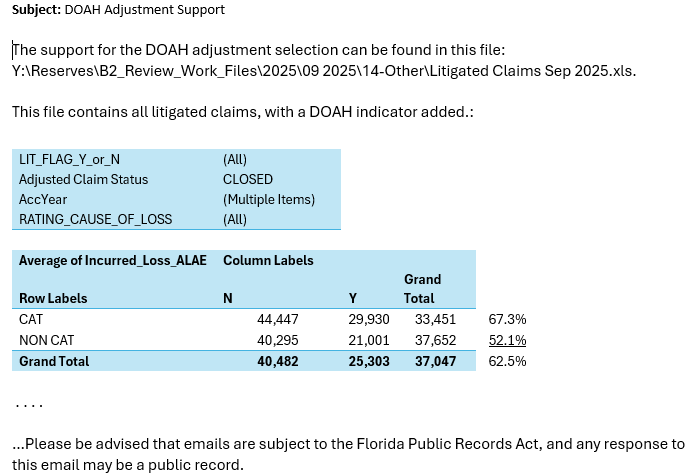

The information confirmed that for disaster claims, the typical ALAE on DOAH circumstances was about 67 % of what Residents spent on comparable non-DOAH circumstances. For non-catastrophe claims, it dropped even additional to about 52 %. In different phrases, DOAH claims value Residents roughly a 3rd to a half much less to litigate.

That’s not proof that policyholders are being helped. As a substitute, it’s proof that Residents is saving cash by steering disputed claims right into a course of it created and controls. It’s also proof that the Residents claims executives are merely constructing a enterprise mannequin case for DOAH’s use. The insurer’s inside information even referred to this evaluation as “help for the DOAH adjustment choice.” This can be a telling phrase that frames DOAH not as a equity initiative however as a cost-reduction instrument to save lots of Residents cash quite than maintain its policyholders by means of full and immediate fee.

The deeper concern is what’s lacking from the info: it doesn’t present indemnity, the precise funds to policyholders for his or her losses. If Residents is systematically resolving claims in DOAH for much less expense and fewer indemnity, then it’s honest to query whether or not the “financial savings” symbolize justice or simply much less cash within the arms of those that suffered losses.

Residents needs lawmakers and the general public to imagine that DOAH arbitration is an environment friendly, consumer-friendly different to litigation. However its personal accounting focus provides away the true motive: that is about decreasing Residents’ expenditures, not delivering fairer outcomes. It’s an insurer-driven system, and the info present it’s working for Residents Property Insurance coverage Firm, however not for Florida residents who discover themselves insured by means of that entity.

Policyholders deserve greater than a government-run insurance coverage firm monitoring its success by how a lot much less it spends contesting their claims. They deserve transparency, accountability, and a dispute course of that measures equity quite than monetary effectivity.

I’ve beforehand criticized DOAH in Florida’s DOAH Arbitration Catastrophe: How the Legislature Gave Residents a License to Steamroll, Policyholders, and Decide Slams Door on Residents’ Arbitration Scheme. It doesn’t take a rocket scientist to determine that Residents has duped Florida politicians into an “environment friendly different dispute decision system” when the interior information present they’re measuring how a lot cash it saves by underpaying policyholders and at much less value. Journalists, legislators, and insurance coverage regulators ought to be asking for all of those inside administration memos that underlie the true motives for DOAH’s existence.

Thought for the Day

“If we’re to maintain our democracy, there have to be one commandment: Thou shalt not ration justice.”

— Decide Realized Hand