Skilled recommendation and fears surrounding new know-how (resembling AI) are key cyber insurance coverage coverage triggers amongst SMEs as per a GlobalData survey. Because the market turns into extra preventative, specialised cyber insurance policies could cut back the barrier to entry and assist present enough safety for SMEs.

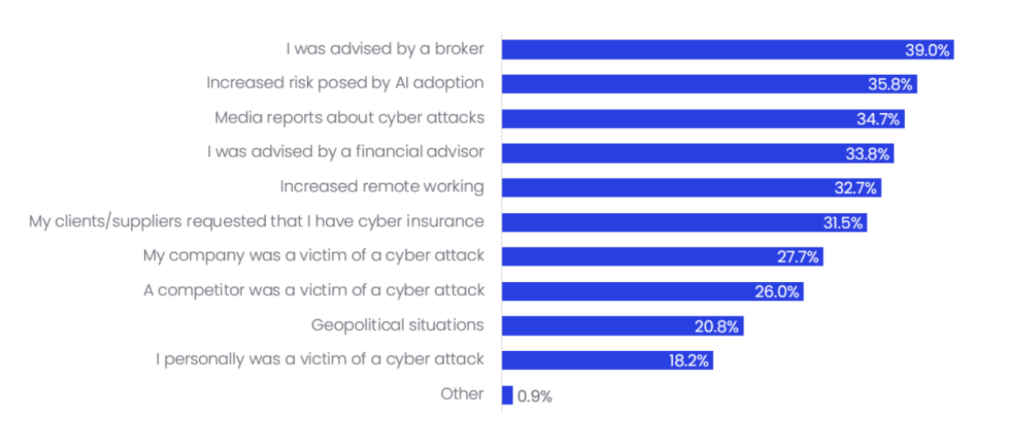

Based on GlobalData’s 2025 SME Survey, skilled recommendation is a very powerful driver prompting international SMEs to take out a cyber insurance coverage coverage. Being suggested by a dealer is the one most necessary issue (39%), whereas receiving recommendation from monetary advisors was cited by 33.8% of respondents. Nonetheless, SMEs are additionally cautious in regards to the elevated dangers posed by AI adoption, citing this because the second most necessary consideration (35.8%).

What was the set off for buying cyber insurance coverage? 2025

Supply: GlobalData’s 2025 SME Survey.

The speedy unfold of AI and its integration throughout all industries is making SMEs really feel uneasy and anxious in regards to the know-how, perceiving it might pose a major threat. Provided that many normal cyber insurance policies don’t point out AI cowl, there could possibly be a niche between what purchasers count on from their coverage and what the coverage truly covers.

Usually, normal cyber insurance policies exclude losses associated to a enterprise’s personal AI software giving faulty outputs (resembling quoting the unsuitable data in a chatbot) or litigations arising from biased knowledge from AI-derived algorithms. In distinction, cyber insurance coverage insurance policies generally cowl losses from AI-powered hackers.

Brokers and monetary advisers are uniquely positioned to evaluate purchasers’ dangers and desires and match them to merchandise that meet their necessities. For purchasers searching for safety towards AI dangers, they need to contemplate providing them cyber insurance coverage insurance policies with add-ons that explicitly cowl AI-related incidents; in any other case, they need to supply them specialist insurance policies alongside cyber insurance coverage.

In the meantime, the market is changing into more and more extra preventative, with skilled recommendation and exterior elements taking part in a stronger affect on SMEs’ buying choices with regards to cyber insurance coverage, versus them (27.7%) or a competitor (26%) falling sufferer of a cyberattack. Whereas this shift makes companies safer, SMEs could not at all times have the ability to afford the price of a coverage or the know-how (resembling software program upgrades) required by insurers. Given the excessive barrier to entry for SMEs, insurers ought to give attention to creating insurance policies overlaying simply the dangers which can be commonest to such companies.