GlobalData finds that over 40% of gig-economy supply staff stay uninsured whereas on the job. As versatile, on-demand fashions proceed to scale throughout meals supply and courier providers, insurance coverage choices constructed round conventional employment are more and more misaligned.

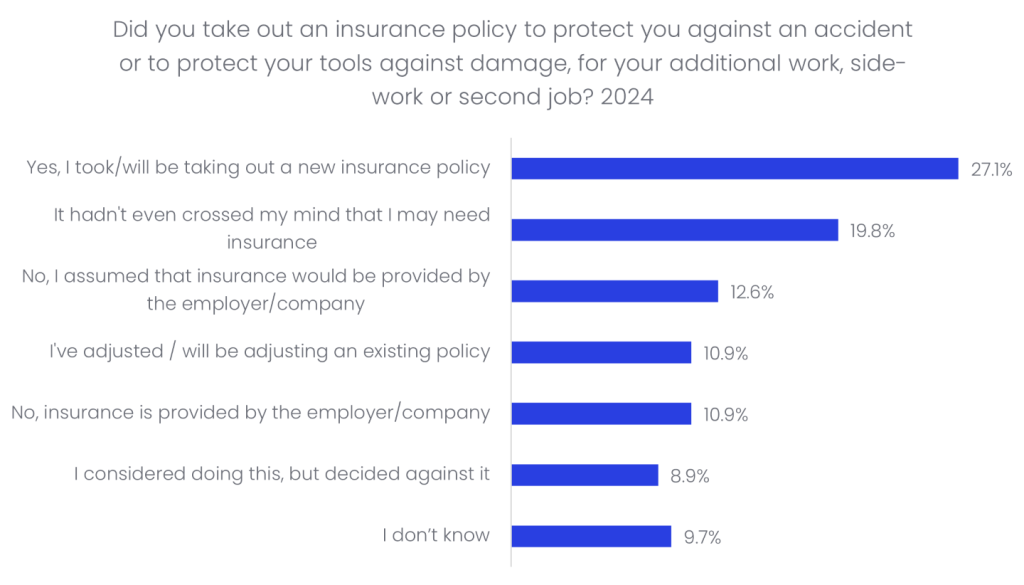

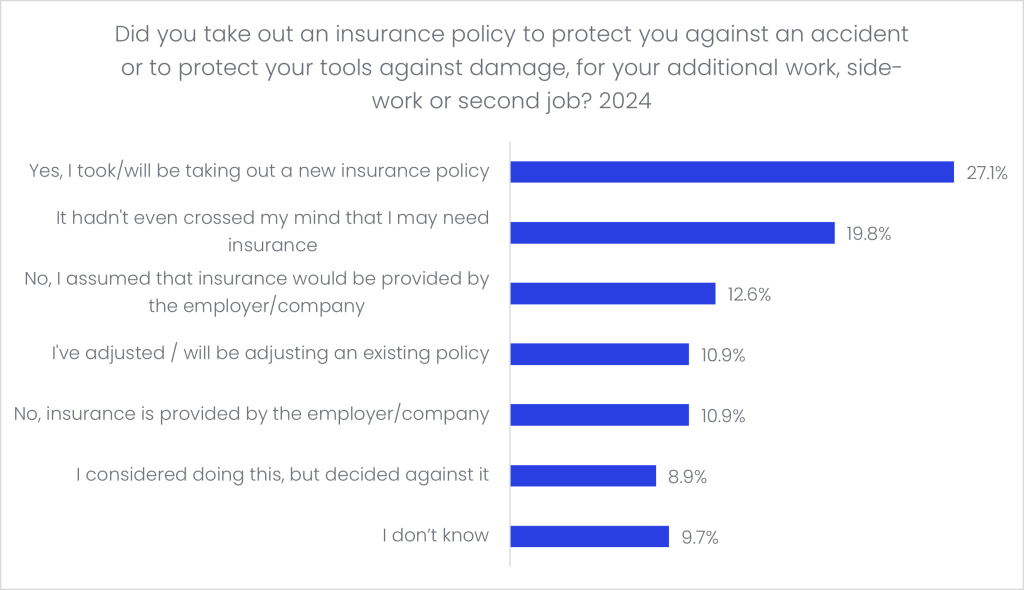

Based on GlobalData’s 2024 UK Insurance coverage Shopper Survey, engagement with insurance coverage amongst gig staff stays lifted and inconsistent. Solely 27.1% of supply service staff reported taking out or planning to take out a brand new insurance coverage coverage, 10.9% adjusted an current coverage, and 10.9% had insurance coverage supplied by their employer/firm. A major proportion of respondents stay uninsured or inadequately lined. 19.8% sated that it had not crossed their thoughts that they may want insurance coverage, whereas 12.6% assumed insurance coverage can be supplied by their employer/platform. An additional 8.9% actively determined towards buying insurance coverage. These findings spotlight that underinsurance is pushed as a lot by misunderstanding and log engagement as by price concerns.

Superscript helps shut this safety hole with a devoted e-bike insurance coverage product for couriers and supply riders, developed in partnership with Sundays Insurance coverage; a specialist bicycle insurer. Constructed particularly for riders utilizing e-bikes for supply work, it consists of third-party legal responsibility and private accident cowl which supplies safety whereas riders are actively on the job. Distribution will initially run via Superscript’s delivery-partner community in main UK cities, specializing in riders who are sometimes underserved by private insurance policies and by conventional business insurance coverage, which is often structured for fleets or different automobile classes.

Superscript’s e-bike insurance coverage launch supplies a transparent instance of how data-led perception right into a gig employee behaviour can inform efficient product design. By addressing misconceptions round employer-provided cowl, lowering engagement obstacles, and providing specialist safety via a digital platform, the initiative demonstrates how insurers and brokers can shut persistent safety gaps, whereas unlocking development alternatives inside an increasing market.