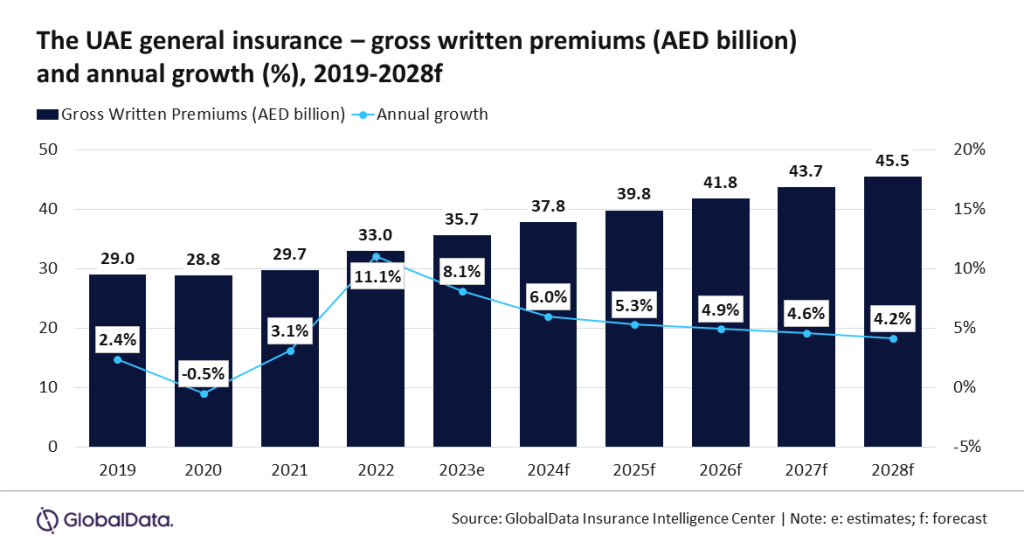

The final insurance coverage business within the UAE is ready to develop at a CAGR of 4.7% from AED37.8bn ($10.3bn) in 2024 to AED45.5bn ($12.4bn) in 2028, by way of GWP.

Moreover, the final insurance coverage sector in UAE is anticipated to develop by 6% in 2024, in keeping with GlobalData. That is predicted to be supported by PA&H, motor, and property insurance coverage traces which are presupposed to account for over 85% of common insurance coverage premiums in 2024.

Prasanth Katam, insurance coverage analyst at GlobalData, stated: “The UAE witnessed a slower financial development of three% in 2023 as in comparison with 7.9% development in 2022, on account of cuts in oil manufacturing and the deceleration of non-oil sectors. In consequence, the final insurance coverage business is anticipated to witness slower development of 8.1% in 2023 as in comparison with 11.1% development in 2022. The development is anticipated to proceed in 2024 and 2025 as a result of international financial slowdown and elevated geopolitical uncertainties.”

PA&H insurance coverage is the main line of enterprise that’s anticipated to account for an estimated 59.1% share of the final insurance coverage GWP in 2024. It’s anticipated to develop by 4.7% in 2024, supported by growing demand for medical insurance insurance policies on account of rising well being consciousness after the COVID-19 pandemic.

As well as, with growing instances of continual ailments, an getting older inhabitants, and developments in medical expertise, the price of therapy and medicine has been growing considerably within the UAE.

In consequence, the premium costs of medical insurance insurance policies have been growing over the past couple of years. The medical insurance premiums are anticipated to rise additional in 2024, which can help the expansion of PA&H insurance coverage.

Entry essentially the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

helpful

choice for your corporation, so we provide a free pattern you can obtain by

submitting the beneath type

By GlobalData

Katam added: “Optimistic regulatory developments may also help the expansion of PA&H insurance coverage. In January 2024, the UAE authorities mandated people making use of for or renewing their residence visas in Dubai and Abu Dhabi to have a legitimate medical insurance coverage.”