Reward of life insurance coverage to charity: Background

Many Canadians select to help causes which can be necessary to them by donating life insurance coverage to charities of their alternative. What most individuals don’t notice is that there are particular insurance coverage options that help you considerably enhance the quantity of your donation whereas paying the identical quantity.

At present, we have a look at how such insurance coverage merchandise work, what they price, and the dimensions of donations they’ll generate for the charities of your alternative. If any of those insurance coverage merchandise curiosity you and also you wish to maximize your contribution to your chosen charity, our skilled advisors are right here that can assist you with these merchandise – simply full a kind on this web page.

Donate life insurance coverage coverage to charity: Background

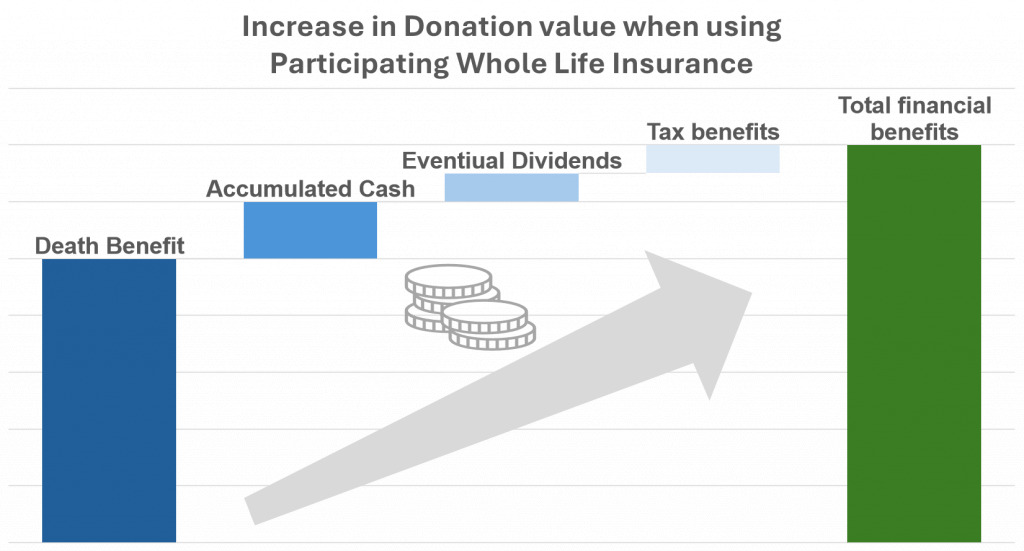

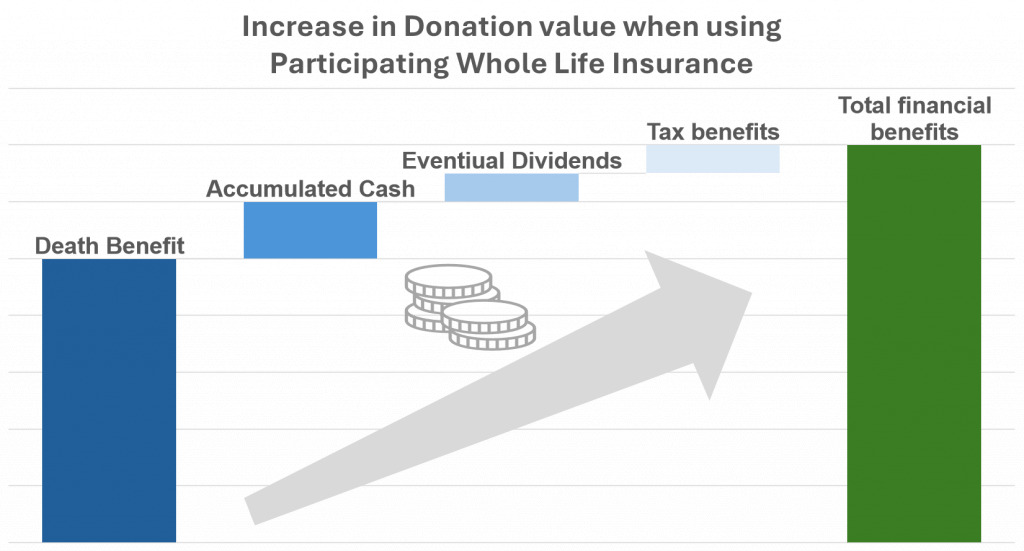

Life insurance coverage affords a easy and cost-effective methodology to make a considerable charitable donation with out affecting your loved ones’s inheritance. This strategy enhances the dimensions of your charitable reward. Usually, a collaborating entire life insurance coverage coverage is utilized for this goal. Such a coverage can enhance the worth for its beneficiary, the charity, in 4 distinct methods (see the image under):

- A entire life insurance coverage coverage has a money accumulation part that will increase over time.

- Taking part life insurance coverage signifies that infrequently, a beneficiary can obtain dividend payouts primarily based on the efficiency of the insurance coverage firm.

- Life insurance coverage ensures that when you move away, a beneficiary (on this case, a charity of your alternative) will obtain a declare payout.

- There are tax advantages within the type of a tax receipt, both for premiums paid (if a charity owns the coverage) or for the loss of life profit (on your property beneficiaries).

These 4 options make life insurance coverage a really interesting possibility for charitable donations. You will need to be aware that your charitable reward doesn’t have an effect on the inheritance supposed for your loved ones. Since there isn’t any must allocate a portion of your property for charity, all the property stays out there for your loved ones’s profit.

Naming a charity as beneficiary of life insurance coverage: How does it impression your contribution

Let’s examine two situations: within the first, Lucy donates $50 per 30 days on to her chosen charity over a interval of 20 years. Within the second, Lucy opts to buy a life insurance coverage coverage, designating her chosen charity because the beneficiary to obtain the proceeds.

| Merely donations | Donation by way of a life insurance coverage coverage |

| Month-to-month contribution of $50Period of contribution: 20 years | Month-to-month premiums of $50Premium fee possibility of 20 yearsParticipating entire life insurance coverage with assured loss of life profit and money values |

| Complete donation worth:$12,000 | Complete donation worth:$102,089 |

The modelling above is accomplished primarily based on Equimax® collaborating entire life insurance coverage from Equitable Life.

Additional information: Equimax Property Builder 20 pay, paid-up additions dividend possibility. Assumes feminine, non-smoker, age 35. Instance of the loss of life profit quantity payable at age 85. Complete loss of life profit values are for illustration functions solely. Illustrated values are primarily based on charges in impact as of August 12, 2023 and the dividend scale as of the charges efficient date remaining unchanged for the lifetime of the coverage.

Naming a charity as beneficiary of life insurance coverage: Two choices

You will need to be aware that charitable giving via life insurance coverage will be completed in two major methods detailed within the desk under

| Choices | Coverage proprietor | Particulars | Tax advantages |

| Choice 1 | You | You pay the premiums and designate the charity because the beneficiary. By retaining possession, you keep the power to vary the beneficiary sooner or later for those who select. | Your property will obtain a tax receipt when the loss of life profit is paid out. |

| Choice 2 | Charity | You pay the premiums and designate the charity because the proprietor of the coverage. On this case, the charity has entry to the money worth within the coverage and is assured of receiving a considerable future donation when the loss of life profit is paid. | The charity will concern you an annual tax receipt for the premiums paid. |

Charitable donation of life insurance coverage coverage: What corporations supply such insurance policies.

There are a number of corporations that supply particular life insurance coverage merchandise designed for charitable donations. We wish to spotlight two of them which can be out there in the marketplace.

|

My Par Reward from Canada Life: Any such life insurance coverage is a collaborating entire life insurance coverage coverage that requires a single premium fee. As soon as the coverage is lively, it’s managed by a charity. The charity has the choice to buy further insurance coverage protection, probably elevating the coverage’s money worth and loss of life profit. Alternatively, they’ll obtain the annual dividends in money. |

|

Equimax collaborating entire life insurance coverage supplies a assured loss of life benefit4, premiums and money values. Shorter premium fee choices of 10 or 20 years can be found.5 It’s a straightforward, hands-off strategy to making a legacy. Equitable Generations product supplies life insurance coverage safety and extra hands-on involvement to maximise tax-advantaged funding progress throughout the plan.6 You choose from a variety of funding choices primarily based in your threat tolerance and have the choice to fund the plan with a single lump sum fee |

Our licensed life insurance coverage brokers are extremely educated about life insurance coverage merchandise designed for charitable donations. If in case you have a particular charity in thoughts and want to make a distinction, we might be delighted to help you in choosing the finest life insurance coverage product. Merely full the shape above, and we are going to offer you the mandatory steerage, with no obligations.