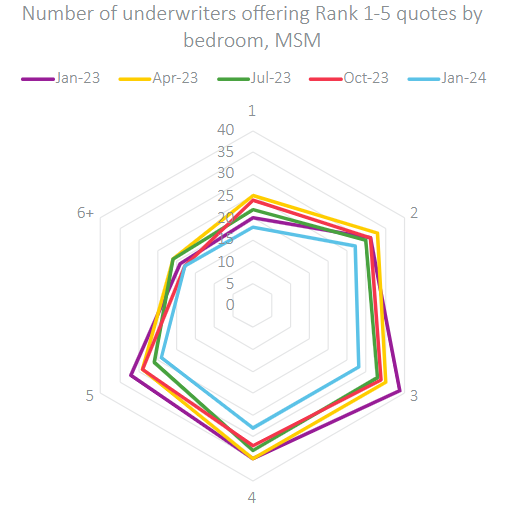

Within the ever-evolving panorama of house insurance coverage, a noticeable shift has occurred over the previous yr: the autumn within the variety of aggressive underwriters out there. The decline we’ve noticed is most pronounced once we take a look at three-bedroom properties — a staple of the UK housing market. Right here, we have noticed a major discount within the variety of underwriting choices, nevertheless most regarding is the 30% discount within the variety of totally different underwriters represented among the many prime 5 best insurers.

Our Insurance coverage Perception Supervisor, Max Thompson, feedback on what this might imply for the insurance coverage panorama, “There will probably be pressure on brokers. Many of those are smaller corporations, with much less assets than direct insurers. They’re seeing extra overheads with inflation, extra compliance by Shopper Obligation, and doubtlessly now fewer aggressive alternatives with the should be on prime of the market to compete.

“Moreover, there will probably be better concentrate on MGA relationships, the place the middleman has underwriting authority with an insurer. Insurers might use the better flexibility allowed by MGA underwriting to focus on areas, fairly than totally different panel members”.

Our worth benchmarking information collected from MoneySuperMarket signifies a stark discount within the whole variety of underwriters — from 45 in January 2023 to simply 34 in January 2024. This pattern suggests a tightening market, the place fewer monetary backers are keen to tackle the dangers related to insuring houses.

Max provides, “We haven’t seen many new entrants previously yr or so. If this was pushed by the uncertainty in claims prices, although, with inflation steadying we’d have a extra secure market that would deliver capital in”.

The idea of managing threat appears to underpin a lot of this shift. For example, wanting on the information from January 2024, we discover that the variety of underwriters accessible for claimants has dropped considerably. The place there have been as soon as 45 underwriters desperate to handle claims, solely 32 stay. This lower is especially noticeable in water harm claims, which have seen essentially the most notable decline in underwriter urge for food.

With this pattern set to evolve, it’s crucial that each one gamers within the insurance coverage market – directs, brokers and underwriters alike – carry on prime of those actions, which have the potential to considerably impression each competitiveness and quotability. We’ve seen this occur over the previous few months, with some manufacturers now not with the ability to quote competitively and diversely sufficient to stay on the forefront of the market, and others rising to the highest of the competitiveness charts. Utilizing our Market View device, you may guarantee your model avoids being hit by surprising modifications within the underwriting panorama, while fuelling assured choice making.