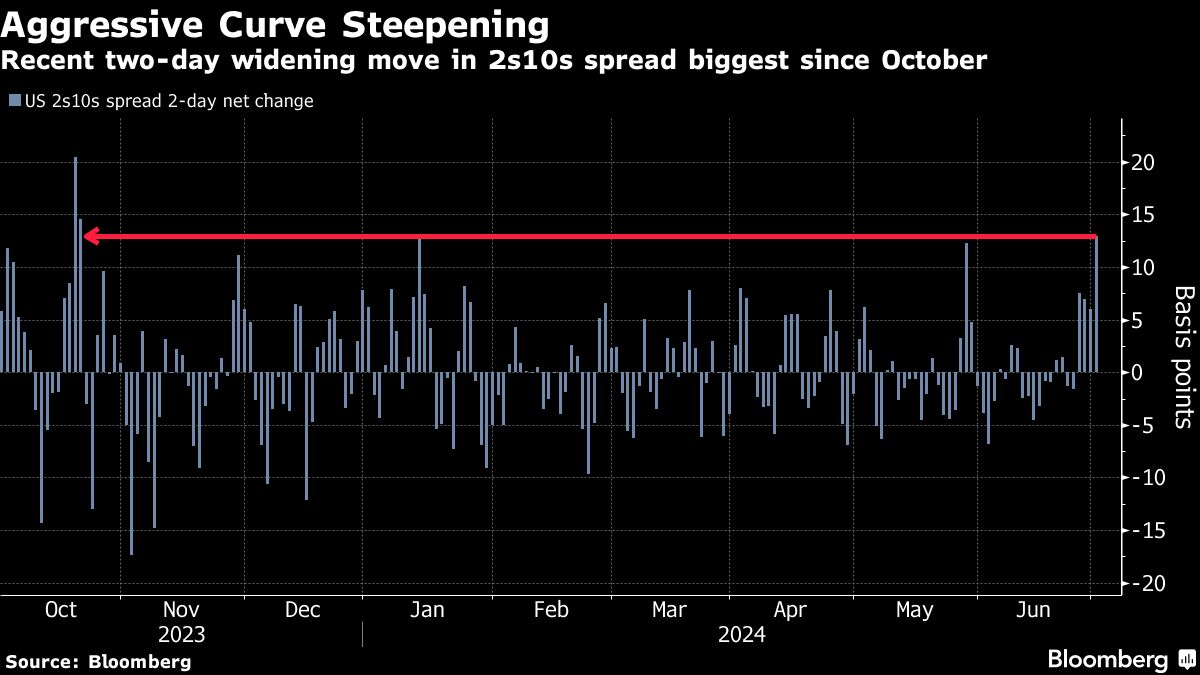

In a two-day span beginning late final week, 10-year yields rose by about 13 foundation factors relative to 2-year charges, within the sharpest curve steepening since October.

Indicators of merchants bracing for near-term volatility within the Treasury market emerged Wednesday, via a purchaser of a so-called strangle construction, which advantages from a transfer greater or decrease in futures via the strike costs.

Together with potential threat over the vacation weekend round Biden’s candidacy, the expiry additionally incorporates Friday’s US jobs information and testimony subsequent week from Fed Chair Jerome Powell.

Shares Achieve

The prospect of a Trump victory has supported myriad shares that stand to learn from his perceived stances on the regulatory surroundings, mergers and commerce relations. The broad market has powered greater within the wake of the controversy.

The flip within the electoral tide since final week has “meant greater shares as Republicans are usually seen as extra enterprise pleasant,” stated Tom Essaye, president and founding father of Sevens Report.

Well being insurers UnitedHealth Group Inc. and Humana Inc. and banks stand to learn from looser laws. Uncover Monetary Providers and Capital One Monetary Corp. are amongst bank card corporations which have risen on optimism over Trump, provided that pair’s pending deal and hypothesis round doable adjustments to late payment guidelines.

Vitality shares like Occidental Petroleum Corp. rose after the controversy, given the previous president is seen as having a pro-oil stance. Personal jail shares like GEO Group Inc. have reacted to his perceived tough-on-immigration views.

Financials ETFs

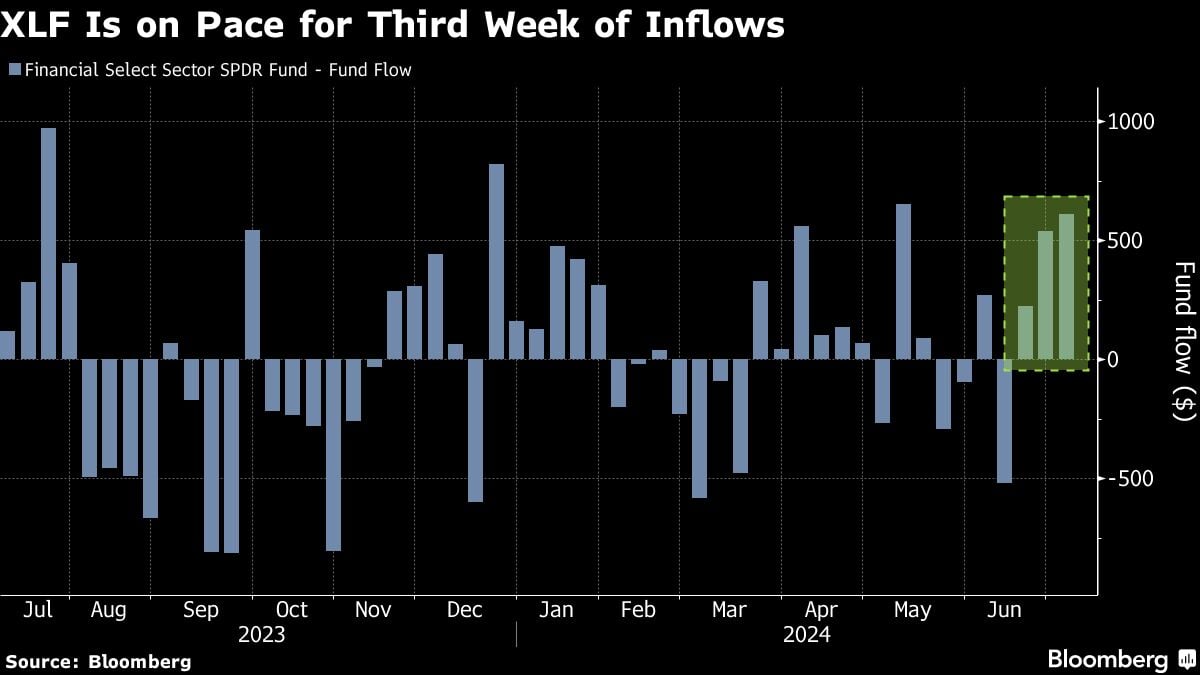

The exchange-traded fund market has proven one clear investing technique of late: Lengthy banks on bets that Trump will spur deregulation and a steeper Treasury curve because of his probably inflationary agenda.

The Monetary Choose Sector SPDR Fund (ticker XLF), a $40 billion fund, final week noticed its largest influx in additional than two months, with traders including roughly $540 million. Up to now this week, they’ve added $611 million amid the newest gyrations within the interest-rate market.

In the meantime, a thematic-investing technique designed to journey the Trump commerce has struggled to realize traction.

An ETF that sports activities the eye-catching ticker MAGA and invests in Republican-friendly shares has been sluggish to garner belongings and hasn’t seen any materials inflows this 12 months, information compiled by Bloomberg present.

Crypto Help

Trump has proven assist for the crypto trade in latest weeks by assembly with trade executives and promising he would guarantee all future Bitcoin mining is finished within the US.

That makes the Solana token — the fifth-largest cryptocurrency with a market capitalization of about $67 billion, in keeping with CoinMarketCap — one potential beneficiary of a Trump return to the White Home. Asset managers VanEck and 21Shares have filed for ETFs that might straight put money into the digital forex.

Whereas many take into account approval a protracted shot, the considering amongst some market individuals is {that a} newly re-elected Trump would appoint a Securities and Alternate Fee chair who’s extra crypto-friendly than Gary Gensler has been below Biden. That’s an consequence that might make a Solana ETF — and a corresponding rally within the token — extra seemingly.

The prospect of a shakeup to the Democratic ticket can be prone to enhance Bitcoin, in keeping with Stephane Ouellette, chief government of FRNT Monetary.

“The crazier that the U.S. political system appears, the higher that Bitcoin appears,” Ouellette stated “That is the form of vibe that Bitcoin would go for. Craziness within the US political system is a pro-Bitcoin issue.”

(Credit score: Bloomberg)