A GlobalData ballot reveals that pet insurance coverage policyholders within the UK are extra inclined to change suppliers than earlier than, citing worth as the first motive behind their resolution. Pet insurance coverage premiums are anticipated to extend within the quick time period, probably resulting in an additional improve in switching exercise. Consequently, pricing methods will turn into extra necessary for insurers.

In line with GlobalData’s 2023 UK Insurance coverage Shopper Survey, 15.7% of pet insurance coverage holders switched suppliers at renewal, with 64.3% of respondents citing worth as the explanation. This swap fee rose from 13% in 2022, highlighting that this can be a rising pattern for pet insurance coverage holders. Because the cost-of-living disaster continues to squeeze family incomes and insurance coverage turns into much less reasonably priced, pet policyholders will look to chop prices, leading to elevated switching exercise.

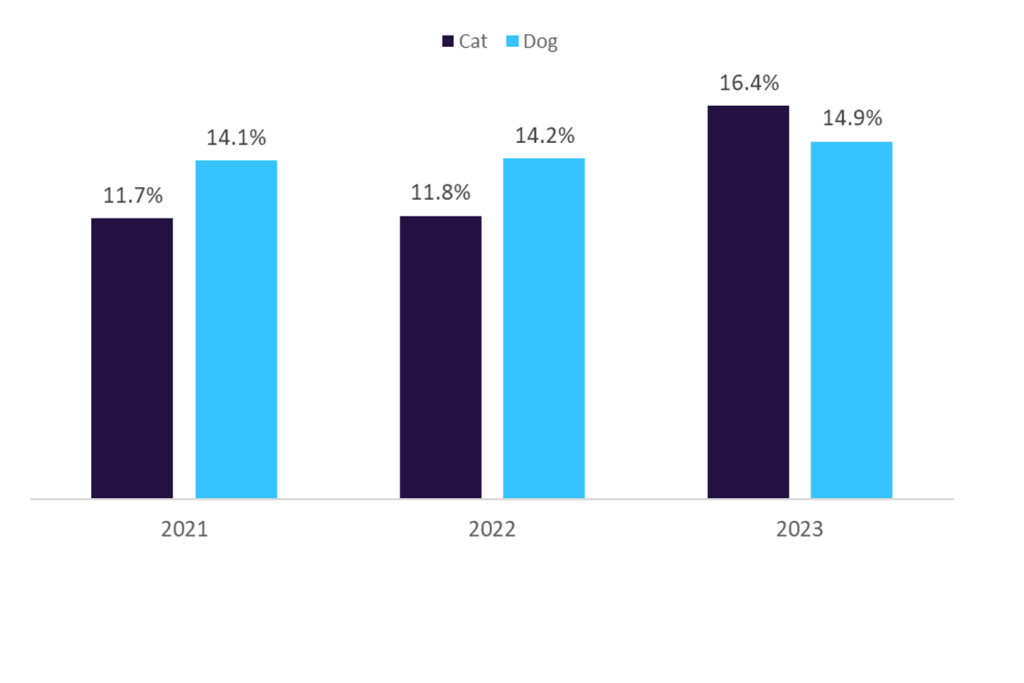

GlobalData reveals that over the past three years, switching exercise from canine insurance coverage holders has risen by 0.8 proportion factors (pp), whereas switching from cat insurance coverage holders has risen by 4.7pp. Likewise, in 2023, the proportion of consumers who shopped round for canine and cat insurance coverage grew by 1.5pp and 1.9pp, respectively, in comparison with 2022. This elevated exercise could be attributed to the mixed affect of rising premiums and the cost-of-living disaster, as switching is likely one of the few methods policyholders can search to scale back prices. Of those that switched, 60% recorded a premium saving of 6%–10%, a cloth distinction. This means that pet house owners have gotten more and more inclined to actively hunt down higher costs and various choices.

Charities such because the PDSA and Blue Cross have famous the quickly rising demand for its (free or subsidised) veterinary providers because of the rising unaffordability of personal veterinary care and the rising value of pet protection. In line with Insurance coverage Occasions, the typical pet insurance coverage worth rose by 21% between February 2023 and March 2024. On this local weather of rising premiums and squeezed incomes, extra pet house owners will search to scale back their prices by switching. Nevertheless, in September 2023, the UK competitors regulator launched a proper investigation into the £2bn veterinary business, with issues that pet house owners had been overpaying for medicines and therapy. Additionally, the Competitors and Markets Authority has provisionally determined to analyze whether or not a cap on therapy prices and prescription charges is important. These developments, coupled with the Workplace of Nationwide Statistics’ prediction that inflation will drop considerably over the subsequent two years, point out that it’s possible that vet prices will fall through the subsequent few years and the upward strain on premiums will ease. This presents a singular alternative for insurers to make use of new pricing methods to safe a better share of the market.

Not solely are extra pet house owners buying round for insurance coverage, however switching is hottest amongst prospects who use worth comparability web sites (PCWs). PCWs will turn into more and more necessary in aiding prospects in switching and buying round, therefore we are able to anticipate elevated switching by way of these channels. Discovering worth is driving pet insurance coverage shopper behaviours, as rising premiums and vet prices are squeezing pet house owners in an already troublesome financial panorama. Insurers ought to reply by adjusting worth methods to make sure insurance policies stay aggressive in each retaining current prospects and attracting new enterprise.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

helpful

resolution for what you are promoting, so we provide a free pattern you can obtain by

submitting the beneath kind

By GlobalData