Not like many friends, purchasers have largely caught with him, a present of religion at a time when different managers are getting chased out of a market dominated by a small coterie of tech mega-firms.

The Russell worth index has lagged its development counterpart in all however two years since 2012. Earlier in 2024, it sank to a report relative low as chipmakers and software program shares rallied amid the artificial-intelligence craze.

In flip, the inhabitants of actively managed funds devoted to worth peaked close to 1,100 in 2015 and has since fallen 15%, in keeping with knowledge compiled by Bloomberg Intelligence mutual fund analyst David Cohne.

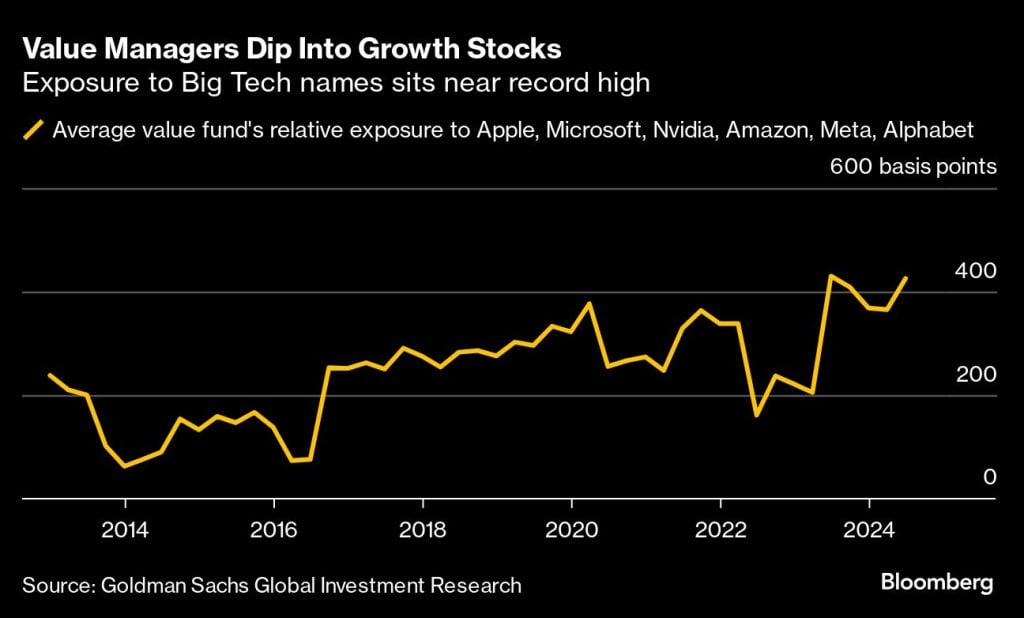

Those who survived have been leaning into expertise equities, principally development names. As of the top of June, the common large-cap worth fund was over-exposed to the group — which incorporates Apple, Microsoft, Nvidia, Amazon.com, Meta Platforms and Alphabet — by 426 foundation factors, the second highest quarterly studying since at the least 2012, knowledge compiled by Goldman Sachs Group Inc. present.

Nonetheless, whether or not a inventory is a discount is dependent upon who’s judging it. Worth could be sliced and diced endlessly and index suppliers can’t agree on a definition. Some worth managers seem to have taken benefit of selloffs in recent times to snap up tech shares seen as extra moderately priced and held them since.

But the widespread follow by this cohort going after development shares highlights stresses in momentum-driven markets, like at this time.

Nonetheless, whether or not a inventory is a discount is dependent upon who’s judging it. Worth could be sliced and diced endlessly and index suppliers can’t agree on a definition. Some worth managers seem to have taken benefit of selloffs in recent times to snap up tech shares seen as extra moderately priced and held them since.

But the widespread follow by this cohort going after development shares highlights stresses in momentum-driven markets, like at this time.

Managers who underperform “lose property, they lose their jobs,” mentioned Cullen. “There’s strain on folks to cheat or what have you ever — to stretch it.”