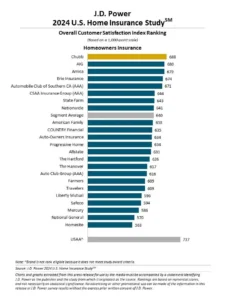

Chubb, AIG, and Amica lead different insurers in J.D. Energy’s evaluation of buyer satisfaction for house insurance coverage, however the shopper intelligence firm stated extra persons are procuring round.

The excellent news for insurers is that solely 2.2% really switched—and that’s down from outcomes two years in the past, in accordance with J.D. Energy’s 2024 U.S. Dwelling Insurance coverage Research. Based mostly on a survey of greater than 14,000 householders and renters, a file 6.8% of house insurance coverage prospects are actively looking for one other coverage.

“Many patrons have ended up staying put as a result of there are so few options accessible, however carriers want to acknowledge that regular charge will increase put coverage retention in danger and has a unfavourable impact on buyer satisfaction,” warned Breanne Armstrong, director of insurance coverage intelligence at J.D. Energy, in an announcement.

In July, J.D. Energy stated auto insurance coverage procuring additionally reached a brand new excessive, however extra prospects took the following step to modify carriers. Its latest house insurance coverage research equally discovered, like auto, a charge enhance was the main drive in no less than deciding to see what else is on the market. In any case, house and renters prices have eclipsed common auto insurance coverage charge will increase and the speed of inflation, in accordance with J.D. Energy. Amongst those that have acquired a house insurance coverage charge enhance, 37% stated they had been prone to begin procuring, and buyer satisfaction was 92 factors decrease (594, on a 1,000-point scale) in comparison with prospects that didn’t get a charge enhance.

Clients switching auto insurers over house insurers seems to have the momentum when taking a look at bundling as properly. J.D. Energy stated bundling has “declined considerably” in 2024 versus 2023, and there may be extra intent to modify auto carriers whereas leaving house insurers alone. Within the newest survey, 21% of respondents stated they “positively will” swap house in the event that they swap auto. That’s down from 24% a yr in the past.

Perhaps Chubb, AIG, Amica, and different home-insurance opponents defined charge will increase clearer than others. Clients which have an understanding are much less prone to store, and can extra seemingly assume their insurer places the curiosity of consumers first, J.D. Energy stated.

Amica additionally ranks among the many prime three in renters insurance coverage satisfaction. Erie tops the listing, with Lemonade in third.

Matters

Householders

Considering Householders?

Get automated alerts for this matter.