The devastation wrought by Hurricane Helene in September 2024 throughout a 500-mile swath of the U.S. Southeast highlighted the rising vulnerability of inland areas to flooding from each tropical storms and extreme convective storms, in accordance with the newest Triple-I “State of the Danger” Points Transient.

These occasions additionally spotlight the size of the flood-protection hole in non-coastal areas. Personal insurers are stepping as much as assist shut that hole, however elevated home-owner consciousness and funding in flood resilience throughout all co-beneficiary teams will probably be wanted as increasingly more individuals transfer into hurt’s method.

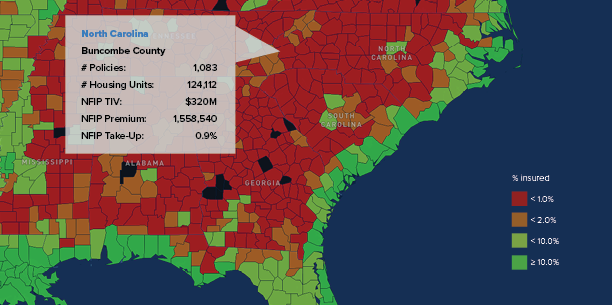

Helene dumped 40 trillion gallons of water throughout Florida, Georgia, the Carolinas, Virginia, and Tennessee, inflicting lots of of deaths and billions in insured losses. A lot of the loss was concentrated in western North Carolina, with elements of Buncombe County – residence to Asheville and its historic arts district – left nearly unrecognizable. Lower than 1 % of residents in Buncombe County had federal flood insurance coverage when Helene struck.

The expertise of those states far inland echoed these of New York, New Jersey, and Pennsylvania in August 2021, when remnants of Hurricane Ida introduced rains that flooded subways and basement flats, with greater than 40 individuals killed in these states.

“The entire swath going up the East Coast” that Hurricane Ida struck within the days after it made landfall “had lower than 5 % flood insurance coverage protection,” mentioned Triple-I CEO Sean Kevelighan on the time.

Then, in July 2023, a collection of intense thunderstorms resulted in heavy rainfall, lethal flash floods, and extreme river flooding in japanese Kentucky and central Appalachia. Flooding led to 39 fatalities and federal disaster-area declarations for 13 japanese Kentucky counties. In accordance with the Federal Emergency Administration Company (FEMA), just a few dozen federal flood insurance coverage insurance policies had been in impact within the affected areas earlier than the storm.

Low inland take-up charges largely replicate client misunderstandings about flood insurance coverage. Although roughly 90 % of all U.S. pure disasters contain flooding, many householders are unaware that a regular owners coverage doesn’t cowl flood harm. Equally, many imagine flood protection is pointless until their mortgage lenders require it. It additionally is just not unusual for owners to drop flood insurance coverage protection as soon as their mortgage is paid off to save cash.

Personal insurers stepping up

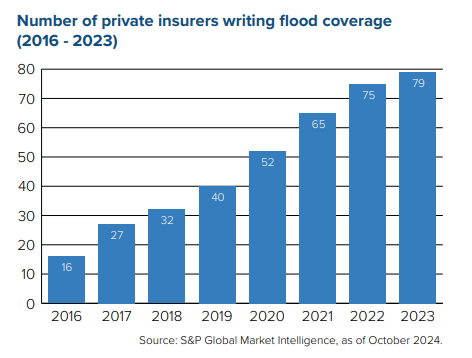

Greater than half of all owners with flood insurance coverage are lined by NFIP, which is a part of FEMA and was created in 1968 – a time when few non-public insurers had been keen to put in writing flood protection. In recent times, nonetheless, insurers have grown extra snug taking up flood danger, thanks largely to improved knowledge and analytics capabilities.

The non-public flood market has modified since 2016, when solely 12.6 % of protection was written by 16 insurers. In 2019, federal regulators allowed mortgage lenders to just accept non-public flood insurance coverage if the insurance policies abided by regulatory definitions. The already-growing non-public urge for food for flood danger gained steam after that. Personal insurers are step by step accounting for an even bigger piece of a rising flood danger pie.

Insurance coverage vital – however not ample

Insurance coverage can play a serious position in closing the safety hole, however, with rising numbers of individuals shifting into hurt’s method and storms behaving extra unpredictably, the present state of affairs is just not sustainable. Higher funding in mitigation and resilience is crucial to lowering the non-public and monetary losses related to flooding.

Such investment has paid off in Florida, the place the communities of Babcock Ranch and Hunters Level survived Hurricanes Helene and Milton comparatively unscathed. Babcock Rance made headlines for sheltering hundreds of evacuees from neighboring communities and by no means dropping energy throughout Milton, which devastated quite a few neighboring cities and left greater than three million individuals with out energy.

Each of those communities had been designed and constructed lately with sustainability and resilience in thoughts.

Incentives and public-private partnership will probably be essential to lowering perils and bettering insurability in susceptible areas. Current analysis on the affect of eradicating improvement incentives from coastal areas can enhance flood loss expertise within the areas instantly affected by the removing of such incentives, in addition to neighboring areas the place improvement subsidies stay in place.

Study Extra:

Govt Alternate: Utilizing Superior Instruments to Drill Into Flood Danger

Precisely Writing Flood Protection Hinges on Various Knowledge Sources

Lee County, Fla., Cities Might Lose NFIP Flood Insurance coverage Reductions

Miami-Dade, Fla., Sees Flood-Insurance coverage Fee Cuts, Because of Resilience Funding

Milwaukee District Eyes Increasing Nature-Based mostly Flood-Mitigation Plan

Attacking the Danger Disaster: Roadmap to Funding in Flood Resilience