Within the ever-shifting panorama of Worth Comparability Web sites (PCWs), GetSafe’s story stands out as a vivid illustration of how market dynamics can flip the tide for trade gamers.

Bear in mind when GetSafe burst onto the PCW scene, making its debut on Go.Examine, in 2020? Backed by a powerful Sequence B funding spherical, they hit the bottom operating with a few of the best costs on the market. It was an thrilling time, and their entry definitely shook issues up available in the market.

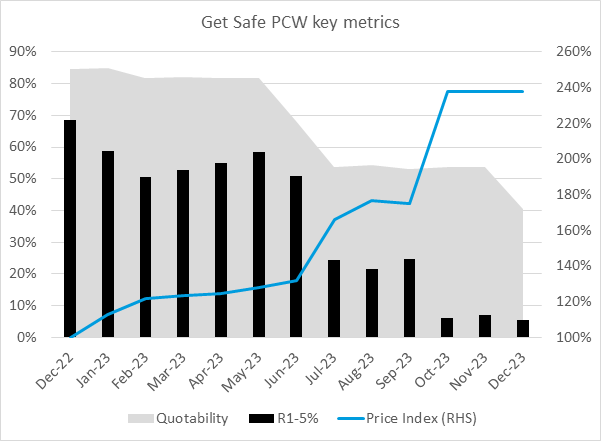

As we moved into 2021, we noticed GetSafe’s PCW presence unfold throughout the Large 4, and in 2022, GetSafe expanded its choices to incorporate buildings and contents insurance coverage, widening its goal demographic from renters to first-time homebuyers and past. This transfer demonstrated a strategic pivot to seize a bigger share of the market, and for some time, it appeared to be paying off. By early 2023, GetSafe had change into one of the vital aggressive gamers within the dwelling insurance coverage market from each a pricing and quotability perspective.

Nevertheless, the insurance coverage market is at all times evolving, and GetSafe’s technique began to shift mid-year. We seen a gradual improve of their charges, which started to have an effect on their quotability and aggressive edge on the PCWs. By October, costs had considerably risen, and by December 2023, GetSafe had quietly exited the PCW stage.

Supply: Client Intelligence Buildings & Contents MarketView, 2,100 dangers per 30 days

It was fairly the event to witness. The speed modifications in June have been the primary trace of a brand new route, nevertheless it was the most important changes in July that appeared to sign a strategic withdrawal. This got here nearly precisely a yr since Get Protected accomplished their buildings and contents product roll-out, elevating the chance that there was a wrestle to steadiness renewals and new enterprise. The outcome was GetSafe relinquishing a lot of their high positions on the comparability websites.

Get Protected weren’t alone of their struggles. Fellow Wakam-underwritten model City Jungle additionally fell in competitiveness, significantly within the second half of 2023. Whereas their mixed product continues to cite, it’s removed from the aggressive heights seen in 2022.

By this narrative, we’re reminded of the fragile steadiness required within the PCW surroundings. It’s not nearly providing the bottom costs, however about sustaining a viable place available in the market. Additionally clear is how exhausting it’s for disruptors to efficiently problem the established order on this channel. Lemonade have achieved longer-term success in contents-only partnering with Aviva. By 2023 any new mixed merchandise on PCWs got here from present insurance coverage teams. It’s unclear the place the subsequent Get Protected will seem from.

For us as trade observers and members, GetSafe’s expertise reinforces the significance of agility and the necessity to continually adapt methods to the market’s rhythm. Will probably be fascinating to see how this can inform future approaches inside the PCW area and for GetSafe itself.

Market View

Optimise your aggressive place in a fast-moving market by accessing uniquely complete and market main insurance coverage pricing insights.