Though Mercury Insurance coverage Group expects gross losses from the 2025 California wildfires within the $1.6 billion-$2.0 billion vary, potential subrogation and reinsurance recoveries will drop the last word invoice all the way down to $325 million or much less, the corporate believes.

“We consider there’s robust video and different proof that exhibits utility tools induced the Eaton hearth,” mentioned Ted Stalick, senior vp and chief monetary officer, throughout an earnings convention name.

Associated articles: Southern California Edison Probes Doable Hyperlink to Los Angeles Fires; Edison Utility Faces Shareholder Lawsuit Over LA Wildfires

Based mostly on subrogation recoveries from 15 previous wildfire occasions, Mercury executives estimate the vary of recoveries from the Eaton hearth to fall within the 40-70% vary.

“With our subrogation potential, I feel the probability of us classifying this as two occasions is much less possible,” mentioned Chief Govt Officer Gabriel Tirador, responding to a query about whether or not the most important fires—the Eaton and Palisades fires—can be thought-about one or two occasions for the needs of reinsurance recoveries. “It’s an choice, and I consider that we’ll most likely decide on that comparatively quickly,” he added.

Associated articles: Mercury Basic Offers Reinsurance Replace: One or Two Occasions Nonetheless TBD; Mercury Basic Wildfire Losses Will Hit Reinsurance Cowl. One Occasion?

In late January, Mercury first addressed the query of whether or not the fires can be thought-about one or two occasions, noting that below a two-event state of affairs, Mercury Basic can elect to make use of reinsurance limits of as much as $1,290 million for the primary occasion and reinstated limits as much as $1,238 million for the second occasion. On this state of affairs, Mercury can be answerable for the primary and second occasion retentions of $150 million every, and as much as a $101 million reinstatement premium.

On the time of the January announcement, Mercury mentioned the election remained an open query, and through the earnings convention executives up to date this, repeatedly saying that subrogation restoration potential from the Eaton hearth made the two-event election a lot much less possible.

“There may be energetic curiosity in buying the corporate’s subrogation rights,” Stalick reported.

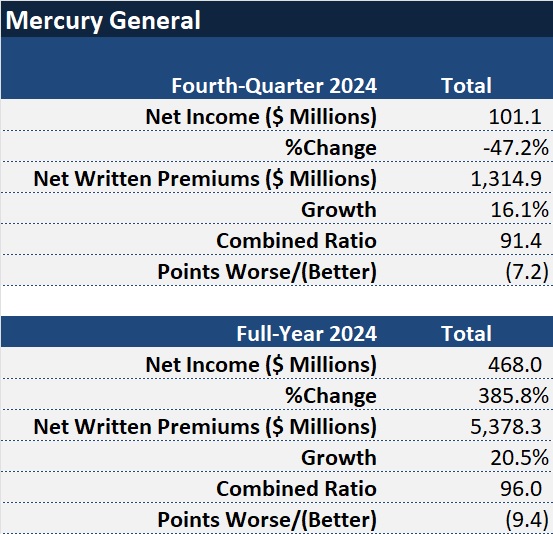

Executives led off the convention name reporting that the insurance coverage firm had damaged a number of monetary information with fourth-quarter working earnings of $154 million and full-year working earnings of $398 million, marking the best figures within the firm’s historical past.

Web written premium progress of 20.5% for the complete yr was the best enhance since 2003, Tirador mentioned, additionally noting that the mixture of fee will increase and moderating inflation helped drive the fourth-quarter mixed ratio greater than seven factors to 91.4.

The total-year mixed ratio improved 9.4 factors in comparison with 2023, coming in at 96 for 2024 despite the truth that the 2024 mixed ratio included 5.5 factors of disaster losses.

12 months-end statutory surplus of over $2.0 billion was additionally the best within the historical past of the corporate.

Trying ahead, Tirador mentioned that continued underlying earnings momentum is predicted to offer sufficient capital era to construct again any capital erosion from the January wildfires.

After reinsurance and subrogation recoveries, however excluding Mercury’s share of FAIR Plan losses, internet final losses from the wildfires will vary from $155 million to $325 million earlier than taxes, the corporate mentioned. After taxes, the online hit to statutory surplus might be $165 million to $295 million, Tirador mentioned.

Inventory market response to information of the report earnings on the publicly traded firm and the potential for subrogation and reinsurance recoveries to shave 80-plus % off the overall wildfire loss invoice was initially constructive. The inventory confirmed the most important upward motion of any P/C insurance coverage firm that Service Administration follows, opening 20% larger on the morning after the information crossed the wires. The inventory value momentum began to wane later within the day with greater than 60% of the acquire erased by the tip of buying and selling on the day of earnings name. Through the name, a number of buyers challenged executives on the assumptions used to peg final losses. One fearful in regards to the exclusion of Mercury’s share of FAIR Plan losses from loss estimates and one other questioned the truth that a part of the estimation course of relied on payout ratios from previous wildfire occasions.

Executives patiently laid out specifics of the estimates of gross losses a number of occasions to calm these particular person buyers, with Stalick explaining that Mercury begins with a tally of identified whole losses, that are recognized by policyholder studies, on-ground inspections and aerial imagery.

“We all know what the overall insured worth is for every one of many whole losses,” the CFO mentioned, itemizing dwelling limits, extra alternative prices, contents limits, particles removing, extra constructions, vegetation and landscaping, extra dwelling bills as parts of these whole losses.

“We then have earlier main wildfire occasions,…and we all know what proportion of the TIV we really finally paid out on these occasions…So, we are able to simply take the TIV from the totals that we all know at present, apply these percentages from earlier very massive wildfire occasions on whole, and that offers us a reasonably affordable estimate of what the last word loss will likely be on the totals,” he mentioned, nonetheless referring to claims for whole losses.

Partial losses are available over time, he acknowledged, referring to smoke harm, evacuation prices, and structural harm to fences or indifferent garages. “We all know what’s been reported so far. We all know sometimes the tail on the reporting sample based mostly on different very massive occasions, and we now have an thought of what the common severities are on these based mostly on different historic info and present info,” he mentioned, explaining the method for tallying partial losses.

“The {dollars} from the overall losses are by far the most important part of the last word loss for the corporate,” he mentioned.

As for the FAIR Plan, Tirador referred to Tuesday’s announcement from the California Division of Insurance coverage stating that CDI had authorised the FAIR Plan’s request for a $1 billion trade evaluation. Since Mercury’s participation fee within the FAIR Plan is roughly 5%, the executives mentioned they count on a $50 million evaluation however harassed that fifty% of that may be recouped by way of a brief supplemental charge to policyholders.

“Something above $1 billion, we are able to recoup 100%,” Tirador added.

“However that money goes [right] out the door, [and] you’re going to need to cost your purchasers extra over [time],” an investor argued, fearful that Mercury has an “fast want for capital.”

“We don’t have any liquidity points,” Tirador mentioned.

Addressing the liquidity query earlier throughout his opening remarks, Stalick reported that the corporate has over $1 billion money readily available and the money is incomes 4.35% at present financial institution charges.

Including to Tirador’s response to the investor who fearful that FAIR Plan losses might mount to $10 billion or $20 billion, Stalick famous that Mercury’s reinsurance treaties permit for the inclusion of FAIR Plan losses.

Associated articles: LA Fires: Calif. Insurance coverage Commissioner OKs FAIR Plan Request for $1B Evaluation; Will California’s FAIR Plan Have Sufficient Money for Its Wildfire Claims?

“So, to the extent that we now have [one] of those worst-case FAIR Plan situations, which by the way in which most likely don’t consider that the FAIR Plan has their very own reinsurance, …we are able to connect the FAIR Plan losses to our reinsurance treaty, which we’ve carried out really in earlier huge wildfires. And on high of that, with these assessments, we’re capable of surcharge our policyholders to recoup the assessments,” he mentioned, explaining why executives bifurcated the dialogue of Mercury’s losses and FAIR Plan losses. “We expect that that’s separate and it’s one thing that’s not going to be as important to the corporate,” he mentioned.

Summing up Mercury’s declare exercise so far, Stalick reported that the corporate has already paid out $800 million to its insureds, primarily for 100% of Protection A dwelling limits, in addition to advances as much as 250,000 on contents losses and advances for added dwelling bills.

“Now we have billed $611 million to our reinsurers and have acquired again, really as of this morning, $531 million so far,” he mentioned on Wednesday.

Later, President and Chief Working Officer Victor Joseph supplied extra element, noting that 2,700 claims have been reported to Mercury from the Eaton and Palisades fires—roughly 650 from householders insurance policies which might be whole losses, and 150 “totals” for landlord, renters, condos, and industrial property insurance policies.

Prime picture: 2025 Palisades Hearth. Supply: CalFire.

Matters

Disaster

Pure Disasters

Wildfire

Louisiana