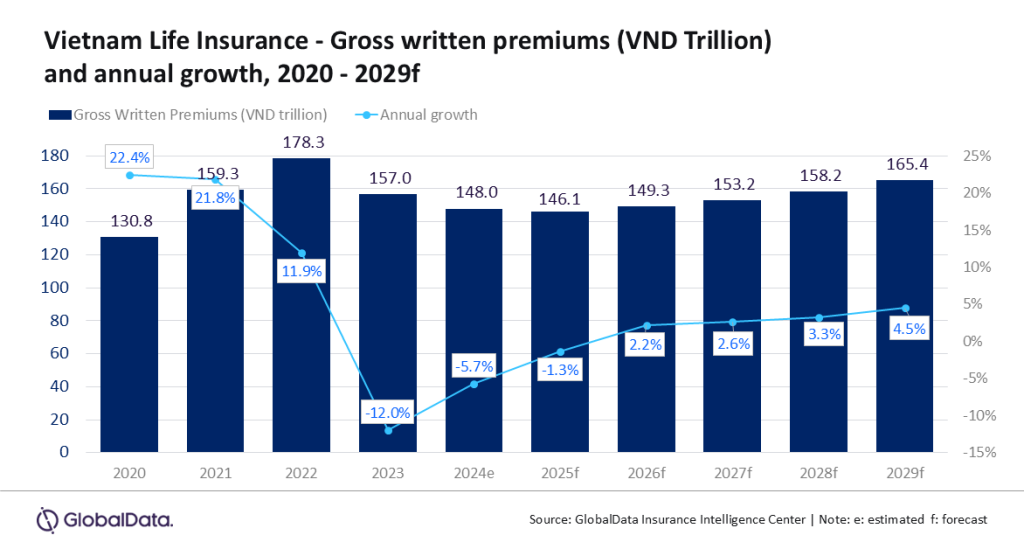

The life insurance coverage sector in Vietnam is predicted to contract by 1.3% to VND146.1trn ($6bn) in 2025 from VND148trn ($6.1bn) in 2024, when it comes to gross written premium.

This follows successive falls of 12% in 2023 and an estimated 5.7% in 2024, based on GlobalData.

Nonetheless, the life insurance coverage market in Vietnam is anticipated to rebound and register optimistic progress beginning in 2026, pushed by an growing older inhabitants, low insurance coverage penetration, rising family earnings, and favorable regulatory initiatives. The market is projected to develop at a compound annual progress price (CAGR) of three.2% throughout 2025-29 to achieve VND165.4trn ($6.4bn) in 2029.

Swarup Kumar Sahoo, senior insurance coverage analyst at GlobalData, stated: “Irregularities in life insurance coverage distribution have led to a decline in shopper confidence, leading to life insurance coverage market contraction throughout 2023-24. False commitments, obscure provisions, misselling, and pushing life insurance policies as necessary with financial institution loans have resulted in a confidence disaster amongst customers.”

Low shopper confidence and fraudulent promoting practices led to very excessive coverage cancellations, leading to a decline within the variety of energetic life insurance coverage insurance policies and insurance coverage penetration. The variety of energetic insurance policies declined by 7.5% in 2023 and three.7% in 2024.

Additionally, life insurance coverage penetration declined from 1.9% in 2022 to 1.5% in 2023 and additional to an estimated 1.3% in 2024.

Sahoo added: “Amid the boldness disaster, nevertheless, strict rules to regulate these irregularities and demographic shifts will help market restoration. Moreover, the low life insurance coverage penetration in Vietnam, which is way decrease than APAC friends reminiscent of Thailand (3.5%) and Taiwan (Province of China) (8.7%), supplies ample progress alternatives.”