Within the period of cutting-edge laptop modeling, satellite tv for pc information and AI, there has by no means been extra plentiful data on the hazard that wildfire poses to houses within the Los Angeles space. However that didn’t essentially assist 1000’s of householders accurately assess their private threat.

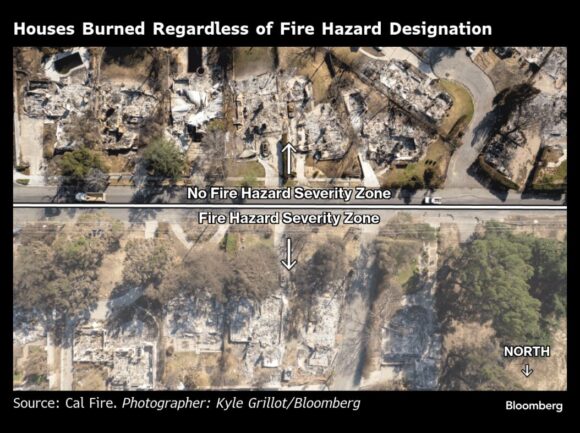

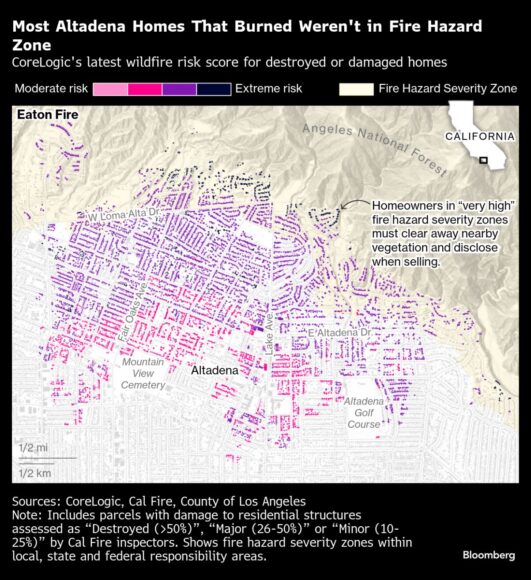

Many houses that burned within the Eaton Hearth lay outdoors the boundaries of state- or local-designated “very excessive” fireplace hazard severity zones, Bloomberg Inexperienced discovered after analyzing inspection studies by the California Division of Forestry and Hearth Safety, or Cal Hearth, for greater than 20,000 residential properties in areas affected by the latest wildfires.

Associated: Munich Re Faces $1.3 Billion in Claims From Los Angeles Wildfires

The fires final month destroyed greater than 11,000 houses in complete, and greater than 40% of these had stood outdoors of the official fire-hazard zones. In Altadena, some 4,500 homes burned in places past the zone boundaries. Which means householders confronted no fire-related disclosure necessities when buying a house, as could be the case for transactions contained in the zones. Property homeowners contained in the zone additionally face mandates for brush clearing and different steps to mitigate threat that didn’t apply to close by houses outdoors the boundary.

Insurers had entry to extra finely tuned threat indicators, and knew methods to interpret them. The neighborhoods that burned in LA “regarded disproportionately excessive threat in comparison with the remainder of the nation, and insurers knew it,” says Anand Srinivasan, head of analysis and improvement at CoreLogic Inc., a property data firm.

This hole factors to a wider drawback. As climate-driven perils equivalent to wildfire and flooding develop into extra frequent and extra extreme, many extra People will attempt to assess their dwelling’s vulnerability. They’ll face combined alerts and a disparity between what information is freely obtainable and the fuller information that non-public firms pays to entry.

The federal government fireplace hazard maps of LA are simply discovered on-line. Different, extra exact data on fireplace threat in LA neighborhoods exists within the personal sector. CoreLogic, which consults for presidency and insurers, amongst different purchasers, had rated the overwhelming majority of houses in Altadena as having a “excessive” or “very excessive” threat of wildfire harm — even when they lay outdoors a hazard zone.

However this information isn’t obtainable to most of the people. It’s bought business-to-business; CoreLogic made it obtainable to Bloomberg for this story.

Associated: Insurers Have Now Paid Out Almost $7B for LA Wildfires, Report Exhibits

There have been different locations householders anxious about wildfire threat may discover extra data, in the event that they have been motivated. First Avenue Know-how Inc. estimates local weather dangers on the property stage and makes its threat scores obtainable to the general public totally free. Its threat rankings seem in listings on the favored actual property websites Zillow and Redfin.

About 95% of destroyed houses in Altadena had a fireplace threat stage of at the very least 7 on a 10-point scale as assigned by First Avenue.

However even individuals who see increased scores may not absolutely grasp them or can discover methods to downplay them.

“If you give folks numbers like this, they have a tendency to numb,” says Anthony Leiserowitz, the founding director of the Yale Program on Local weather Change Communication. “Particularly in the event that they’re not based mostly straight on somebody’s personal expertise.”

Associated: California Approves FAIR Plan Request to Assess Insurers $1B for Wildfire Claims

Individuals are inclined to low cost hazard that isn’t quick. Whereas a majority of People say that international warming is already occurring, solely 47% imagine that it’s inflicting hurt within the US “proper now,” in keeping with latest analysis. In different phrases, folks are inclined to see local weather change as an issue of the long run though it’s already wreaking harm.

Local weather change made the LA fires considerably extra more likely to occur, scientists have concluded, and intensified final yr’s ferocious Hurricane Helene. “We examine local weather change and we all know that it’s altering the percentages in all these elementary methods,” Leiserowitz says, “however most individuals don’t perceive that.”

Local weather threat can be tough to convey as a result of it’s decrease within the very close to time period than over a lifetime, or the everyday size of a mortgage. For instance, what’s usually referred to as the 100-year floodplain shouldn’t be an space that floods roughly as soon as a century, as is commonly assumed. It’s an space the place the chance of flooding is 1% a yr, and over 30 years, that likelihood quantities to 1 in 4.

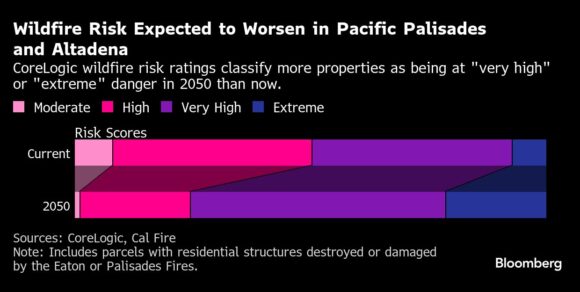

Complicating the image additional, present ranges of local weather threat aren’t fixed. They may rise as extra greenhouse gases are pumped into the ambiance. Danger modelers account for this of their projections.

Arguably, the clearest sign for LA householders was being positioned in a fireplace hazard severity zone. However brilliant boundary traces might be lulling to these simply on the opposite facet of them.

Doug Mark, a resident of West Hollywood, lives lower than a block from the place Sundown Boulevard marks the beginning of a zone. He says it’s not of nice concern to him and his neighbors, and that he hasn’t had hassle getting or maintaining insurance coverage.

“Even for those who’re 5 minutes from the hills, I don’t assume there’s any concern. As quickly as you cross Sundown Boulevard, that’s when persons are occupied with it,” he says.

Altadena sits on the edge of 1 “very excessive” severity zone. Eighty p.c of the native houses that burned sat outdoors the zone.

Cal Hearth takes pains to elucidate that threat ranges and hazard zones usually are not the identical factor. Hazard zones are mapped based mostly on bodily circumstances that create a probability of fireplace, and the anticipated habits of potential fires, over a 30-to-50-year interval. That course of doesn’t consider doable mitigation measures equivalent to dwelling hardening or gas discount, which might change the chance.

Matthew Eby, the founder and president of First Avenue, says the corporate thought loads about methods to talk threat, selecting a 1-to-10 scale for simplicity, paired with descriptors equivalent to “reasonable” or “extreme.” Nonetheless, its estimates are simply that. Each threat modeler approaches the duty otherwise and infrequently with totally different inputs. A previous Bloomberg evaluation of estimates of flood threat in Los Angeles — together with by First Avenue and CoreLogic — discovered huge discrepancies between them. And wildfire threat is extra complicated to mannequin than flood threat.

Eby says that since insurers and monetary establishments have entry to property-level threat estimates, it’s solely honest for householders to have it, too.

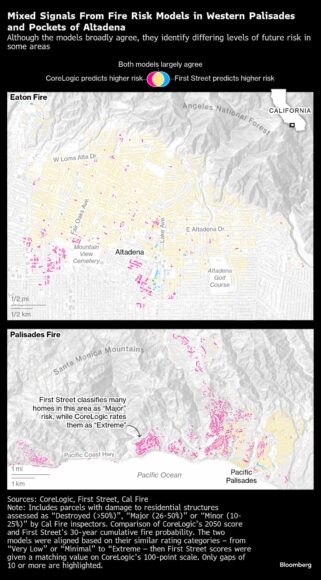

Combined Indicators From Hearth Danger Fashions in Western Palisades and Pockets of Altadena | Though the fashions broadly agree, they determine differing ranges of future threat in some areas

Whereas First Avenue assesses the relative threat of fireplace occurring on a given property, CoreLogic calculates its scores based mostly on the projected prices of repairing or rebuilding resulting from wildfires and smoke over time. CoreLogic can estimate present threat or take a look at threat going into the long run. (Against this, First Avenue’s threat scores are designed to seize cumulative threat over 30 years.)

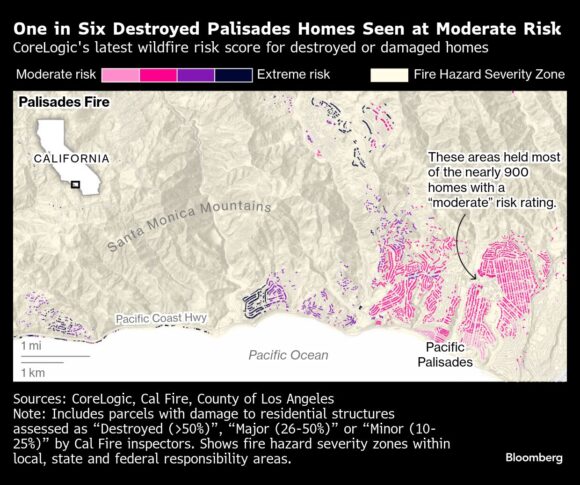

Additional west, all the space leveled by the Palisades Hearth was coated by state or native fireplace hazard severity zones. But about 850 of the houses destroyed, or 15% of the overall, had a present wildfire threat rating from CoreLogic within the “reasonable” vary, between 36 and 55 out of 100. Many of those houses have been clustered within the jap areas of the fireplace’s path, within the Pacific Palisades neighborhood correct. Against this, additional west in Malibu, one in three houses had an “excessive” rating of 86 or increased.

The catch is that whereas unusual residents are inclined to low cost threat scores, insurance coverage firms completely don’t. And so they don’t measure it the identical approach, both. Insurers are a liquid pool of capital with no emotional attachment to houses; it’s their enterprise to be ruthless of their analytical assessments.

Even a “reasonable” CoreLogic rating would ship a robust sign to an insurance coverage firm. Totally 70% of houses throughout the US scored by CoreLogic have fireplace threat beneath “reasonable.” Insurers additionally look not solely at averages however on the tail of the curve, which is possible most loss.

Though a share of the houses had decrease scores, says CoreLogic’s Srinivasan, “the majority have been increased, and while you couple that with 80-mile-an-hour sustained winds and the proximity of the properties, you’ll have a extreme influence on even lower-risk properties.”

Insurers had already been pulling out of Pacific Palisades. State Farm, California’s largest residential insurer, moved to cancel practically 70% of its insurance policies in a single Zip code there final yr. (The corporate paused non-renewals after the fires, in response to a moratorium issued by the state.)

In idea, high-priced insurance coverage or a scarcity of insurance coverage choices needs to be one other clear message to householders that they’re in hurt’s approach. However, says Yale’s Leiserowitz, it’s doable to place that down principally to insurance coverage firm greed.

Marcy Weinstein, an actual property agent in fire-prone Newport Seaside, south of LA in Orange County, says her purchasers usually interpret it that approach.

After the fires in LA, “I’m not seeing an enormous stage of hysteria occur,” she stated. “What we’re seeing is backlash towards the insurance coverage being so tough to get. You’re attempting to get your dream dwelling, and it’s tough for insurance coverage to match up.”

Copyright 2025 Bloomberg.

Subjects

Louisiana