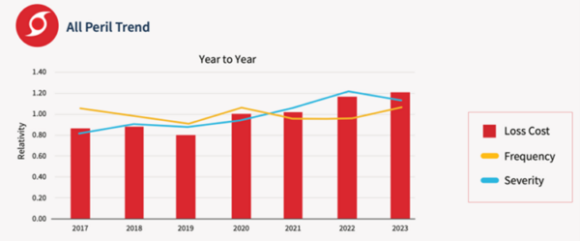

The U.S. house insurance coverage business has skilled an upward pattern in all-peril loss prices over the previous seven years, in response to a brand new report launched by LexisNexis Threat Options.

The ninth annual LexisNexis U.S. Residence Traits Report discovered that all-perils misplaced prices and all-perils frequency elevated by 4.1 p.c and 11 p.c, respectively, from 2022 to 2023. Since 2019, all-perils loss prices rose 52 p.c, with frequency climbing 16.9 p.c.

Though severity has declined 6.3 p.c since 2022, it stays 29.8 p.c increased than 2019 figures, the information confirmed.

For the needs of the report, the all-perils figures mix information for hail, wind, water, hearth and lightning climate perils, in addition to non-weather associated claims resembling water leaks, thefts or legal responsibility.

Disaster claims represented 46 p.c of claims throughout all perils mixed in 2023, the very best in seven years.

By peril, a few of the information breaks down as follows:

- Hail loss prices elevated 57.9 p.c from 2022 to 2023, together with frequency (up 53.6 p.c) and severity rising 2.8 p.c 12 months over 12 months from 2022. States with the very best impression of hail-related perils embody Colorado, Nebraska and Wyoming.

- Loss prices for different weather-related perils declined from 2022 to 2023, with hearth and lightning prices down 11.1 p.c, and weather-related water down 51.4 p.c.

- Non-weather-related water loss prices decreased by 11.2 p.c in the identical interval however remained on an upward pattern over the previous seven years.

“Within the final 12 months, the U.S. noticed a number of historic-level climate catastrophe occasions and the very best degree of catastrophic claims throughout all perils we’ve seen previously seven years, which contributes to rising premiums that customers throughout the nation face proper now,” mentioned Cole Winans, vice chairman, house insurance coverage, LexisNexis Threat Options.

“As house insurance coverage carriers proceed to cope with seasonal and geographic variabilities associated to local weather— along with rising inflation, materials and labor price—understanding by-peril and macro degree house insurance coverage developments, coupled with sustaining in depth information and imagery on present home circumstances over an prolonged time period is crucial to stay nimble in immediately’s risky and dynamic market,” he added.

“Whilst extra insurers are prone to see fee will increase accredited in sure states within the coming months, they may must be discerning in writing new enterprise solely in these pockets the place they will accomplish that profitably and that will probably be on a carrier-by-carrier and state-by-state foundation.”

Regardless of the all-perils severity discount in 2023 (6.3 p.c down from 2022), the elevation in severity above 2019 (up 29.8 p.c) factors to the significance of long-term pattern information when evaluating threat and pricing, the report said.

Colorado ranks highest in loss prices from catastrophic claims (274 p.c above 2023 U.S. common catastrophic loss price), whereas the severity of claims ({dollars} misplaced, on common, per declare paid) was highest within the state of Hawaii in 2023 (63 p.c above 2023 U.S. common severity).

U.S. states with the very best mixed disaster and non-catastrophe loss prices embody Colorado, Minnesota, Nebraska, Louisiana and Iowa. Lowest rating states embody Massachusetts., New Hampshire, West Virginia, Vermont and Maine.

In 2023, the information indicated the U.S. skilled 6,962 hail occasions, up 57.3 p.c from 2022, with 71 p.c of hail claims deemed catastrophic.

With 28 climate and local weather disasters in 2023, every surpassing the billion-dollar injury threshold, 17 had been attributed to extreme climate or hail occasions.

Hail peril seasonality over the previous seven years continues, with April, Could and June observing the very best frequency and loss price in 2023.

Wind peril frequency rose 14.8 p.c, together with a loss price growing 0.7 p.c from 2022-2023. Severity, by comparability, fell 12.3 p.c year-over-year, the report discovered. Regardless of seasonal loss price averages peaking in August and September over the previous seven years, 2023 loss price and frequency had been highest in March.

In 2023, 62 p.c of wind claims had been deemed catastrophic claims, up from 52 p.c the 12 months prior.

Hearth and lightning perils in 2023 noticed decreases in loss prices (-11.1 p.c), frequency (-8.6 p.c) and severity (-2.7 p.c) from 2022. Nonetheless, catastrophic claims rose 7 p.c from 2023, with the Maui, Hawaii, wildfire thought-about one of the damaging and lethal occasions in 2023.

Climate-related water perils declined in 2023 with a discount in loss price (-51.4 p.c), frequency (-25.5 p.c) and severity (-34.8 p.c). In 2023, 61 p.c of weather-related water claims had been catastrophic.

Addressing claims associated to water injury, resembling leaking pipes and home equipment, non-weather-related Water perils decreased throughout loss price (-11.2 p.c), frequency (-10.3 p.c) and severity (-1.1 p.c) in 2023.

Whereas theft loss price and frequency decreased by 14.2 p.c and 15.8 p.c, respectively, in 2023, severity rose by 1.9 p.c, partially attributed to the rising price of client items resembling high-end kitchenware.

Legal responsibility noticed a marginal improve in severity (0.2 p.c) in 2023, with an 18.3 p.c drop in frequency driving down total loss prices (down 18.2 p.c).

Different perils, together with bodily injury claims not included elsewhere, prolonged protection, injury to property of others, and so on., noticed a frequency improve of 9.3 p.c year-over-year. Loss prices, together with severity, each declined 10.7 p.c and 18.3 p.c, respectively, from 2022 to 2023.

“Once we have a look at peril information over a seven-year span, it’s more and more clear that house insurers can’t depend on short-term developments alone to make absolutely knowledgeable selections about their books of enterprise and operational methods,” mentioned George Hosfield, affiliate vice chairman, house insurance coverage, LexisNexis Threat Options. “For instance, whereas hail loss price surged by 57.9 p.c in a one-year observance, the longer-term pattern reveals constant will increase throughout all perils year-over-year. This emphasizes the necessity for carriers to think about broader historic information when evaluating threat and adjusting pricing methods to assist help their long-term profitability.”

Subjects

Traits

Pricing Traits

Owners