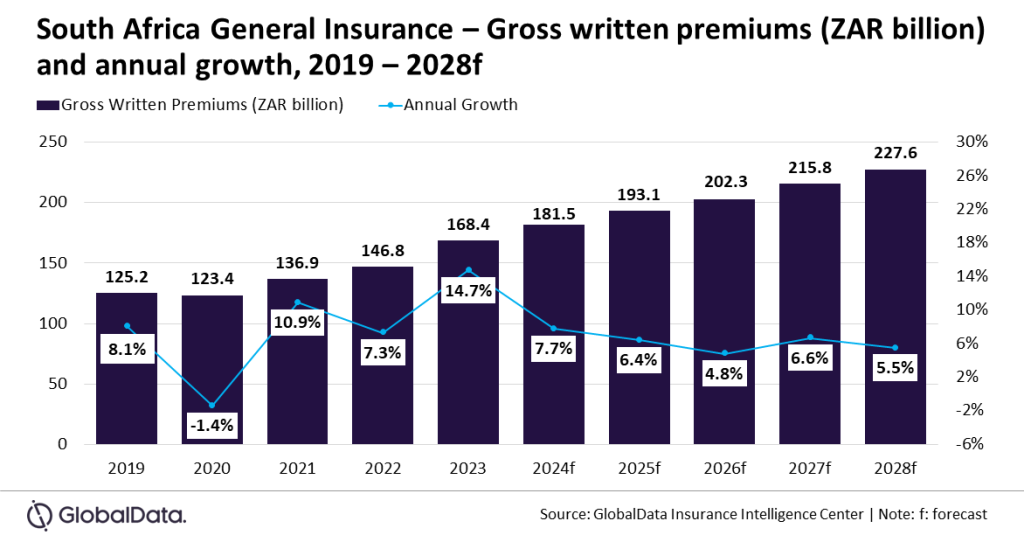

The final insurance coverage trade in South Africa is ready to develop at a CAGR of 5.8% from ZAR181.5bn ($9.8bn) in 2024 to $11.2bn in 2028 when it comes to gross written premiums.

That is in line with GlobalData which additionally predicted that the overall insurance coverage trade in South Africa will develop by 7.7% in 2024. Rising car gross sales, rising demand for insurance policies overlaying pure disasters and rising cybercrime incidents will encourage this rise.

Sutirtha Dutta, insurance coverage analyst at GlobalData, mentioned: “The South African basic insurance coverage trade grew by 14.7% in 2023, recording the best development within the final 5 years. The expansion was supported by robust efficiency of the important thing financial sectors resembling vehicles, building, and monetary providers. Nonetheless, the expansion of basic insurance coverage trade is anticipated to stay subdued in 2024 and 2025 as a result of slower financial development.”

Motor insurance coverage is the main line of enterprise within the South African basic insurance coverage trade, which is anticipated to account for 42.5% share of the overall insurance coverage GWP in 2024.

As well as, it’s anticipated to develop by 5.6% in 2024, supported by rising car gross sales.

In keeping with the Automotive Enterprise Council (NAAMSA), complete car gross sales elevated by 6.8% in July 2024 as in comparison with July 2023.

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain electronic mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

choice for your enterprise, so we provide a free pattern that you would be able to obtain by

submitting the beneath type

By GlobalData

The rising recognition of electrical automobiles (EVs) and new vitality automobiles (NEVs) will even assist the expansion of motor insurance coverage. Gross sales of New Vitality Automobiles (NEV) elevated by 82.7% in the course of the first quarter of 2024 as in comparison with the identical interval of the earlier yr.

Dutta added: “Rising premium charges will even assist motor insurance coverage development. The rising costs for vehicles, frequent nat-cat occasions, in addition to rising circumstances of auto theft and street accidents, have led to a rise within the total value of claims for insurers. In consequence, insurers are anticipated to reassess their danger publicity and enhance the premium charges for motor insurance coverage. Motor insurance coverage is anticipated to develop at a CAGR of 6.5% throughout 2024-28.”