UK brokers consider cyber insurance coverage is the brand new or rising industrial insurance coverage product with essentially the most development potential, as per a GlobalData survey. Considerably low cyber insurance coverage penetration charges amongst smaller companies make SMEs a largely untapped marketplace for development.

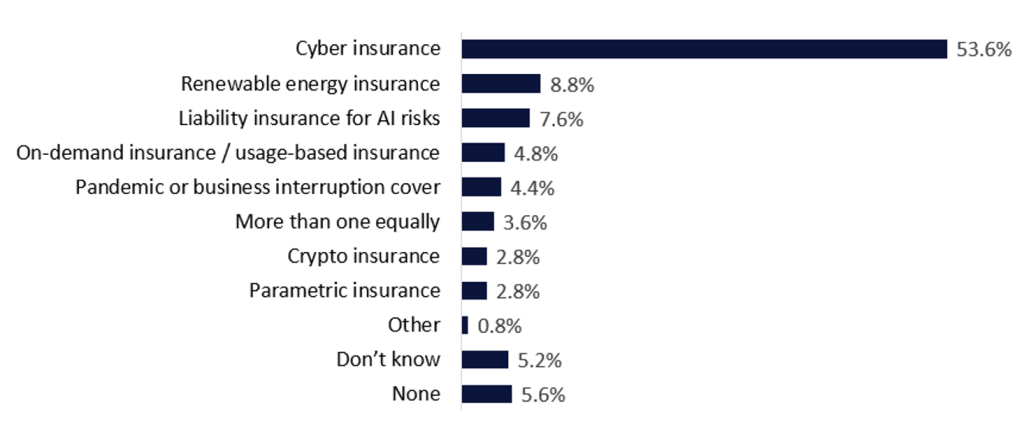

Based on GlobalData’s 2025 UK Business Insurance coverage Dealer Survey, over half of brokers (53.6%) consider cyber insurance coverage has the potential to report the strongest development amongst new or rising industrial insurance coverage merchandise. Cyber insurance coverage considerably surpasses the potential of different rising merchandise, with renewable power insurance coverage—the second-most fashionable product—attaining 8.8% of responses.

Which new or rising industrial insurance coverage product do you see as having essentially the most development potential? 2025

GlobalData’s findings are supported by current analysis revealed by Aon. Its Reinsurance Market Dynamics: Midyear 2025 Renewal report finds that reinsurance capability is poised to assist development within the international cyber insurance coverage market as reinsurers diversify their methods to faucet into rising dangers. Better urge for food round this line of enterprise will assist softening market circumstances, as a rise in capability will help insurers fight hovering premiums.

Regardless of the rising consciousness of cyber dangers amongst companies, the adoption of cyber insurance coverage shouldn’t be common, with underinsurance remaining a key problem to the business. The safety hole is extra pronounced amongst smaller companies, with GlobalData’s 2025 UK SME Insurance coverage Survey revealing that 60.8% of SMEs don’t maintain such cowl. The commonest motive for not holding cyber insurance coverage is as a result of companies consider it’s unlikely that they are going to be a goal of a cyberattack, as cited by 40.5% of SMEs. But the chance of a cyberattack is six instances higher than an occasion impacting property, in response to Aon.

Insurers might want to sort out the safety hole via a number of fronts to develop the cyber insurance coverage market. Specializing in conveying the influence {that a} cyberattack can have on a enterprise—not solely when it comes to operations, but additionally popularity—could be helpful. Equally, there might be higher transparency on coverage wording, making it clearer what the perils and exclusions are to keep away from this being a barrier to consumers. Lastly, SMEs stay a largely untapped market and are sometimes extra susceptible to assaults however have fewer sources to reply successfully. This makes them robust candidates for tailor-made cowl, growing merchandise that handle their particular wants.