Cyber insurance coverage is now seen by trade leaders because the product with the best demand potential resulting from political tensions, in line with GlobalData polling. As political tensions spill into our on-line world and assaults develop into costlier and extra disruptive, insurers and organisations alike are shifting their strategic focus to enhancing cyber resilience and danger switch.

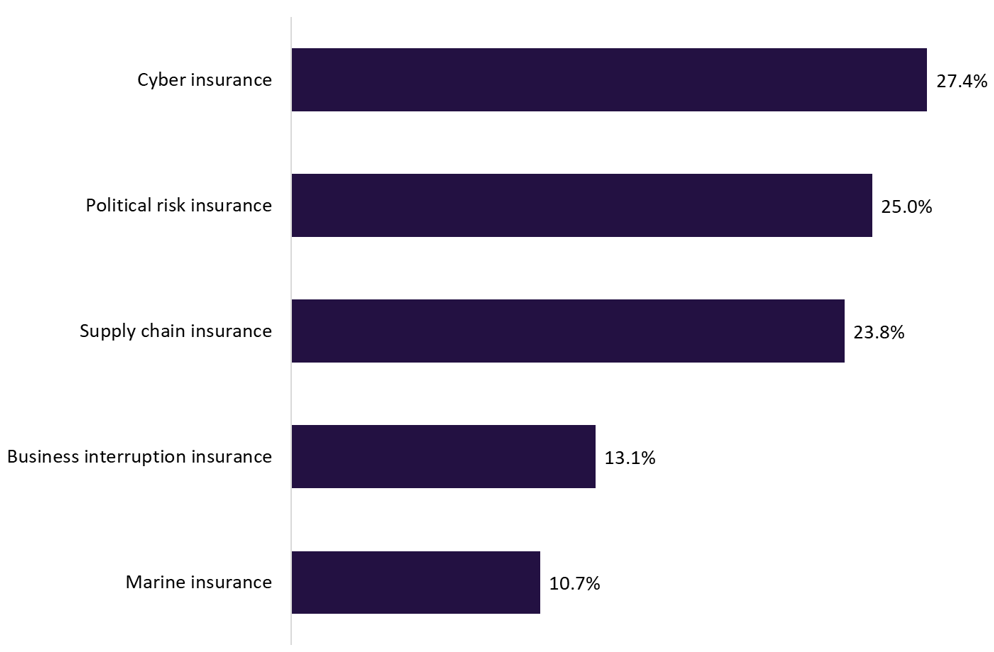

GlobalData’s newest ballot run on Verdict Media websites in Q3 2025 discovered that trade insiders imagine cyber insurance coverage will see the very best improve in demand, with 27.4% choosing it as the highest product. This notion is pushed by rising geopolitical tensions and the rising menace of cyberattacks. Cyber insurance coverage was positioned forward of political danger insurance coverage (25%), provide chain insurance coverage (23.8%), and enterprise interruption insurance coverage (13.1%), which exhibits that digital safety considerations have overtaken conventional political and operational exposures.

What sort of insurance coverage product do you assume will see the very best demand resulting from geopolitical tensions? Q3 2025

The continued battle between Russia and Ukraine has prolonged past typical warfare to incorporate refined cyber operations concentrating on essential infrastructure and company networks.

Concurrently, heightened instability within the Center East is more and more manifesting as state-sponsored and hybrid cyberattacks that span past conventional struggle zones. Organisations at the moment are recognising that cyber incidents are usually not solely the area of particular person hackers or prison teams however can originate from geopolitical escalation and nation-state actors.

These threats can compromise provide chains, undermine operational resilience, and harm reputations—creating complicated exposures that typical insurance coverage merchandise battle to handle. Consequently, cyber insurance coverage is rising as a core strategic danger switch device in a world the place digital threats and political tensions are deeply intertwined.

Insurers can play a extra energetic position in mitigating dangers by providing clearer protection, enhancing menace monitoring, and offering stronger preventative and incident-response assist. Options reminiscent of vulnerability assessments, worker cyber consciousness coaching, and enhanced safety partnerships may also help organisations cut back the probability of an assault within the first place. By collaborating carefully with governments and cybersecurity specialists, insurers can keep forward of evolving assault strategies linked to geopolitical tensions. This twin deal with prevention and quicker restoration will assist strengthen operational resilience and guarantee organisations are higher protected earlier than and after cyber incidents happen.