The U.S. surplus strains market notched double-digit year-over-year (YoY) premium progress from 2018-2023, as wholesale brokers tapped this market with higher frequency to discover protection options for companies amid increasing dangers.

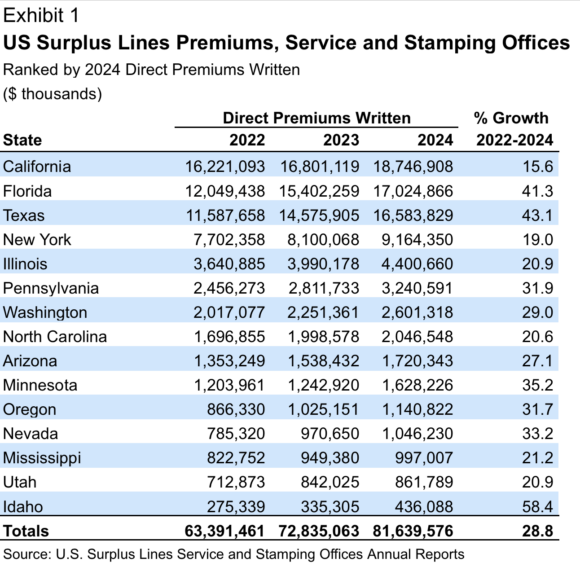

The magnitude of the YoY progress peaked at 30% in 2021, primarily based on information compiled by AM Greatest. The U.S. surplus strains and stamping places of work detailed the continuation of premium momentum, highlighting a 12.1% YoY premium improve in 2024 for surplus strains’ insurers reporting information to the 15 particular person state service and stamping places of work nationwide. Throughout the final full three years from 2022-2024, premiums produced by the service and stamping places of work elevated by 28.8%.

A number of segments have been key in contributing to the expansion in premiums generated by surplus strains—or non-admitted—insurers within the three-year interval, together with strains immediately experiencing turbulence post-COVID from macroeconomic pressures.

“Surplus strains writers have collectively been offering a higher proportion of market protection for a number of the identical strains which have generated unfavorable underwriting outcomes for the general P/C business through the previous decade.”

Though private strains protection, particularly householders’ insurance coverage, stays a comparatively small a part of the general surplus strains market, elevated writings in that section have contributed to the constant surplus strains premium progress. Many states, along with a number of strains of enterprise, have been key contributors to this momentum.

Largest States Drive Premium Progress

4 states that constantly account for the most important share of U.S. surplus strains direct premium written (DPW) yearly—California, Florida, Texas, and New York—additionally generate nearly all of complete property/casualty (P/C) insurance coverage direct premium. The primary three states referenced every generated over $16 billion in surplus strains premium for the yr, with New York lagging behind, comparatively, at $9.1 billion (see Exhibit 1 under). In 2024, these states produced over 75% of complete U.S. surplus strains DPW, primarily based on the companies and stamping places of work information.

Even earlier than the devastating California wildfires in the beginning of this yr, excessive climate in 2023 and 2024, together with heavy rains that subsequently yielded mudslides, created unfavorable outcomes for householders’ and industrial property insurers providing protection within the state, considerably affecting underwriting ends in these years.

Subsequently, some admitted insurers reassessed their urge for food for property enterprise and pushed extra of it into the excess strains market. California’s property insurance coverage market is more likely to face extra challenges within the close to time period, and surplus strains’ insurers might be referred to as upon to fill provide gaps as extra admitted insurers turn out to be more and more even handed with their market capability in particular areas of the state. If this happens, it will be much like market dynamics in Florida and Louisiana following the affect of elevated weather-related losses earlier this decade.

Troubled Protection Traces Present Alternatives

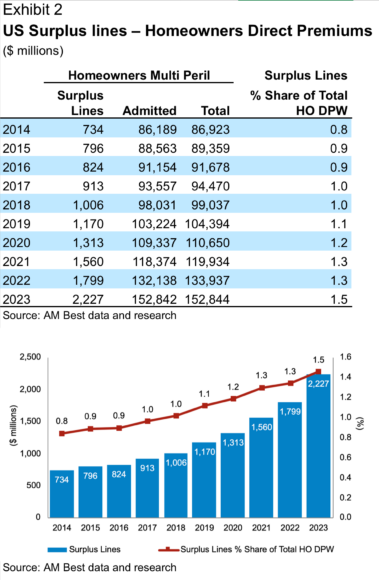

Volatility within the underwriting outcomes for property insurers has led to the upper coverage pricing for each industrial and private strains property companies. Whereas surplus strains writers haven’t traditionally centered a lot on private strains enterprise, they generated 1.5% of U.S. householders’ DPW in 2023, reaching the best degree through the decade and surpassing the $2 billion mark for the primary time (see Exhibit 2 under).

AM Greatest expects that when 2024 surplus strains information is totally aggregated, it’s going to reveal a continuation of the pattern. Surplus strains’ insurers have had the pliability to satisfy demand throughout robust markets, which has led to surplus strains’ householders’ premium greater than doubling over the last six years, from $1.0 billion in 2018 to $2.2 billion in 2023.

Throughout this time, the P/C business’s year-over-year householders market profitability has exhibited a higher-than-normal degree of volatility. Line of enterprise premium information serves as an indicator of the sorts of enterprise being provided within the surplus strains market throughout any given interval.

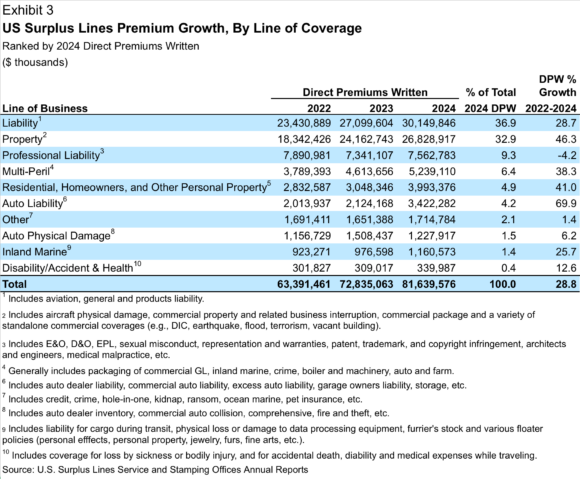

From 2022 via 2024, surplus strains service workplace information revealed that complete surplus strains premium grew by 28.8% (see Exhibit 3 under).

Casualty strains of enterprise embody common legal responsibility, merchandise legal responsibility, umbrella and extra legal responsibility protection. AM Greatest has discovered that common legal responsibility coverages constantly mixed to signify the most important portion of the excess strains market from a DPW perspective.

Preliminary information aggregation for 2024 signifies an nearly 10 proportion level deterioration within the P/C business’s internet incurred loss ratio for the opposite legal responsibility (prevalence) protection line, which represents the bigger of the 2 common legal responsibility protection strains. The mixture of common legal responsibility (36.9%) and industrial property (32.9%) protection represented nearly 70% of surplus strains market premium written via the service and stamping places of work during the last three years.

Business property included enterprise interruption protection related to industrial property insurance policies, along with standalone coverages, together with however not restricted to distinction in circumstances, earthquake, flood and terrorism. No different protection accounted for as a lot as 10% of the excess strains market. The pattern displaying rising premium progress underscores the excess strains market’s potential to adapt to shifting calls for, using its freedom of charge and kind to supply protection for troubled threat courses and features of protection when admitted market carriers show reticence to do the identical.

Selective Progress in Adversely Trending Traces

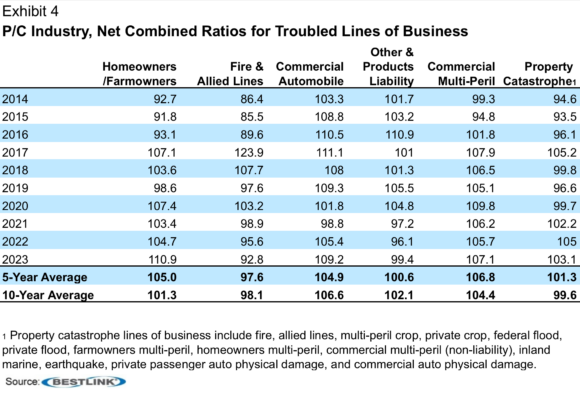

Surplus strains writers have collectively been offering a higher proportion of market protection for a number of the identical strains which have generated unfavorable underwriting outcomes for the general P/C business through the previous decade. For many of those strains, business underwriting outcomes have been trending poorly and have exhibited notable volatility in recent times (see Exhibit 4 under).

The five-year common internet mixed ratios for the householders, industrial auto, and property disaster strains of insurance coverage—which encompasses industrial property, and each householders and farmowners multi-peril strains of protection, amongst others—all exceeded the breakeven mixed ratio of 100. The industrial multi-peril line, which largely displays protection written for small- and medium-size industrial enterprises, posted the best common mixed ratio (106.8) throughout that five-year interval and generated a mixed ratio nearly as excessive (104.4) during the last 10 years.

In the course of the 2014-2023 interval, altering climate-related dangers led to extra frequent weather-related occasions, and inflationary pressures on declare prices added to the challenges confronted by insurers underwriting property, industrial auto, and common legal responsibility strains, which have been strong progress areas for surplus strains’ insurers. Many customary market insurers have reassessed their threat urge for food and underwriting methods for these protection strains.

Surplus strains’ firms have confirmed adept at opportunistically choosing the dangers they’re prepared to insure and utilizing their freedom to develop bespoke coverage provisions to provide distinctive merchandise to satisfy the wants of policyholders.

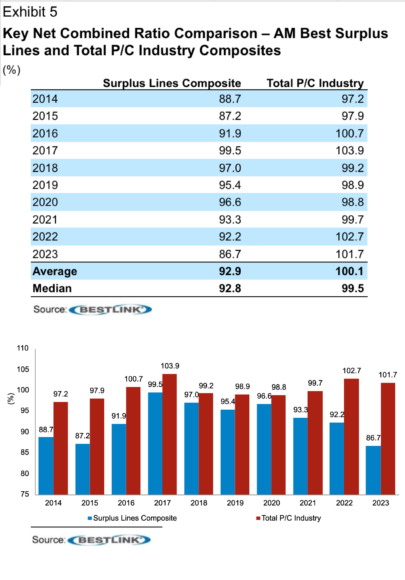

That effectiveness has resulted in surplus strains’ firms, within the combination, producing superior underwriting outcomes in comparison with the outcomes of the overall P/C business wanting via the lens of AM Greatest’s surplus strains composite and its complete P/C business composite (see Exhibit 5 under). AM Greatest’s surplus strains composite displays the outcomes of firms for which greater than 50% of their enterprise is written on a non-admitted or surplus strains foundation.

Growing Progressive Protection Options

The excess strains section has efficiently pivoted throughout difficult circumstances by adjusting methods, growing revolutionary protection options and modifying enterprise threat administration rules. These strengths have been important to the market’s enlargement and as carriers undertake practices that usually have led to short-term enhancements throughout troublesome intervals, whereas searching for to ascertain long-term success.

As companies proceed integrating newer applied sciences similar to generative synthetic intelligence into each day operations and use new scientific discoveries and instruments of their operations that current new threat exposures, AM Greatest believes the position of surplus strains’ insurers will proceed to broaden. These insurers will likely be critically necessary to insureds in manufacturing, engineering, development, and different companies that require nimble protection options to guard their companies.

Associated:

Subjects

Extra Surplus

Property Casualty