In accordance with the Insurance coverage Analysis Council (IRS), the typical householders insurance coverage expenditure has grow to be much less reasonably priced for U.S. customers over time.

Trying on the the years 2001 to 2021—the newest yr wherein related information is accessible—householders spent about 2% of family earnings on householders insurance coverage, with what the IRC known as “placing disparity” between states. The U.S. common expenditure on householders insurance coverage elevated from $508 in 2001 to $1,411 in 2021, or a 5% annualized rise.

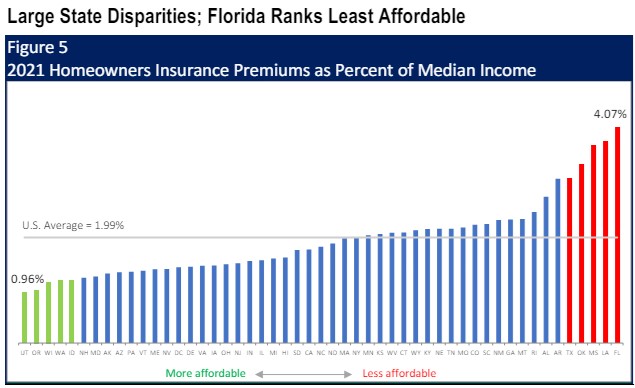

The IRC’s evaluation, meant to be a useful resource information for policymakers trying to enhance affordability, measures householders insurance coverage affordability by calculating the ratio of common householders insurance coverage expenditures (from information derived from the Nationwide Affiliation of Insurance coverage Commissioners) to median family earnings.

For example, Utah is probably the most reasonably priced state with customers spending 0.96% of family earnings on house insurance coverage. Florida ranks because the least reasonably priced, with customers per family paying barely greater than 4%—greater than double the nationwide common—on house insurance coverage, the IRC’s evaluation concluded. Louisiana had held the excellence of the least reasonably priced state for a few years however the state improved in 2021 as a consequence of a drop in median family earnings to offset an 11% enhance in insurance coverage spending.

The IRC concluded that from 2001 to 2021, householders insurance coverage expenditures confirmed a normal upward development, pushed by components similar to pure disasters, financial circumstances, rising development prices, and litigation exercise in some states. In the meantime, the typical family earnings additionally grew throughout the identical time. Nevertheless, the IRC discovered, the rise in insurance coverage spend outpaces the rise in family earnings, with an annualized development price of two.5%. It is very important observe the report doesn’t embrace the fast will increase in insurance coverage charges since 2021, IRC stated.

“An understanding of what drives the price of insurance coverage is important for customers navigating the present insurance coverage market,” stated Dale Porfilio, president of the IRC and chief insurance coverage workplace for the Insurance coverage Info Institute (Triple-I). “Efforts to advertise house owner consciousness and adoption of protecting measures, strengthen state and native constructing codes, and encourage group resilience packages can all enhance insurance coverage affordability.”

Matters

Revenue Loss

Householders

Thinking about Householders?

Get computerized alerts for this subject.