When Bernard Weisse first observed a tiny crack within the outer wall of his home on the outskirts of Paris, he dismissed it as little greater than a nuisance. However within the 4 years since, a spiderweb of fissures has unfold from ground to ceiling and snaked into nearly each nook of his dwelling.

“We are able to hear loud cracking noises particularly when it’s heat exterior,” mentioned the retired salesman and father of three. “Typically, I feel we must always get all our stuff collectively and depart.”

Like a rising variety of individuals world wide, Weisse is grappling with subsidence — a time period for the sinking land that’s inflicting injury to properties and different buildings constructed on it. The slow-moving local weather catastrophe has already triggered tens of billions in injury and has the potential to have an effect on 1.2 billion individuals in areas accounting for greater than $8 trillion of financial output.

Whereas groundwater extraction, mining and earthquakes additionally trigger the bottom to shift, world warming vastly will increase the dangers. What occurs is that soil swells with winter rain after which shrinks because it dries within the warmth, cracking foundations within the course of.

Due to its soil and its standing because the world’s fastest-warming continent, Europe is especially uncovered. The European Central Financial institution estimates the area’s potential injury from sinking land at greater than €2.5 trillion ($2.9 billion) throughout all euro-area monetary establishments. Though most of that’s categorised as “low danger,” this summer time is forecast to be one of many hottest and driest on the continent, creating good situations for subsidence injury.

For Weisse, the fee for repairs might climb to as a lot as €200,000 to maintain his two-story dwelling from crumbling. That might be a part of the estimated €43 billion in injury that households face by 2050 in France alone, in line with insurance coverage commerce group France Assureurs. With that a lot cash at stake, it’s set off a battle over who will in the end need to pay.

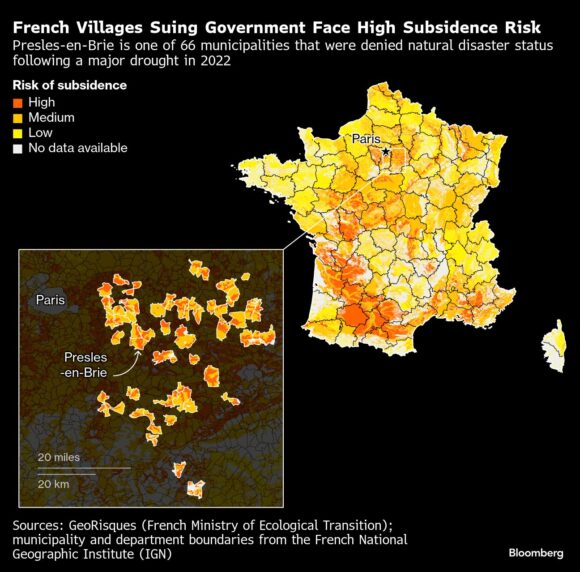

Weisse’s city of Presles-en-Brie has teamed up with 14 close by villages and sued the state to have their subsidence points acknowledged as a pure disaster like flash floods and wildfires. That might set off funds from insurers and the federal government, highly effective opponents for the municipalities.

“It’s David in opposition to Goliath,” mentioned Dominique Rodriguez, who’s been mayor of the pastoral group of two,300 individuals for greater than three a long time.

Up to now, the large guys are successful. In Presles-en-Brie, at the least 40 owners have sought subsidence compensation since 2020, and whereas two homes have been granted CatNat recognition, others have been rejected.

Europe is the epicenter due to its clay-rich soil and comparatively excessive inhabitants density. Additionally, buildings from the Nineteen Seventies and 80s — when a postwar housing building growth was nonetheless underway — are significantly prone.

Whereas Presles-en-Brie is an early sufferer, the problems are world. Jakarta has sunk greater than 2.5 meters (8 ft) in a decade, and Tehran drops as a lot as 22 centimeters a yr. Within the US, Houston is most affected, with 40% of town subsiding greater than half a centimeter a yr.

Greater than 425,000 Dutch homes will probably be uncovered over the subsequent decade, with subsidence already decreasing home costs by as a lot as 5%, in line with a current research by the Tinbergen Institute. Restore prices can exceed €100,000 per dwelling and are not often coated by insurance coverage.

“The state of affairs is pressing,” mentioned Karsten Klein, director of advocacy at Vereniging Eigen Huis, a Dutch owners affiliation. “Ready till properties turn into uninhabitable just isn’t an choice.”

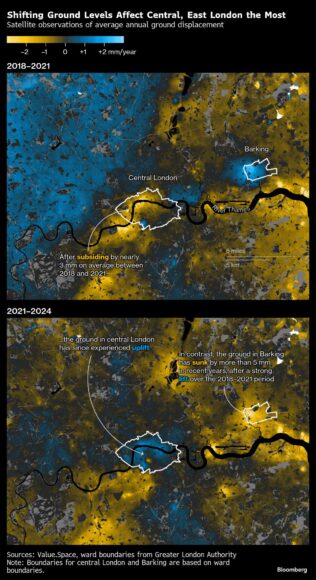

In London, shifting floor ranges over the subsequent 5 years are set to have an effect on two-fifths of the housing inventory, or greater than one million properties, in line with the British Geological Survey.

Throughout the UK, there have been a half dozen “surge years” for subsidence during the last 20 years. With the nation experiencing certainly one of its driest springs in a century, 2025 might find yourself as one other “excessive danger” yr, in line with Geobear, an organization that undertakes repairs.

Insurance coverage claims for the hazard jumped 78% between 2019 and 2023 and the typical payout rose 40% over that interval, in line with information supplied by the Affiliation of British Insurers.

Whereas the UK is among the few nations on the planet the place insurers cowl subsidence injury, it’s difficult to handle as a result of the impacts will be affected by native situations like timber absorbing water. Just a few years in the past, central London suffered probably the most from subsidence, however now it impacts jap neighborhoods extra, in line with satellite tv for pc information from Worth.Area.

Geobear says its information helps the shift of the subsidence burden to jap London, the place the floor is much less constructed up and so extra uncovered. If actions are associated to clay shrinkage, then it is smart that locations like Barking are hit more durable, mentioned Otso Lahtinen, Geobear’s chief govt officer.

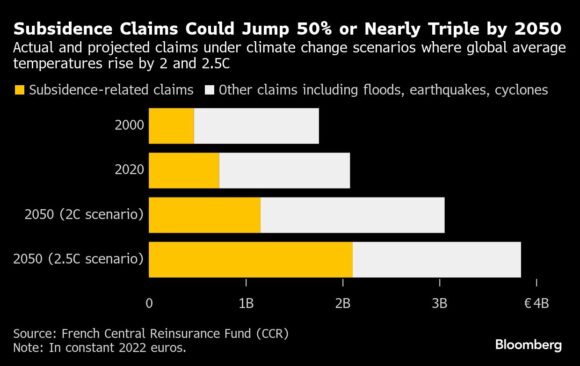

In France, half of all single-family properties might be affected by subsidence by the tip of the last decade, in line with Paul Esmein, head of the French insurance coverage foyer. Since 2016, the nation’s insurers have paid about €1 billion a yr for subsidence claims. That quantity tripled in 2022, when European temperatures hit their second-highest stage.

To deal with rising losses from pure disasters and supply safety for owners, France launched a public-private insurance coverage program in 1989 referred to as CatNat — a system that places the state and the trade on the identical aspect as prices surge. Owners are compensated for injury after their municipality has been awarded a CatNat certification. In any other case, insurers are free to reject claims.

Regardless of the challenges confronted by communities like Presles-en-Brie, France’s system is near a best-case situation for owners, which have little to no recourse to have subsidence injury coated in most different nations.

“Since its creation, the French system for recognizing pure disasters has continually tailored to the injury suffered by the inhabitants,” the French inside ministry mentioned in response to Bloomberg questions, including that the factors for subsidence recognition was relaxed final yr.

Within the case of Presles-en-Brie, the inside ministry mentioned pure catastrophe situations was acknowledged for a part of 2020 as soil moisture was decided to be irregular. It didn’t touch upon the continued dispute.

Allianz France says that during the last decade subsidence constituted 60% of all CatNat damages within the nation, virtually double the speed of the earlier 15 years.

“The development is getting extra difficult with local weather change,” mentioned Pierre Vaysse, chief underwriting officer for property and casualty on the French insurer. “The forecast is that claims will at the least enhance by 50% and doubtless double by 2050.”

France’s CatNat system misplaced €49 million in 2024, its eighth straight annual deficit. Often known as the Central Reinsurance Fund, this system is paid for by a nationwide surcharge on insurance coverage insurance policies, which was raised by eight share factors in January to account for local weather change.

For owners, the strained system means larger premiums however with no certainty of protection, and there’s a danger that insurers abandon weak areas as has occurred in elements of the US susceptible to hurricanes and wildfires.

Potential repairs embody basis reinforcements often called micropiles and injecting compounds into the soil to stabilize the clay. In some circumstances, the prices can method the worth of the house. With promoting hardly a viable choice, homeowners have little alternative however to fork out the cash themselves.

“There’s a actual menace that the injury will find yourself dislocating our complete home,” mentioned Weisse, the proprietor of the broken home in Presles-en-Brie.

Burdened by the influence of local weather change, the insurance coverage system is “on its final legs,” mentioned Regis Thauvin, who handles subsidence points for the city council and can also be affected. “We are able to’t simply inform individuals to attend a yr and a half for a call to be made earlier than doing the required work.”

The authorized combat with the state has been happening since late final yr and the cities, which symbolize about 72,000 individuals in whole, are nonetheless ready for a court docket date. As of early June, the federal government hadn’t despatched consultants to evaluate native injury.

The municipalities are ready to take their case to the European Court docket of Human Rights in the event that they lose, in line with Rodriguez, the mayor of Presles-en-Brie.

“Now we have little hope that our authorized attraction will ultimately succeed,” he mentioned. “However the residents welcome our motion and the truth that we’re at the least attempting to make ourselves heard.”

{Photograph}: A crack between two residential buildings in Amsterdam. Picture credit score: Peter Boer/Bloomberg

Associated:

Copyright 2025 Bloomberg.

Matters

Carriers

Europe

Owners

Local weather Change