Whereas Western wildfires have dominated catastrophe information for many years, new evaluation utilizing synthetic intelligence reveals hundreds of thousands of properties throughout the nation—even within the swampy Southeast—are in danger for wildfires.

New knowledge evaluation from ZestyAI discovered that $2.15 trillion value of U.S. residential property is at excessive threat of wildfire harm. The examine assessed 126 million properties nationwide and located 4.3 million particular person properties face heightened wildfire threat.

“Wildfires are threatening extra properties than ever earlier than, with billions of {dollars} in publicity even in areas many individuals don’t affiliate with hearth threat,” Attila Toth, founder and CEO of ZestyAI.

The examine used AI fashions skilled on over 2,000 previous wildfires and mapped publicity on the property stage, integrating satellite tv for pc and aerial imagery, topography and structure-specific traits.

The report discovered rising growth abutting wild lands and intensifying local weather situations are driving increased wildfire threat in states like North Carolina (4.6% of properties at excessive threat), Kentucky (2.9%), Tennessee (2.3%) and even South Dakota (11.0%).

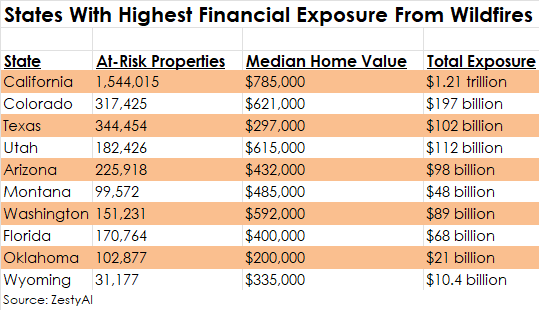

Unsurprisingly, California has the best whole publicity for wildfire harm, with over 1.54 million properties and $1.21 trillion in whole publicity. California was adopted by Colorado, Texas, Utah and Arizona.

As a result of many areas aren’t traditionally liable to wildfires, householders could also be unaware of dangers and underinsured, Toth stated. One in eight U.S. householders already lacks sufficient insurance coverage protection.

Alternatively, Toth stated, “Insurers have historically relied on broad, regional fashions that don’t account for particular person property traits. Which means some householders are denied protection even when their true threat is way decrease than their neighbors’.”

Toth stated that AI-driven threat analytics can imply extra correct and environment friendly assessments of wildfire publicity. Granular, property-specific insights might help insurers make smarter underwriting choices—maintaining protection out there in high-risk areas whereas making certain that householders who take mitigation steps are acknowledged.

Subjects

Disaster

Pure Disasters

USA

Wildfire

Concerned with Disaster?

Get computerized alerts for this subject.