Within the aftermath of wildfires, when households are left sifting by means of ashes and attempting to rebuild their lives, the true high quality of an insurance coverage coverage comes sharply into focus. Too typically, we hear from policyholders who thought they have been adequately insured. Then they file a declare and study that their coverage doesn’t totally pay for the loss.

They’re shocked to study that what they believed to be complete safety seems to be riddled with limitations, exclusions, and advantageous print that advantages the insurer way over the insured. This disconnect is a direct results of the widespread false impression that every one insurance coverage is similar, a commodity differentiated solely by value. That perception will not be solely mistaken; it’s harmful.

There’s a cause why some insurance coverage insurance policies value much less. It’s not as a result of the insurer has discovered a magical manner to supply the identical advantages extra effectively. It’s as a result of they’re providing much less protection, much less flexibility, much less help, and infrequently much less of an ethical dedication to face by the policyholder when catastrophe strikes. The distinction will not be at all times seen in a quote comparability, however it turns into painfully clear when a declare is filed and denied or underpaid primarily based on narrowly worded endorsements or hidden exclusions.

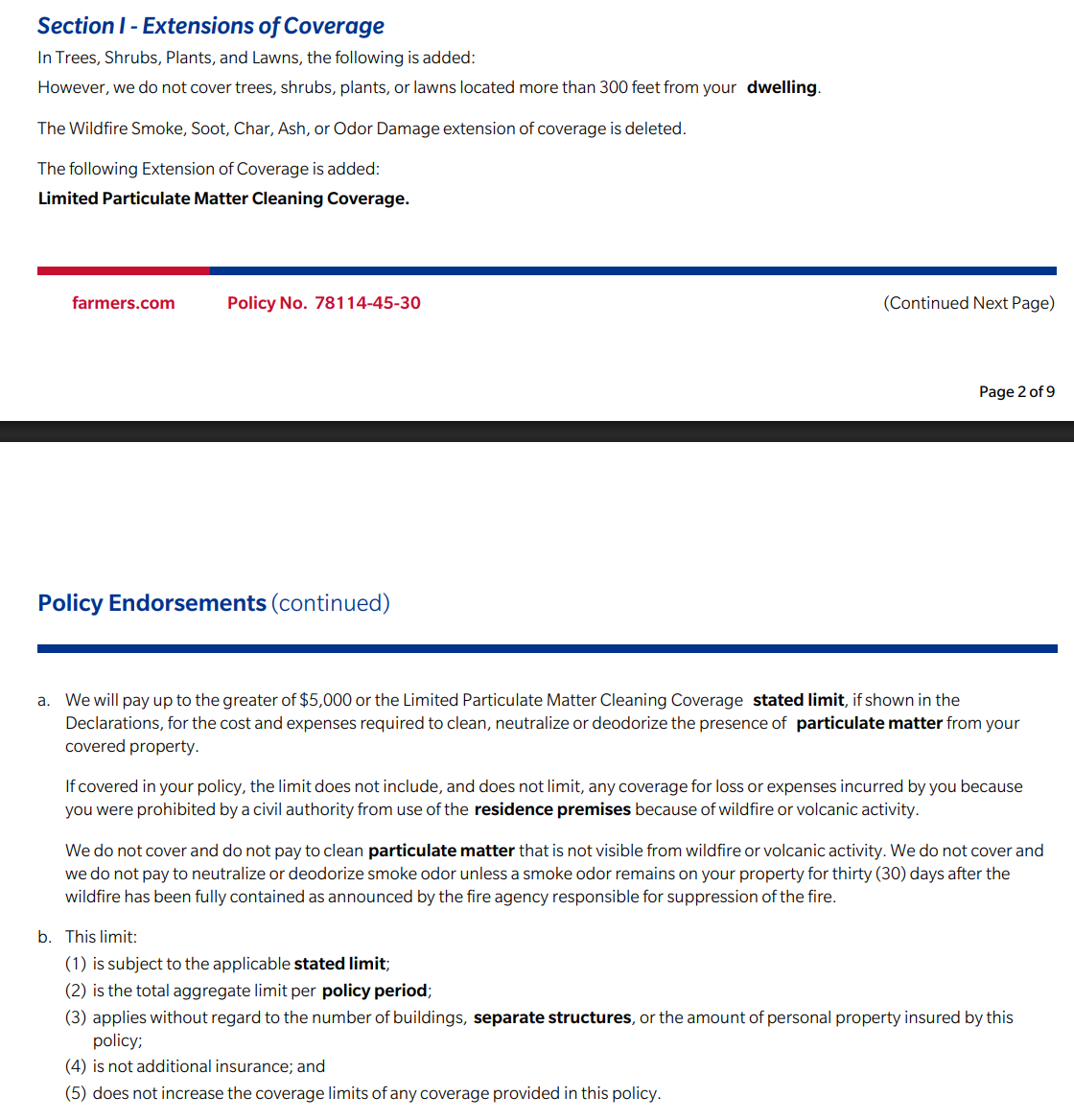

I’ve beforehand written concerning the flaws in Farmers Good Plan insurance coverage and its alarming contribution to the rising safety hole in property insurance coverage in “The Safety Hole in Property Insurance coverage—Why No one Ought to Purchase Farmers Good Plan Insurance coverage.” Sadly, latest coverage endorsements, such because the so-called Restricted Particulate Matter Cleansing Protection, underscore simply how deeply this drawback runs. These endorsements typically seem benign and even useful at first look, however in actuality, they substitute broader protections with extra restrictive phrases. In some circumstances, they restrict protection to such a level that the coverage provides little actual assist after a wildfire. As an illustration, when protection for wildfire smoke, ash, and soot injury is capped, topic to visibility necessities, and even excluded completely except odors persist for 30 days, the promise of monetary restoration turns into an phantasm.

Shopping for insurance coverage ought to by no means be a race to the underside. The stakes are too excessive. A house is usually the most important asset an individual owns, and insurance coverage is meant to be the protection internet that protects it. When that security internet is constructed with cut-rate supplies, it fails exactly when it’s wanted most. Shoppers deserve higher than to be bought stripped-down insurance policies disguised as good financial savings. They deserve honesty, readability, and protection that may stand the check of catastrophe.

The reality is, not all insurance coverage firms write insurance policies with the identical intention. Some design insurance policies to guard policyholders. Others design insurance policies to guard earnings. When purchasing for insurance coverage, the query ought to by no means be “What’s the most cost effective possibility?” however “Who might be there for me when it issues most?” The reply typically lies not within the premium, however within the rules behind the coverage. And with regards to firms like Farmers, the warning indicators are too many to disregard.

Insurance coverage regulators should be conscious that small wording adjustments considerably change advantages beneath the coverage. They need to bear in mind that adjustments such because the one Farmers has made will scale back the quantity of protection policyholders have obtained for fireplace losses for over 100 years. But, these endorsements and adjustments proceed to be permitted as a result of insurers don’t totally clarify the change and its full impression on the endorsement. Insurers like Farmers acquire a market benefit by offering much less protection and increasing safety gaps. This must be addressed.

Thought For The Day

“Be a yardstick of high quality. Some individuals aren’t used to an setting the place excellence is predicted.”

Steve Jobs