GlobalData surveying signifies that firms are more than likely to ascertain surroundings, social, and governance (ESG) efficiency plans in response to exterior regulatory and monetary pressures. In the meantime, the FCA has set out new proposals aimed toward bettering the transparency and reliability of ESG scores throughout the market.

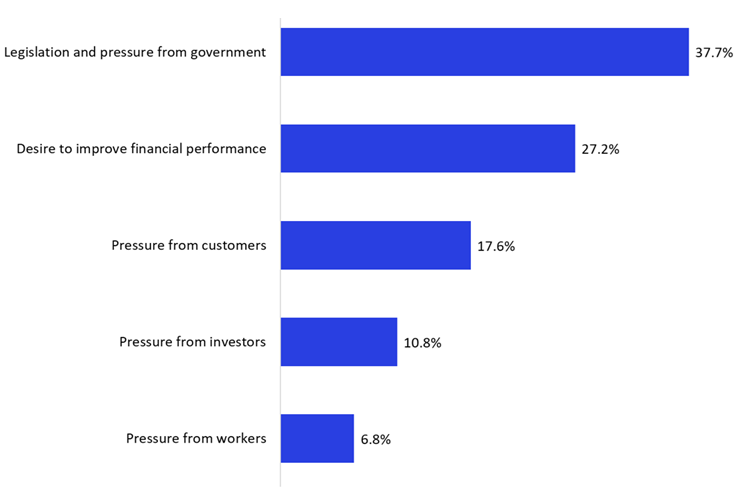

GlobalData’s Thematic Intelligence: ESG Sentiment Polls Q3 2025 exhibits that laws and strain from authorities is the main driver for implementing ESG efficiency plans, chosen by 37.7% of respondents. That is adopted by a want to enhance monetary efficiency at 27.2%, whereas strain from prospects accounts for 17.6%. Strain from buyers is cited by 10.8% and strain from staff by 6.8%. The outcomes spotlight that whereas monetary incentives stay related, regulatory strain is by far the most-influential issue shaping ESG adoption.

What’s the main purpose why an organization ought to arrange an ESG efficiency plan? Q3 2025

In the meantime, the Monetary Conduct Authority (FCA) has outlined proposals to make sure ESG scores turn out to be more-transparent, dependable, and comparable, following the federal government’s choice to carry these scores below the regulator’s remit. Supported by 95% of session respondents, the proposals goal to handle long-standing considerations about inconsistent methodologies and restricted transparency that have an effect on insurers’ skill to evaluate ESG dangers. The FCA’s framework focuses on bettering ranking transparency, strengthening governance and oversight, managing conflicts of curiosity, and setting clear expectations round stakeholder engagement and complaints dealing with. Current FCA guidelines may even apply proportionately to new companies coming into the regime.

With laws recognized as the highest driver for firms establishing ESG efficiency plans, the introduction of clearer regulatory expectations on ESG scores reinforces the compliance pressures already shaping company behaviour. On the similar time, more-transparent and constant ranking methodologies will assist firms dealing with monetary, buyer, investor, and workforce scrutiny; making certain ESG efficiency will be assessed and communicated extra credibly throughout all stakeholder teams.

The mixture of regulatory strain, stakeholder expectations, and the necessity for credible ESG metrics means insurers and different firms will face rising calls for for demonstrable ESG efficiency. Aligning inner ESG frameworks with the FCA’s strengthened requirements is not going to solely assist compliance, but additionally improve companies’ skill to benchmark progress, establish dangers, and talk responsibly with buyers and prospects. As ESG expectations proceed to evolve, clear and well-governed efficiency plans will turn out to be more and more important throughout the monetary companies sector.