While you buy by hyperlinks on our website, we could earn a fee. Right here’s the way it works.

Jack Russell Terriers are spirited, fearless little athletes, however their boundless vitality and genetic predispositions make them vulnerable to sure well being points.

From patellar luxation and eye ailments to dental issues and pores and skin allergic reactions, Jack Russells can rack up vet payments that shock even essentially the most ready pet dad and mom.

That’s the place pet insurance coverage turns into a clever funding.

A well-chosen plan helps offset the price of diagnosing and treating these situations, permitting you to focus in your canine’s care as an alternative of the invoice.

On this information, I’ll stroll you thru:

- The most typical Jack Russell Terrier well being issues

- The estimated prices of treating them

- How to decide on the greatest insurance coverage tailor-made for this energetic breed

Not each coverage covers issues equally, so let’s discover the proper match to your JRT.

Greatest Pet Insurance coverage For Jack Russell Terriers

I’ve researched the highest pet insurance coverage corporations with Jack Russell Terriers in thoughts, specializing in what issues most to their house owners.

Utilizing elements like:

- Age & enrollment limits

- Month-to-month premium prices

- Protection particulars

- Breed-specific well being issues

…I narrowed down essentially the most dependable suppliers that can assist you discover the proper coverage to your energetic Terrier.

Whether or not you’re apprehensive about eye ailments, joint issues, dental illness, or sudden accidents from their high-energy way of life, the proper plan could make an enormous distinction in your pup’s long-term well being.

Most Inexpensive: Pets Greatest

When you’re in search of protection that received’t break the financial institution, Pets Greatest persistently gives among the lowest premiums for Jack Russell Terriers. Regardless of the budget-friendly worth, the plans are very complete and stay fairly inexpensive once you think about examination charge protection and different extras. This makes it a stable selection for value-conscious house owners.

Why It’s a Nice Match:

- A number of the most inexpensive pricing throughout age ranges

- Quick protection for orthopedic situations (14 days)

- Non-compulsory wellness add-ons for dental cleanings and preventive care

- Multi-pet low cost accessible

Estimated Value Abstract:

- Among the many most inexpensive choices for Jack Russells

- Nice worth for house owners in search of important accident and sickness protection

- Pricing stays aggressive at the same time as canine age

Backside Line:

Pets Greatest gives broad protection at a lower cost level, making it preferrred for Jack Russell house owners who need peace of thoughts with out excessive premiums.

See our full Pets Greatest evaluation.

| Execs | Cons |

|---|---|

| Among the many most budget-friendly choices for JRTs | Declare reimbursement isn’t the quickest (averages 10 days) |

| 5% multi-pet low cost | Examination charges and complementary remedy price additional* |

| Accident-only and non-compulsory wellness plans accessible | |

| Covers treatable pre-existing situations as soon as healed | |

| Solely 14-day look ahead to patellar luxation and hip dysplasia (vs 6 months) | |

| Quick 3-day ready interval for accidents | |

| No most age restrictions for enrollment | |

| 24/7 vet helpline |

Greatest For All-Inclusive Plans: Fetch

Jack Russells are vulnerable to each accidents and long-term well being points, so broad safety could be a lifesaver. Fetch is one of the vital complete choices accessible, masking objects that many suppliers exclude or cost additional charges for, akin to veterinary examination prices, behavioral remedy, and complete care.

Why It’s a Nice Match:

- In depth protection, together with examination charges, dental sickness, and behavioral remedy

- Pre-approvals accessible, so that you’ll know what therapies can be coated earlier than committing to a process

- Extras like digital vet visits, misplaced pet promoting, and boarding charges are included in commonplace plans

Estimated Value Abstract:

- Increased premiums than funds manufacturers, however broader protection is included

- Good stability of price and safety for all-inclusive plans

- Definitely worth the worth in order for you examination charges, behavioral care, and extras coated

Backside Line:

Fetch gives among the most full protection you’ll discover, although you’ll pay a bit extra, and orthopedic waits are longer. It’s greatest fitted to Jack Russell dad and mom who need to guard in opposition to each “what if.”

See our full Fetch evaluation.

| Execs | Cons |

|---|---|

| Broadest protection, together with behavioral and dental sickness | Longer 6-month orthopedic ready interval (hips, knees) |

| Consists of free digital vet visits, journey cancellation, misplaced pet assist | No multi-pet low cost |

| Covers curable pre-existing situations after 12 months with no signs | Premiums are increased than funds rivals |

| Pre-approval accessible | |

| No higher age limits for enrollment | |

| Non-compulsory wellness plan | |

| Puppies might be enrolled at 6 weeks |

Greatest For Limitless Payouts: Wholesome Paws

If you’d like full peace of thoughts, Wholesome Paws delivers with no caps on protection — ever. For Jack Russells, which means you’ll by no means have to fret about hitting a restrict in case your pup wants costly orthopedic or eye surgical procedure.

Why It’s a Nice Match:

- Limitless payouts on each plan (no annual or lifetime caps)

- Quick claims turnaround, typically inside 2–3 enterprise days

- 15-day ready interval for patellar luxation

- Excessive buyer satisfaction and easy plan choices

Estimated Value Abstract:

- Average month-to-month charges in comparison with rivals

- Robust worth since each plan contains limitless payouts

- Prices climb with older canine, however stay truthful for the protection provided

Backside Line:

Wholesome Paws gives limitless safety and fast reimbursements, making it a best choice for Jack Russell dad and mom who don’t need to fear about protection caps. Simply notice that hip dysplasia has an extended ready interval and restrictions should you wait too lengthy to enroll.

See our full Wholesome Paws evaluation.

| Execs | Cons |

|---|---|

| Limitless annual payouts on all insurance policies | No protection for examination charges or behavioral remedy |

| Aggressive charges for limitless protection | 12-month look ahead to hip dysplasia (if enrolled beneath age 6) |

| Quick claims processing (avg. 2–3 days) | Hip dysplasia excluded if enrolled after age 6 |

| Quick 15-day look ahead to patellar luxation | Some canine could also be ineligible based mostly on age or location |

| Covers complementary therapies | Enrollment cut-off at age 14 |

| Excessive evaluations for customer support |

Greatest For Basset Hound Puppies: Figo

Jack Russell puppies are curious, daring, and typically reckless, so accidents and early well being points aren’t unusual. Figo is a wonderful match for younger pups due to its brief ready occasions and versatile plan choices.

Why It’s a Nice Match:

- 1-day accident protection (one of many shortest waits accessible)

- Extremely customizable, with choices for 100% reimbursement and limitless payouts

- Quick claims processing (typically 2–3 days)

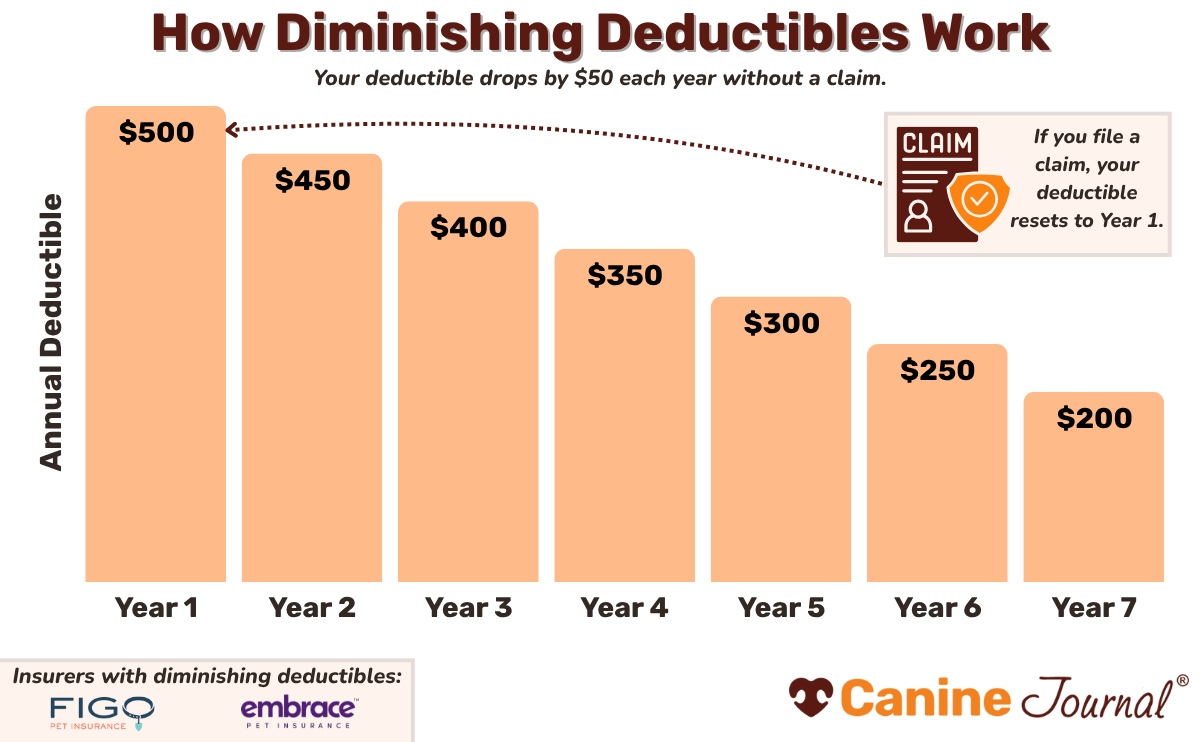

- Deductible decreases by $50 annually you don’t file a declare

Estimated Value Abstract:

- Versatile pricing with customizable deductibles and reimbursement ranges

- Will be very inexpensive for fundamental protection

- Premiums improve with richer advantages, however choices assist management your funds

- Most protection is above common in some instances

Backside Line:

Figo is constructed for pet dad and mom who need flexibility and pace. With brief accident waits and extremely customizable plans, it grows along with your Jack Russell from puppyhood by maturity.

See our full Figo evaluation.

| Execs | Cons |

|---|---|

| 1-day accident ready interval | Examination charges require add-on |

| Customizable plans, together with 100% reimbursement | 6-month orthopedic ready interval |

| Consists of behavioral, complementary, and dental care | Premiums climb with senior canine |

| Quick 3-day claims processing | |

| Deductible drops $50 each claim-free 12 months | |

| Non-compulsory wellness plans accessible | |

| Multi-pet low cost (5%) |

Greatest For Behavioral Points: Embrace

Dental illness and issues are among the many most important well being dangers for Jack Russell Terriers. Embrace stands out as a result of its dental advantages are among the many greatest within the business, masking non-routine dental therapy, endodontic illness, tooth infections and extractions, dental accidents, and extra. It additionally gives protection for behavioral remedy, which might be useful for Terriers with nervousness, aggression, or damaging habits.

Why It’s a Nice Match:

- Consists of as much as $1,000/12 months for dental sickness, together with extractions and oral infections

- Covers behavioral remedy (for points like nervousness, aggression, or chewing)

- Diminishing deductible—drops $50 annually you don’t file a declare

- Customizable plans, with choices so as to add examination charge and prescription protection

Estimated Value Abstract:

- Mid-range pricing in comparison with funds suppliers

- Nice worth for dental and behavioral protection that many insurers exclude

- Premiums keep aggressive for complete accident and sickness safety

- Inexpensive pricing for fundamental plans

Backside Line:

When you’re apprehensive about your Jack Russell’s tooth or desire a plan that rewards claim-free years, Embrace gives glorious dental protection plus perks many different insurers don’t embody.

See our full Embrace evaluation.

| Execs | Cons |

|---|---|

| Covers dental sickness as much as $1,000/12 months | Prescription and examination charge protection require add-ons |

| Consists of behavioral remedy and complementary care protection | 6-month ready interval for orthopedic points |

| Totally customizable plans with limitless payout possibility | Canine enrolled after 15 years outdated are solely eligible for accident-only protection |

| Non-compulsory wellness protection | |

| Vanishing deductible rewards claim-free years |

Most Inexpensive: Lemonade

Lemonade’s à-la-carte method to pet insurance coverage insurance policies offers pet dad and mom quite a lot of flexibility to tailor protection for any funds. Along with adjustable deductibles, reimbursement charges, and protection limits, Lemonade gives the choice to improve with a number of separate add-ons, permitting you to fine-tune a plan that matches your funds.

Why It’s a Nice Match:

- Extremely customizable with a number of deductibles, reimbursement, and payout choices

- Add-ons accessible for dental, examination charges, conduct, and extra

- Quick 2-day accident ready interval (one of many quickest within the business)

- Fast digital claims submitting by the Lemonade app

Estimated Value Abstract:

- Inexpensive entry-level plans in comparison with most rivals

- Aggressive pricing for customizable protection

- Worth depends upon the choices you choose

- Most protection with all add-ons is usually dear

Backside Line:

Lemonade is greatest for Jack Russell house owners who wish to set their very own stability between price and protection, with one of many shortest accident waits accessible.

Try our full Lemonade evaluation.

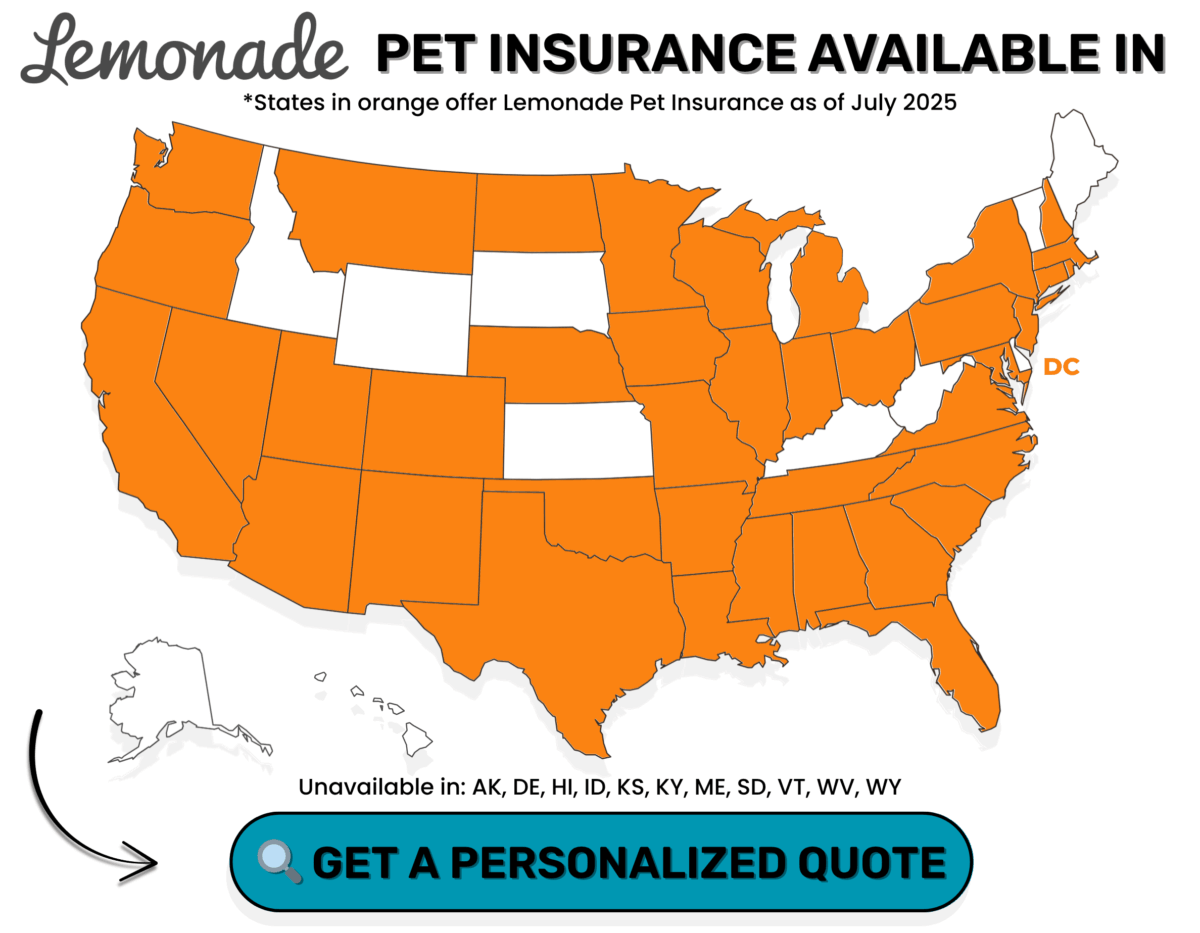

Lemonade Pet Insurance coverage Is NOT Accessible In: AK, DE, HI, ID, KS, KY, ME, SD, VT, WV, WY

| Execs | Cons |

|---|---|

| Extremely customizable pricing | Solely accessible in sure states |

| 5% multi-pet low cost | Should pay additional for examination charges, dental sickness, behavioral remedy, and complementary care |

| Quick, app-based claims course of | Cellphone buyer help might be tough to achieve |

| Covers curable pre-existing situations after 12 months with no signs | |

| Two non-compulsory wellness plans | |

| Quick 30-day look ahead to hip dysplasia and patellar luxation (vs 6 months with different suppliers) |

Greatest For Vet Direct Pay: Trupanion

With most insurers, you pay the vet invoice up entrance and look ahead to reimbursement. Trupanion is totally different — it pays vets immediately on the time of service, so that you’re not caught masking hundreds out of pocket whereas ready on a declare.

Why It’s a Nice Match:

- Direct vet pay prevents massive out-of-pocket bills

- Covers hereditary and persistent points frequent in Jack Russells

- No annual or lifetime payout caps on all plans

- Lifetime per-condition deductibles (set as soon as per difficulty)

Estimated Value Abstract:

- Among the many most costly choices general

- Good match if avoiding massive upfront funds issues greater than maintaining premiums low

Backside Line:

Trupanion is likely one of the pricier suppliers, however the direct-to-vet funds could be a enormous reduction in case your Jack Russell ever wants expensive surgical procedure or hospitalization.

Try our full Trupanion evaluation.

| Execs | Cons |

|---|---|

| Pays vets immediately at checkout | Increased premiums than most rivals |

| No annual or lifetime payout limits | No protection for vet examination charges |

| Quick 30-day look ahead to hip dysplasia and patellar luxation | Lengthy 30-day sickness ready interval |

| Covers curable pre-existing situations after 12 months | Enrollment cut-off at age 14 |

| Fast 2-day common declare processing |

Plan Choices Comparability Desk

All the suppliers we’ve highlighted supply accident and sickness plans—essentially the most full protection for Jack Russell Terriers.

Your most suitable option depends upon your funds and desires, together with:

Some additionally present wellness add-ons or accident-only protection in order for you extra flexibility.

Use the desk under to match the core options aspect by aspect.

| Firm | Deductibles | Reimbursements | Limits | Wellness Plans | Accident-Solely Plans |

|---|---|---|---|---|---|

|

$50–$1,000 | 70%, 80%, 90% | $5,000, $10,000, Limitless | ||

|

$250–$700 | 70%, 80%, 90% | $5,000, $10,000, $15,000, or Limitless | ||

| $100–$1,000 | 50%, 60%, 70%, 80%, 90% | Limitless | |||

|

$100–$750 | 70%, 80%, 90%, 100% | $5,000, $10,000, Limitless | ||

|

$100–$1,000 | 70%, 80%, 90% | $2,000, $5,000, $8,000, $10,000, $15,000, Limitless | ||

|

$100–$750 | 60%, 70%, 80%, 90% | $5,000, $10,000, $20,000, $50,000, $100,000 | ||

|

$0–$1,000 | 50%, 60%, 70%, 80%, 90%, 100% | Limitless |

What Kind of Pet Insurance coverage Plan Is Greatest For Basset Hounds?

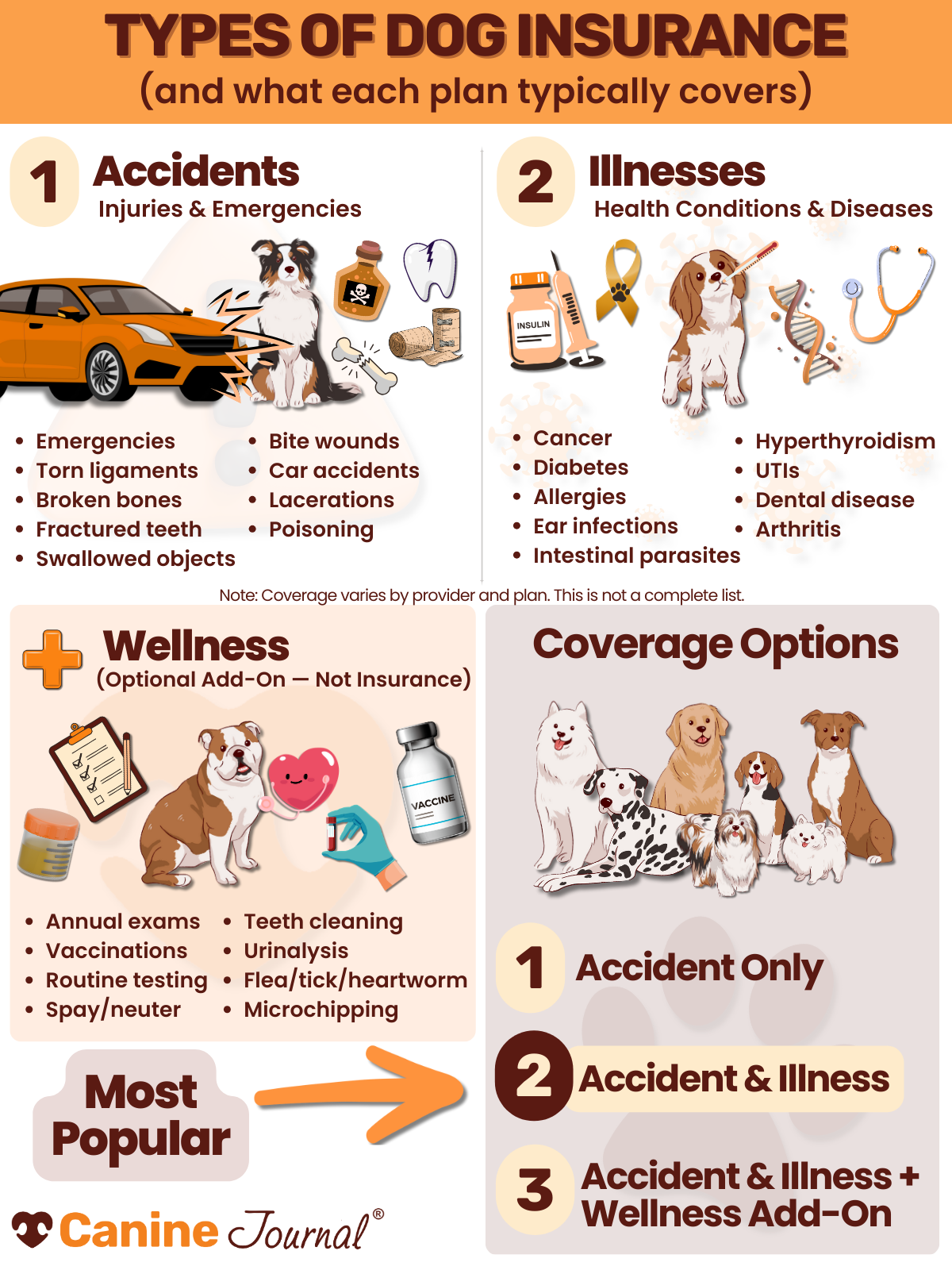

Pet insurance coverage is available in a couple of totally different kinds, however not each plan offers Jack Russell house owners the safety they actually need. The primary classes are accident-only protection and accident & sickness protection, with wellness add-ons accessible from many suppliers.

What Is An Accident-Solely Plan?

Accident-only protection pays for sudden accidents, akin to:

- Damaged bones from a fall or collision

- Chunk wounds from a canine struggle on the park

- Eye trauma from tough play or accidents

- Torn ligaments (like a cranial cruciate ligament [CCL] tear)

These plans are budget-friendly however received’t cowl sicknesses or genetic situations, each of which Jack Russells are in danger for.

Pricing Tip: Accident-only is normally the most cost-effective possibility, but it surely received’t assist with hereditary points like lens luxation, patellar luxation, or hip dysplasia.

What Is An Accident & Sickness Plan?

That is the most well-liked and complete possibility. It contains all the pieces coated by accident-only plans, plus situations frequent in Jack Russells, akin to:

- Patellar luxation

- Lens luxation and cataracts

- Dental illness

- Pores and skin allergic reactions and infections

- Legg-Calvé-Perthes illness

- Power digestive or metabolic issues

If you’d like sturdy safety for the situations most certainly to have an effect on your JRT, that is the best choice.

What Are Wellness Plans?

Wellness add-ons assist cowl routine and preventive care, like:

Whereas these aren’t technically pet insurance coverage, they will help you funds for predictable care and encourage preventive vet visits, which is very helpful for small breeds like Jack Russells, who typically want ongoing dental consideration.

Vital Observe: Wellness add-ons solely cowl routine care. They received’t assist in case your JRT develops an sudden sickness or damage.

What Does Pet Insurance coverage Cowl & Exclude?

Each pet insurance coverage firm designs its insurance policies slightly otherwise, however most accident and sickness plans observe the identical normal sample: they’ll cowl situations which are unavoidable and medically obligatory, whereas leaving out issues which are elective, routine, or pre-existing.

Right here’s a side-by-side have a look at what’s normally included (and what isn’t) for Jack Russell Terriers:

| Lined | Excluded |

|---|---|

| Various therapies (e.g., acupuncture, bodily remedy, rehab, and many others.) | Boarding |

| Diagnostic exams (bloodwork, X-rays, MRIs, CT scans, ultrasounds) | Cremation & burial prices |

| Emergency care & hospitalization | Elective procedures (declawing, ear cropping, tail docking, spaying/neutering) |

| Euthanasia (if on account of a coated situation) | Meals & dietary supplements |

| Hereditary & persistent situations (e.g., IVDD, glaucoma, hypothyroidism, and many others.) | Grooming |

| Sicknesses (most cancers, ear infections, GI points, eye issues) | Pre-existing situations* |

| Accidents (cuts, damaged bones, chew wounds) | Being pregnant & breeding |

| Non-routine dental therapy | Preventable situations (e.g., parasites, sicknesses on account of lack of routine care, and many others.) |

| Prescription medicines | Routine care (annual exams, vaccines, dental cleanings) |

| Specialists (cardiologists, neurologists, and many others.) | |

| Surgical procedure |

Dig Deeper Into Protection Guidelines

Not each plan attracts the road in the identical place. Need to know precisely what’s included, what’s non-compulsory, and what’s by no means coated? Try our information to what pet insurance coverage covers so that you go in with clear expectations to your Jack Russell’s coverage.

What Determines The Value Of Pet Insurance coverage For Jack Russells?

Pet insurance coverage premiums aren’t random—they’re calculated utilizing a number of elements tied to your canine and your selections because the proprietor. With Jack Russells, some parts are out of your management (like their breed danger), whereas others you may modify to handle prices.

Right here’s what usually impacts what you’ll pay:

- Age

- Younger Jack Russells are normally cheaper to insure as a result of they’re much less prone to have developed well being situations.

- Premiums improve steadily as your Terrier ages, particularly as soon as points like patellar luxation or cataracts grow to be extra frequent.

- Breed

- Purebred canine like Jack Russells typically price extra to insure than combined breeds as a result of they’re predisposed to particular hereditary well being issues.

- Gender

- In some instances, males are barely pricier to cowl since they are typically a bit bigger, which might affect treatment dosages and surgical prices.

- Location

- The place you reside issues. City areas with increased vet prices normally include increased month-to-month premiums.

- Insurers issue within the common price of veterinary care in your ZIP code when setting charges.

Methods You Can Affect Premium Pricing

You may’t change your Jack Russell’s age, breed, or gender, however you can modify your protection particulars to suit your funds.

Most Payout

That is the utmost quantity your insurer will reimburse you.

- Annual payout: (e.g., $5,000, $10,000, limitless) reset yearly (utilized by most insurers)

- Lifetime payout: Max over your canine’s whole life

Pricing Tip: A decrease payout means a less expensive premium, but it surely additionally will increase the danger of being underinsured in case your canine develops a expensive situation.

Deductible Kind

- Annual deductible: You pay this quantity as soon as per 12 months earlier than protection takes impact. These are the most typical and budget-friendly.

- Per-condition deductible: You pay as soon as for every new situation or sickness. This may be useful in case your JRT develops a long-term drawback, akin to luxating patellas.

Pricing Tip: The upper the deductible, the decrease your month-to-month invoice.

Reimbursement Share

After the deductible, that is the share your supplier pays on every invoice. Widespread choices are 70%, 80%, or 90%.

- Instance: At 70% reimbursement, you cowl 30% of the invoice plus your deductible.

When you select 80%, you pay 20% of the vet invoice (your copay) after the deductible.

Pricing Tip: Selecting a decrease reimbursement stage retains premiums down however will increase your out-of-pocket prices once you file a declare.

Study Extra About Pet Insurance coverage Prices

Need to dive deeper?

Discover how premiums are calculated and get recommendations on saving cash whereas staying protected.

How A lot Is Pet Insurance coverage For A Jack Russell Terrier?

What are you able to realistically count on to spend every month?

Simply enter your zip code and your JRT’s particulars under. You’ll get personalised quotes from prime pet insurance coverage suppliers tailor-made to your canine’s breed, age, and site.

Whereas it’s helpful to see typical U.S. pricing, understand that your canine’s particular person wants and the place you reside will form what you find yourself paying.

In keeping with NAPHIA (North American Pet Well being Insurance coverage Affiliation), the common month-to-month premium for an accident and sickness canine insurance coverage coverage within the U.S. is $62.44 ($32.10 for cats).

Under, you’ll discover a comparability of pattern month-to-month charges for Jack Russells throughout the U.S. to offer you a ballpark thought.

Bear in mind: these numbers are simply averages. Your precise worth could also be increased or decrease based mostly in your canine’s age, location, and well being historical past.

Take into accout: Your precise quote will fluctuate based mostly in your canine’s age, location, and well being historical past.

*80% reimbursement; **70% reimbursement; §Limitless annual payouts

Jack Russell Terrier Insurance coverage Value: Low & Excessive Estimates

To present you a clearer image of what you may pay, right here’s a have a look at the lowest and highest month-to-month premiums accessible for Jack Russells from main suppliers. These examples don’t embody wellness add-ons.

I’ve included pricing for each puppies and grownup canine so you may see how prices on the time of enrollment shift as your Terrier will get older.

Tip: The sooner you insure your Jack Russell, the extra inexpensive your month-to-month fee can be—and also you’ll lock in protection earlier than any well being points seem.

| Firm | 2mo outdated 92117 (San Diego, CA) | 5yr outdated 92117 (San Diego, CA) | 2mo outdated 14211 (Buffalo, NY) |

5yr outdated 14211 (Buffalo, NY) |

2mo outdated 33604 (Tampa, FL) |

5yr outdated 33604 (Tampa, FL) |

2mo outdated 78731 (Austin, TX) |

5yr outdated 78731 (Austin, TX) |

2mo outdated 07305 (Jersey Metropolis, NJ) |

5yr outdated 07305 (Jersey Metropolis, NJ) |

|---|---|---|---|---|---|---|---|---|---|---|

|

$14.04-$87.26 | $16.67-$103.58 | $10.93-$69.55 | $12.98-$82.55 | $10.00-$63.48 | $10.87-$69.01 | $11.99-$68.07 | $13.03-$74.00 | $16.42-$94.49 | $17.85-$102.72 |

|

$40.87-$104.23 | $76.33-$199.81 | $24.02-$50.14 | $40.01-$88.09 | $22.06-$48.25 | $36.86-$83.36 | $24.96-$51.69 | $30.85-$65.66 | $24.91-$52.25 | $40.35-$88.91 |

| $23.78-$46.97 | $35.31-$70.09 | $16.85-$34.43 | Uninsurable | $13.90-$55.62 | $25.89-$103.56 | $19.38-$61.50 | $29.36-$58.09 | $21.76-$42.36 | $30.14-$58.90 | |

|

$17.97-$105.73 | $23.35-$137.38 | $15.08-$114.31 | $19.60-$148.53 | $14.77-$112.05 | $19.73-$149.64 | $12.71-$96.44 | $16.98-$128.78 | $23.27-$150.64 | $30.24-$195.75 |

|

$15.09-$90.81 | $15.09-$90.81 | $11.11-$96.96 | $11.37-$99.19 | $10.61-$69.94 | $13.80-$90.92 | $15.39-$78.61 | $19.14-$97.75 | $14.34-$94.45 | $18.78-$123.73 |

|

$20.26-$148.84 | $21.08-$154.54 | $19.07-$113.10 | $19.51-$115.45 | $13.78-$95.72 | $14.19-$98.98 | $19.77-$92.26 | $19.79-$92.33 | $27.41-$127.68 | $26.42-$123.58 |

|

$65.57-$279.01 | $135.08-$601.67 | $58.59-$246.60 | $100.50-$441.12 | $31.77-$122.09 | $59.98-$253.06 | $39.38-$157.40 | $76.86-$331.40 | $45.07-$183.86 | $88.85-$387.08 |

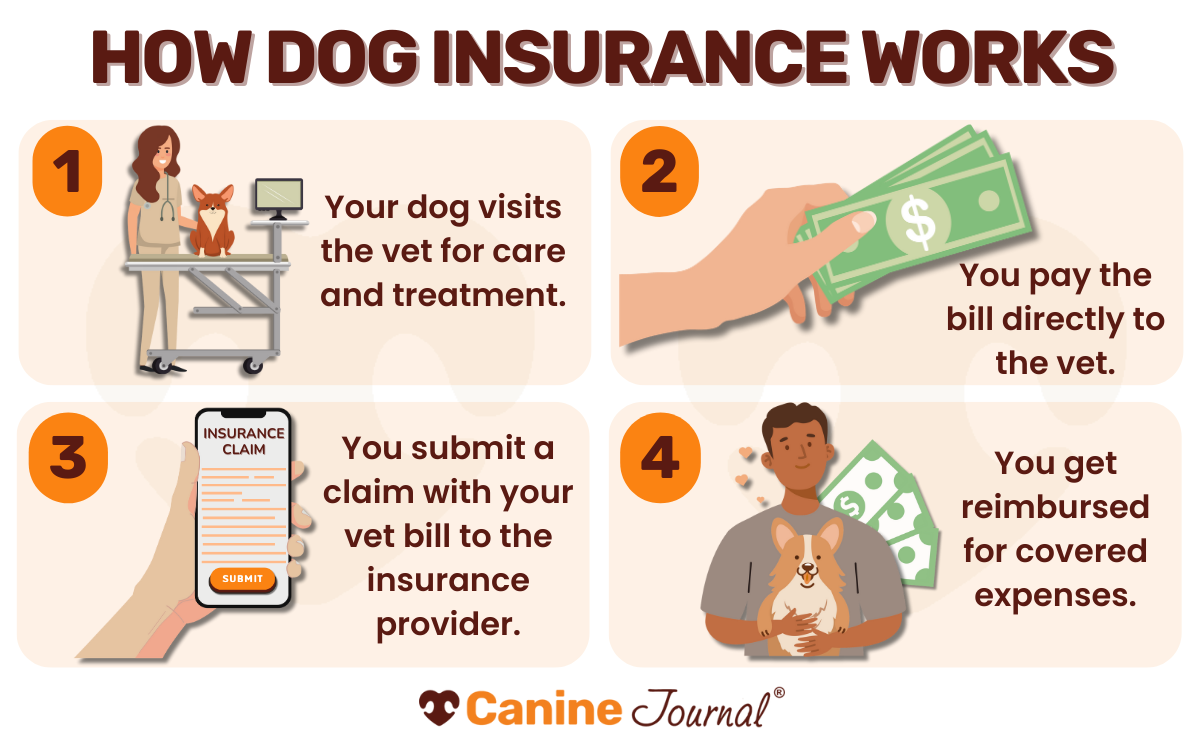

How Does Pet Insurance coverage Work For Jack Russells?

At its core, pet insurance coverage is designed to reimburse you for eligible vet bills when your Jack Russell wants medical care. You pay the vet up entrance, submit a declare, after which get a reimbursement based mostly on the phrases of your coverage.

Earlier than protection begins, each supplier has a ready interval, normally wherever from a couple of days for accidents to a few weeks for sicknesses. Orthopedic situations typically have longer waits, which is vital for JRTs given their knee and hip dangers.

As soon as your coverage is energetic, the quantity you’re reimbursed depends upon:

- Deductible

- Reimbursement proportion

- Most payout

- What’s included or excluded beneath your particular coverage

The excellent news? Utilizing pet insurance coverage is normally fairly easy.

How To Use Your Pet Insurance coverage

Submitting a declare to your Jack Russell is normally a easy course of. Right here’s what it seems like in observe:

- Go to the vet – Take your canine in for therapy, whether or not it’s a sudden damage or an sickness.

- Pay the invoice – Most suppliers require you to pay up entrance earlier than reimbursement.

- Submit your declare – Ship in an itemized receipt by the insurer’s on-line portal, cell app, or by e mail.

- Get reimbursed – Relying in your coverage setup, you’ll obtain a direct deposit or examine for the coated portion. Some corporations even course of claims inside minutes, whereas others could take a number of days or perhaps weeks.

For Jack Russell dad and mom, who typically cope with recurring points like knee or eye therapies, fast claims turnaround could make a giant distinction in managing money stream.

What Are Ready Intervals For Jack Russell Terrier Pet Insurance coverage?

A ready interval is the stretch of time between once you enroll and when your protection really begins. Each supplier units its personal guidelines, and the main points matter.

Right here’s what you’ll usually see throughout insurers:

- Accident protection: 0 to fifteen days

- Sickness protection: Usually 14 days

- Orthopedic situations (like patellar luxation or hip dysplasia): Many have prolonged ready intervals, typically as much as 6–12 months

As a result of Jack Russells are genetically vulnerable to orthopedic issues, it’s sensible to evaluation the high quality print earlier than enrolling. Some corporations have particular ready intervals particularly for these situations.

*States are regularly adopting a Mannequin Regulation for pet insurance coverage, aiming to standardize rules, together with uniform ready intervals. In California, Delaware, Louisiana, Maine, Mississippi, Nebraska, New Hampshire, Washington, Rhode Island, and Maryland, ready intervals are:

- Accidents: 0 days

- Sicknesses: 14 days

- Cruciate Ligament Circumstances: 30 days

- Routine Care: 0 days

Study Extra About Ready Intervals

Ready intervals might be irritating, particularly in case your JRT is already coping with a possible well being concern.

Need to see which insurers supply the shortest waits and even zero ready interval for accident protection?

Try our information to pet insurance coverage with no ready intervals.

10 Widespread Well being Points In Jack Russell Terriers

Jack Russell Terriers are robust little canine with lengthy lifespans, however their genetics and energetic life can set them up for some expensive well being issues.

Under are among the most typical situations vets see on this breed — and what you may count on to pay for diagnostics and therapy.

1. Luxating Patellas

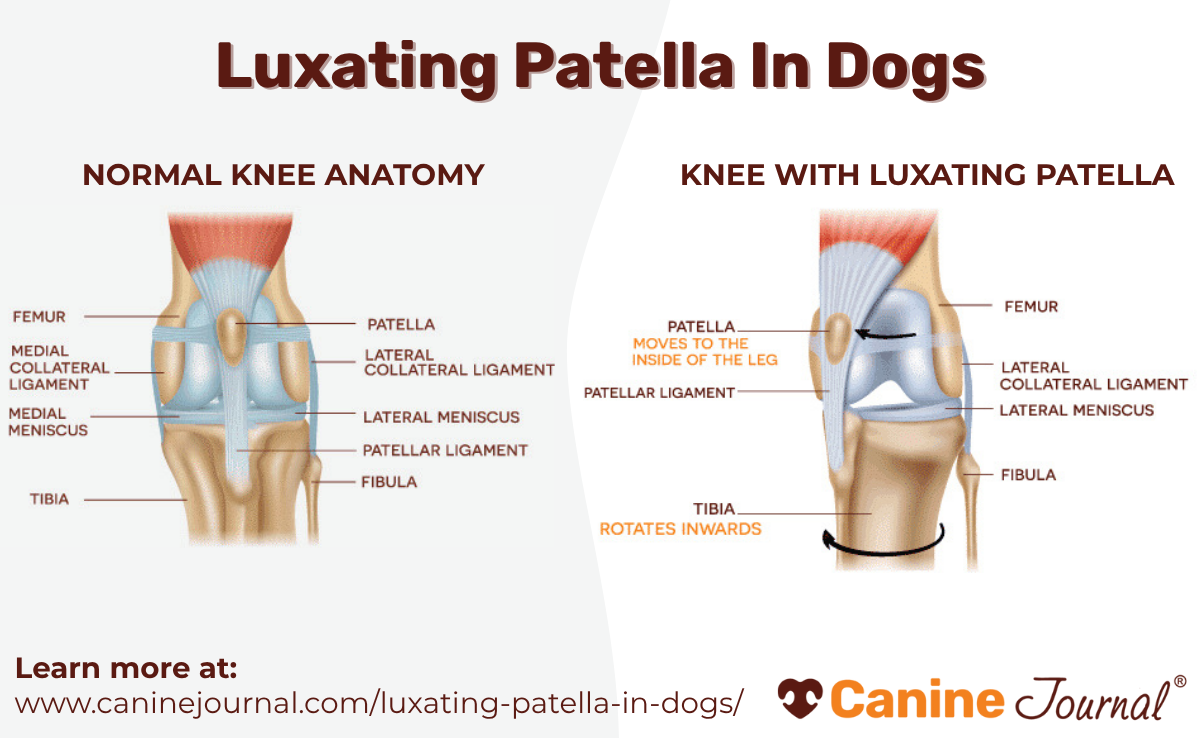

A luxating patella occurs when the kneecap slips misplaced, resulting in limping or problem bearing weight. Over time, it could actually trigger arthritis if not corrected. A luxating patella is one of the vital frequent orthopedic points in small breeds like JRTs.

Value: $1,500–$3,000 per knee if surgical procedure is required.

2. Allergic reactions

JRTs incessantly battle with environmental and meals allergic reactions, which might trigger itching, ear infections, and pores and skin issues. Our canine allergy information covers frequent triggers and coverings.

Value: $200–$1,000+ per 12 months for testing, treatment, and ongoing care.

3. Dental Illness

With their small jaws, Jack Russells are vulnerable to dental illness that results in plaque buildup, infections, and tooth loss. Untreated dental issues also can have an effect on coronary heart and kidney well being.

Value: $300–$1,000+ for routine cleanings; extractions add considerably extra.

4. A number of Eye Circumstances

Inherited eye situations are a significant concern for Jack Russells. Main lens luxation, cataracts, and glaucoma can all seem on this breed, typically resulting in blindness if untreated.

Value: $1,500–$5,000+, relying on the situation and whether or not surgical procedure is required.

5. Ear Infections

Jack Russells’ floppy ears can lure moisture and particles, which makes them vulnerable to persistent ear infections. Power allergic reactions additionally trigger recurring ear infections.

Value: $100–$300 per vet go to, relying on severity and recurrence.

6. Legg-Calvé-Perthes Illness

This degenerative hip situation reduces blood stream to the femur bone, inflicting ache and lameness in younger canine. It’s much less frequent than patellar luxation however might be devastating if untreated.

Value: $2,000–$4,000+ for surgical correction.

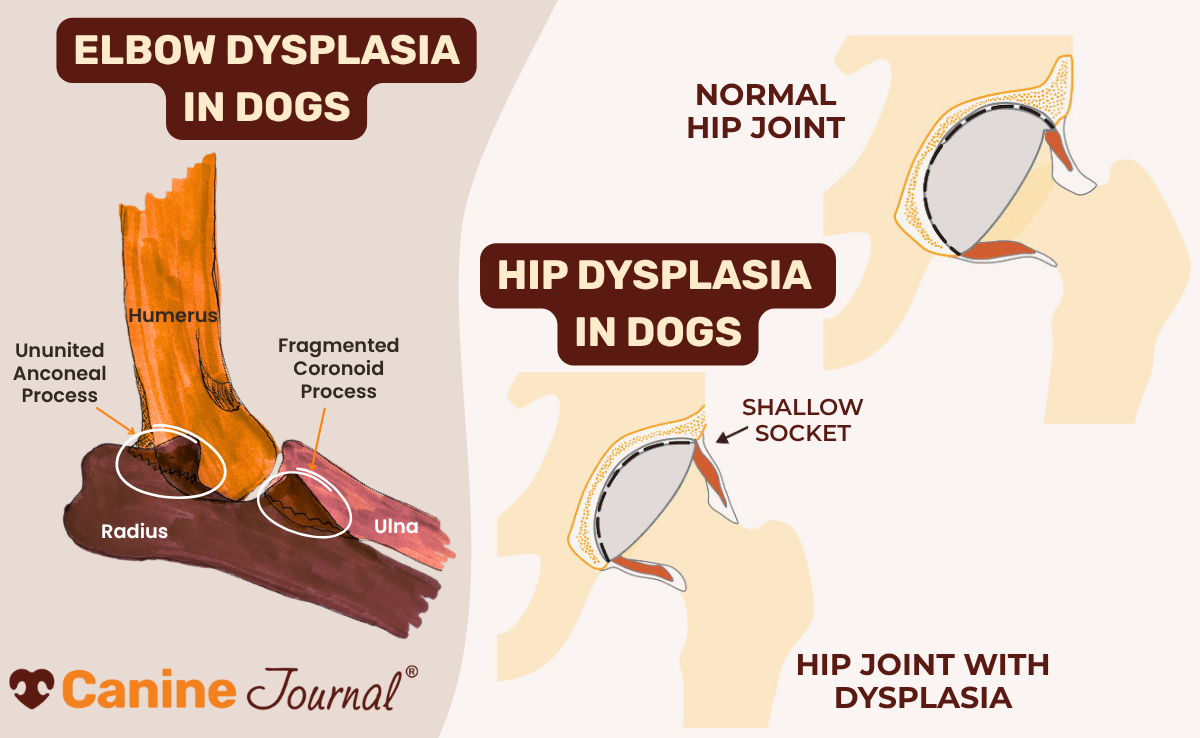

7. Hip And Elbow Dysplasia

Whereas typically related to bigger breeds, Jack Russells also can develop dysplasia. These joint situations have an effect on mobility and luxury, particularly in older or chubby canine.

Hip dysplasia is a persistent situation the place the pinnacle of the femur bone doesn’t match appropriately into the hip socket. Elbow dysplasia consists of irregular growth of the elbow joint on account of defects in cartilage growth, irregular bone progress, or joint stress.

Value: $1,500–$4,500+ for surgical procedure; $50/month for dietary supplements or treatment.

8. Portosystemic Shunt (PSS)

A congenital liver dysfunction the place blood bypasses the liver, resulting in toxin buildup. Puppies with liver shunts typically present poor progress and neurological signs.

Value: $2,000–$6,000 for surgical procedure, plus treatment or dietary administration.

9. Bladder & Kidney Stones

Painful urinary stones can block the urinary tract and require pressing care. Our information to bladder stones in canine explains causes and therapy.

Value: $800–$3,500+, relying on severity and therapy technique.

10. Pancreatitis

Pancreatitis is irritation of the pancreas, typically triggered by fatty meals. It’s painful and may grow to be life-threatening with out instant therapy.

Value: $500–$3,000+ for hospitalization, fluids, and supportive care.

Is Pet Insurance coverage Price It For Jack Russell Terriers?

Jack Russell Terriers are famously robust, however toughness doesn’t cancel out vet payments. Their genetic dangers (like luxating patellas, lens luxation, and liver shunts) mixed with their high-energy way of life imply accidents and persistent well being points are pretty frequent.

From allergic reactions and dental illness to eye issues and orthopedic surgical procedures, Jack Russells can rack up hundreds in medical prices over their 12–15+ 12 months lifespans. And since many of those points require long-term therapy, payments can shortly snowball.

That’s why pet insurance coverage typically is sensible for this breed. By masking a good portion of sudden prices, insurance coverage helps you give attention to maintaining your JRT wholesome as an alternative of worrying about tips on how to pay for care.

Curious whether or not protection is sensible to your canine? Discover our information on whether or not pet insurance coverage is value it to assist weigh the professionals and cons.

5 Steps To Discover The Greatest Jack Russell Terrier Insurance coverage

Jack Russell Terriers can stay properly into their teenagers, which is great, but it surely additionally means extra years of potential vet bills. Selecting a plan early will help you safe protection earlier than issues seem.

Listed below are 5 sensible steps to information your determination:

- Analysis the corporate’s monitor report

Search for suppliers with sturdy buyer evaluations, a historical past of paying claims shortly, and good communication. - Contemplate breed-specific dangers

Jack Russells are vulnerable to points like patellar luxation, eye illness, and dental issues. Be certain your plan covers these situations with out lengthy ready intervals. - Decide the proper protection sort

Accident-only plans are the most affordable, however accident & sickness plans are normally the higher match for Jack Russells since they expertise hereditary and persistent situations. - Test how claims are dealt with

Some corporations course of reimbursements in a few days, whereas others take weeks. If quick turnaround issues to you, issue this into your selection. - Evaluate a number of quotes

Costs can fluctuate broadly, even for a similar canine. Get at the very least three quotes to search out the proper stability between price and protection.

Methodology

My group and I conduct intensive analysis on essentially the most respected pet insurance coverage corporations, analyzing buyer suggestions, coverage modifications, and business developments. Our licensed insurance coverage agent fact-checks all the pieces, and we replace our evaluations year-round as insurers modify premiums, protection, exclusions, and customer support.

We rank every U.S. pet insurance coverage supplier utilizing a 100-point scale, making certain an unbiased breakdown of how corporations carry out in real-world claims.

Our Rating Standards

- Protection & Exclusions (30%) – We analyze insurance policies, exclusions, and age restrictions, rewarding corporations with fewer protection limitations.

- Pricing (15%) – We run hundreds of pattern quotes and think about additional charges, reductions, and add-ons.

- Buyer Service & Popularity (12%) – We evaluation a whole bunch of buyer experiences, assess the sign-up course of, and consider declare help.

- Monetary Energy (10%) – We study A.M. Greatest & Demotech rankings to make sure corporations will pay claims reliably.

- Customization Choices (10%) – Suppliers with extra deductible, reimbursement, and payout flexibility rank increased.

- Ready Intervals (5%) – Shorter sickness & accident ready intervals lead to a greater rating.

- Declare Processing (5%) – Corporations providing quick reimbursements and direct vet pay rating increased.

- Innovation (3%) – We acknowledge distinctive choices and superior know-how within the business.

Unbiased Pet Insurance coverage Rankings: Placing Pets First

In contrast to many evaluation websites, we don’t promote rankings—each supplier earns its spot based mostly on actual efficiency. Our in-depth comparisons assist pet dad and mom make knowledgeable choices, whereas insurers use our evaluations to enhance their insurance policies. We solely advocate one of the best as a result of that’s what our readers deserve.