Leap to winners | Leap to methodology

Dominate, specialize, and scale

In an evolving and more and more complicated insurance coverage atmosphere, the position of the retail insurance coverage dealer has change into considerably extra demanding – and extra worthwhile. Gone are the times when success was measured solely by coverage placement.

Insurance coverage Enterprise America’s 5-Star Retail Brokers 2025 recorded a collective 39 % common development in fee income (over the previous 12 months), with all these on the celebrated record producing a minimum of $1 million in premium income in 2024, with a minimal of fifty % coming from business P&C enterprise.

These top-performing brokers convey a multifaceted talent set that blends market experience, technical acumen, and long-term strategic considering. Their worth lies not simply in inserting protection, however in optimizing threat switch methods, navigating turbulent markets, and performing as trusted companions.

Retail brokers are grappling with carriers pulling again on urge for food throughout a number of traces, tightening phrases, and rising scrutiny on loss histories. In response to Swiss Re’s April 2025 US P&C Outlook, premiums are forecast to rise by 5 % in 2025 and 4 % in 2026, pushed by sustained loss price inflation and heightened insured values. Whereas return on fairness is projected to carry at 10 %, brokers should proceed to handle consumer expectations amid market hardening, significantly in casualty traces the place extra significant fee firming is probably going.

A technique IBA’s 5-Star Retail Brokers differentiated themselves was by means of sector specialization. Whether or not targeted on development, actual property, logistics, or healthcare, they create industry-specific insights that permit them to navigate nuanced underwriting standards and safe tailor-made, sustainable insurance coverage options. This depth of data not solely helps efficient placement however strengthens broker-carrier relationships and fosters belief in complicated renewal negotiations.

Market entry, negotiation energy,

and execution

The most effective retail brokers keep broad and trusted entry to each home and worldwide service markets. Their reputations are constructed on transparency, efficiency, and continuity, permitting them to command consideration even in high-demand segments. These relationships are important to structuring bespoke packages that not solely meet protection wants, but additionally account for evolving dangers, compliance necessities, and business-specific sensitivities.

In execution, these brokers are strategic negotiators able to structuring refined placements that optimize pricing and protection by means of methods resembling quota sharing, blended packages, and threat layering. They’re additionally educators who be sure that purchasers perceive complicated coverage language, limitations, and triggers, and are outfitted to make knowledgeable, risk-aligned selections.

The most effective retail brokers are advisors, negotiators, and problem-solvers who drive outcomes and ship long-term worth in a market the place precision, belief, and foresight are in greater demand than ever.

Information evaluation of prime retail brokers

A comparability of the efficiency of IBA’s winners in 2025 and former years, in relation to income, consumer development, and insurance policies written, delivered fascinating outcomes.

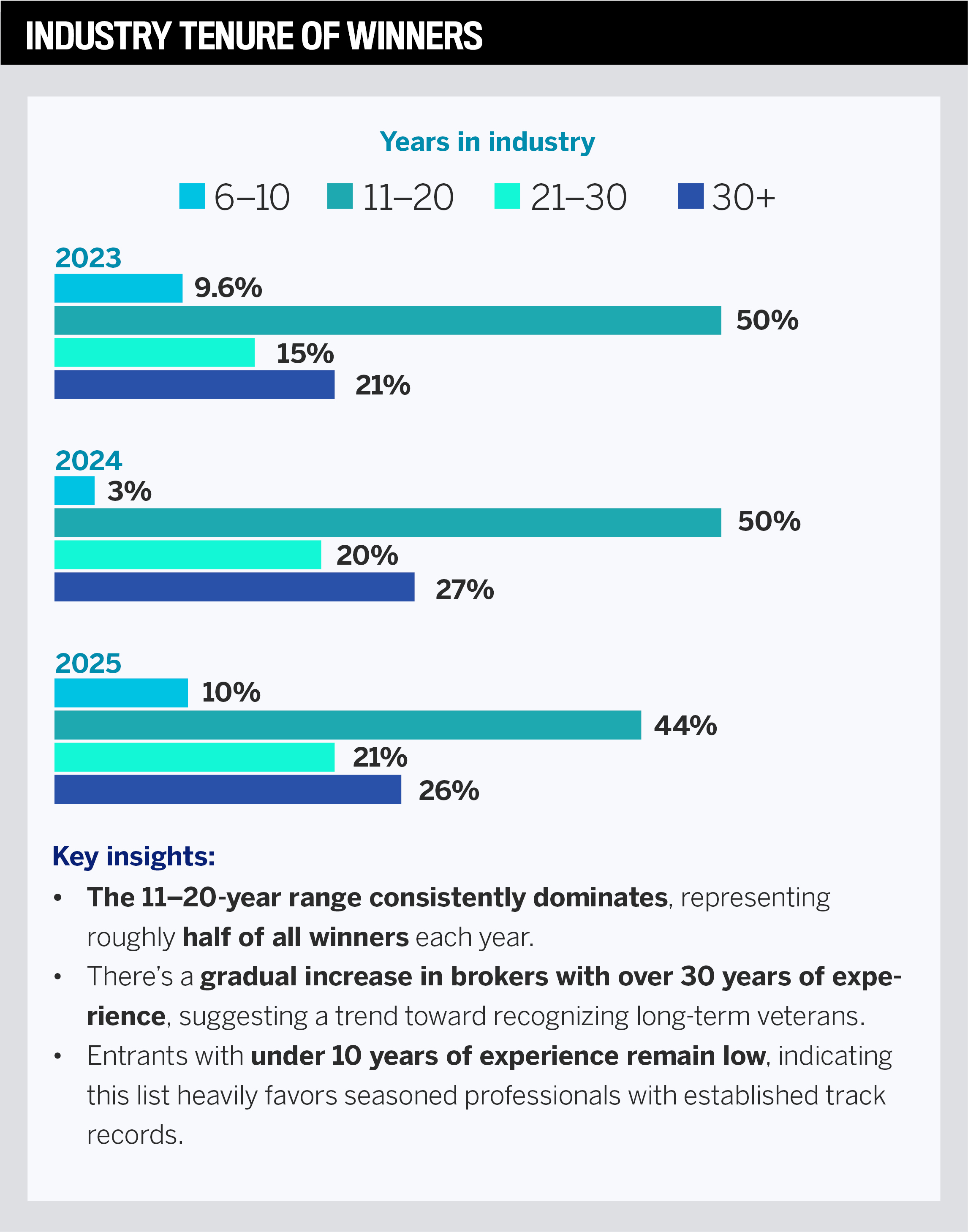

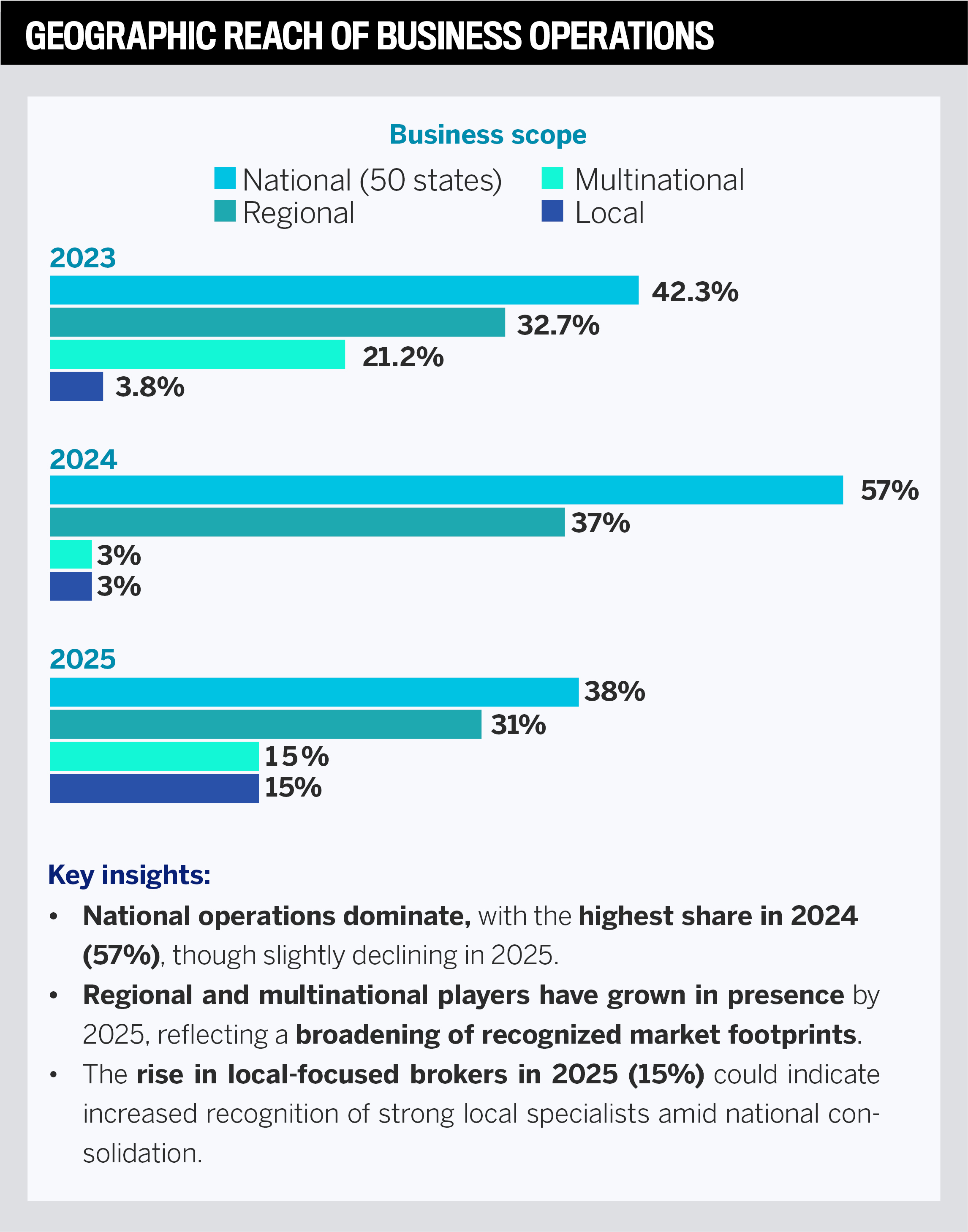

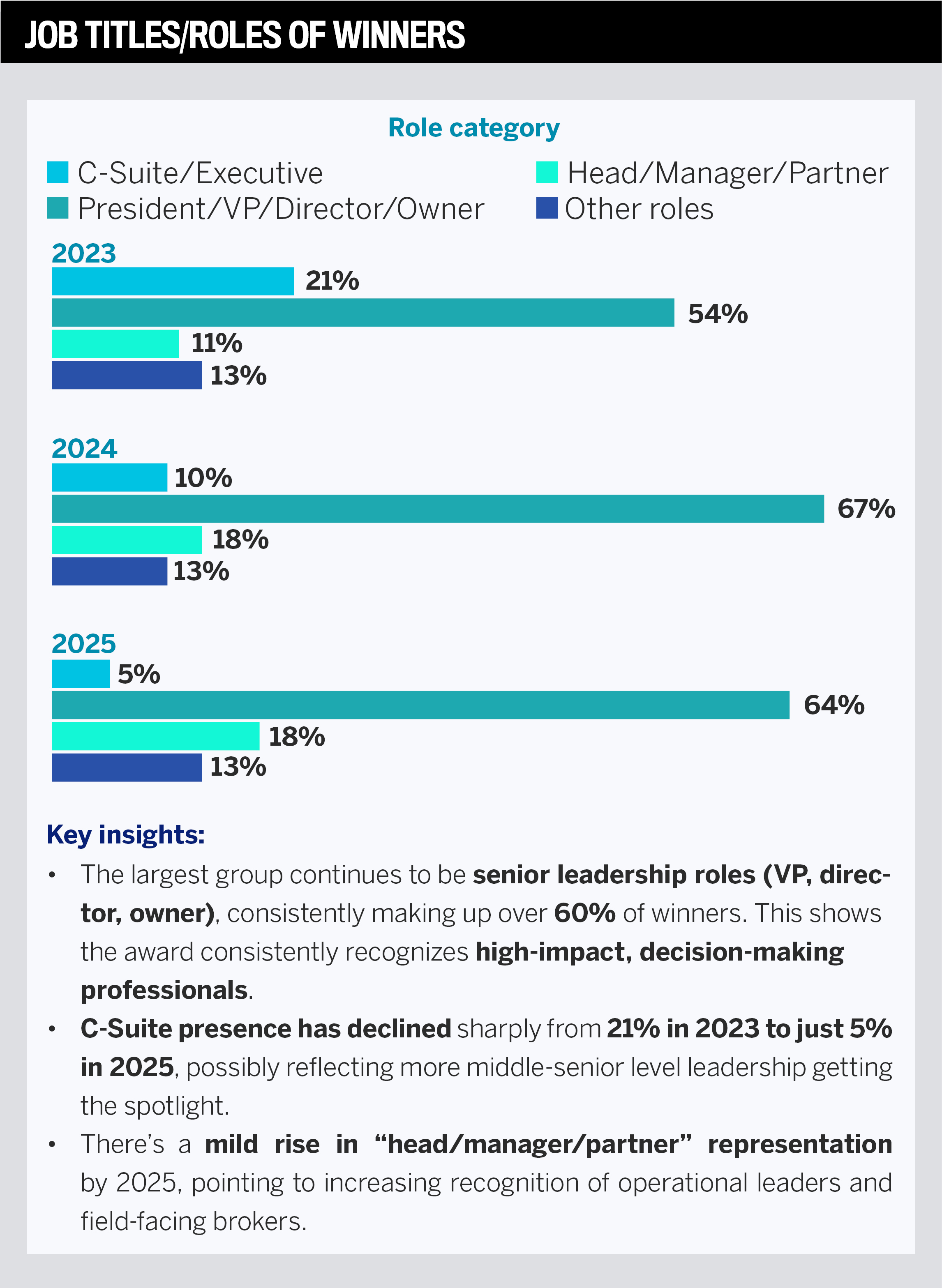

Additional perception and knowledge comparability of the profiles and demographics of 2025’s winners and former years’ revealed the next.

Meet IBA’s High Retail Brokers 2025

Progress by means of market experience, precision,

and visibility

In one of the vital disrupted insurance coverage environments within the US – the coastal property market – Brian Payne has established himself as a top-performing retail dealer by turning volatility into alternative. Via a mixture of market specialization, branding technique, and operational effectivity, the CEO has not solely grown his enterprise, which he joined as an intern in 2003, however created a proprietary service mannequin enabling scalability and long-term consumer retention.

Navigating a unstable market

Primarily based in South Carolina, a area with heightened coastal publicity, Payne operates on the heart of one of the vital dynamic markets. Service capability constraints, rising property values, and frequent non-renewals have created an atmosphere in fixed flux.

“There’s been important disruption,” he says, “with conventional carriers pulling out or tightening urge for food. That creates alternatives for brokers who know the way to navigate the panorama.”

And that’s precisely what Payne does. Leveraging his intensive community of regional carriers, E&S markets, and Lloyd’s companions, he ensures that even essentially the most complicated property dangers discover viable, aggressive placement. With deep relationships throughout underwriting groups, Payne brings options the place others see roadblocks.

“Entry to markets and the flexibility to put worthwhile enterprise is the whole lot,” he says. “We convey carriers alternatives they wish to write – and that makes all of the distinction.”

Driving demand

A key factor of Payne’s success lies in his refined advertising technique. Through the use of a layered method that mixes social media, billboards, radio, and tv, he builds model familiarity with potential purchasers by means of repetition and visibility.

“We’re not simply selling a product – we’re reinforcing a reputation,” he says. “Even when a buyer isn’t actively buying, that model recognition drives curiosity and finally conversion.”

What differentiates Payne’s method is his understanding of top-of-mind consciousness in a fragmented market. Whereas giant nationwide carriers flood media channels, Payne has tailor-made that precept for regional effectiveness.

“We might not be GEICO or State Farm, however it’s the identical precept of constructing the model,” he says

“Having the data and understanding of what’s happening out there provides us a platform to proceed to develop”

Brian PayneArea Insurance coverage Company

Operational excellence

Behind the scenes, Payne has constructed a extremely organized company mannequin with clearly outlined roles and tasks, a construction he designed particularly to fulfill the calls for of a high-volume, fast-paced market.

“We developed in-house programs to deal with the whole lot from underwriting and doc processing to cost coordination and mortgagee modifications,” Payne explains. “Each activity is assigned to a specialist, which permits us to work extra effectively and supply higher turnaround instances.”

That construction is supported by long-tenured workers, with many group members celebrating 5, 10, and even 15 years. This continuity enhances consumer expertise and helps the company’s development with out compromising service high quality.

“It’s not nearly measurement,” he says. “It’s about having the precise folks in the precise roles – and we’ve constructed that from the bottom up.”

Payne additionally credit know-how as a development accelerator. With built-in platforms for quoting, underwriting, and knowledge retrieval, his group can generate aggressive proposals in hours – not days.

“We will bind insurance policies any day of the 12 months, even on holidays,” he says. “Geo-coded ranking, entry to immediate property knowledge, and digital purposes have utterly modified the sport. What used to take per week now takes a day.”

By combining these instruments with a eager understanding of service ranking fashions, Payne positions every submission for optimum success. “We’re strategic with underwriting placements,” he says. “We all know what carriers are searching for, and we match properties accordingly, chopping out delays and rising bind charges.”

Positioned for continued growth

Because the market begins to melt barely and reinsurance urge for food returns, Payne sees extra alternatives on the horizon. New entrants are producing aggressive merchandise, and customers are extra targeted than ever on correctly insuring their largest property.

“For most folk, one in every of their largest property is both their business or residential property, and there’s now extra consideration and focus about their coverages,” he says. “And when that occurs, the dealer who’s already constructed belief and visibility wins.”

With the foundations he has created, Payne is well-positioned to proceed his upward trajectory – delivering worth to purchasers, profitability to carriers, and long-term development.

Delivering by means of precision, hustle, and perception

With almost 17 years within the {industry}, Termechi has constructed a profession outlined by hands-on diligence, strategic considering, and an unwavering deal with outcomes.

Primarily based in California and specializing within the extremely technical transportation and development sectors, Termechi has emerged as a 5-Star Retail Dealer 2025 by mastering the nuances of market shifts, consumer operations, and underwriting complexity, particularly in a few of the most difficult segments of the US insurance coverage panorama.

Progress pushed by effort and execution

Termechi attributes his current year-over-year development to at least one central issue: private drive. Whereas previous years leaned extra on group collaboration, this previous 12 months marked a turning level as he took full possession of his advertising and outreach methods.

“I mainly busted my ass,” he says candidly. “I knew I wanted to push tougher, and I did. That meant getting on the market, making chilly calls, actively going after new accounts, and being seen out there.”

That hustle translated into important development – fueled partly by a surge in referrals and new consumer acquisition.

This method is very important within the present atmosphere, the place brokers should work proactively to seize alternatives in a tightening market. Termechi embraces this problem, significantly within the business auto and transportation area, the place fee will increase and restricted service urge for food have created each volatility and alternative.

He says, “With auto charges rising and protection choices narrowing, I noticed an opportunity to step in and be an answer supplier when purchasers had been feeling the strain.”

Deep understanding of complicated dangers

Termechi’s success is rooted in a elementary precept: perceive your consumer’s enterprise totally earlier than providing protection. Nowhere is that this extra vital than within the development sector, the place a lot of his purchasers are commerce contractors. These should not paper contractors however corporations doing drywall, portray, framing, and out within the subject, uncovered to actual threat.

“These companies face tight margins and might’t afford gaps in protection. That’s why we take a deep dive into each operation, ensuring there are not any exclusions.”

A key differentiator for Termechi is his coverage literacy. “Too many brokers don’t learn the types,” he says. “Shoppers might imagine they’re saving cash, however I’ve seen in circumstances the place the work that they’re doing is particularly excluded, in order that they’re actually paying for nothing.”

By totally vetting insurance policies, educating purchasers about exclusions, and tailoring options to their operational realities, Termechi mitigates that threat and builds long-term belief.

“I wish to below promise and over ship”

David Termechi

Group collaboration and strategic delegation

Whereas Termechi is a self-starter, he’s fast to credit score the assist system round him. He leverages a full-service group at his company – claims assist, certificates processing, renewal prep – so he can keep targeted on what he does greatest: constructing consumer relationships and shutting enterprise.

“Delegation is essential. You must know what you’re greatest at and focus there. For me, it’s being the face of the enterprise, fixing consumer issues, and driving development.”

This use of sources not solely maximizes effectivity however permits him to scale with out sacrificing service high quality.

A status constructed on expertise

Shoppers wish to work with somebody who understands their world and delivers outcomes. Termechi’s status is grounded in each.

“Expertise issues,” he says. “However greater than that, purchasers wish to see which you can execute.” This results-oriented mindset has not solely helped him retain purchasers however develop his guide of enterprise 12 months after 12 months. “I get essentially the most satisfaction when purchasers are completely satisfied, once they know they’re correctly coated, and once they really feel like they’re in good arms. That’s after I know the work I’ve put in is value it.”

- Adam Gabler

Building Chief

Newfront - Bo Allen

Senior VP Enterprise Insurance coverage

Marsh McLennan Company - Brian Johnson

Senior Govt Vice President

Fisher Brown Bottrell, a Marsh McLennan Company - Bryce Bacic

Gross sales Govt, Business Strains

AssuredPartners - Chase Carlisle

Power Follow Chief/Consumer Advisor

Acrisure - David Delorenzo

Proprietor/Agent

Bar and Restaurant Insurance coverage - David Garcia

President

Rancho Mesa - David Jacobson

Accomplice

Acrisure - Eric Harden

Vice President, Business Strains

Insuramax - Fernando Silva

Producer

Lockton - Fred Zutel

President of Property and Casualty

Lockton - Gabe Erle

President, Co-Founder

C3 Danger & Insurance coverage Providers - Grant Mehlich

Founder

GCM Insurance coverage & Danger Administration Advisors - Gregory Havemeier

Consumer Advisor and Accomplice

Acrisure - Hunter Cox

Senior Vice President

Marsh McLennan Company - Jack Carra

Govt Vice President

AssuredPartners - Jamie Reid

Chairman

Gamie LLC dba C3 Danger & Insurance coverage Providers - Jeffrey R. Sanders

Accomplice and Consumer Advisor

Acrisure - Jeff Williams

President

AWA Insurance coverage - Jerry Becerra

President

Heffernan Barbary Insurance coverage Providers - Justin Failoni

Senior Vice President

Acrisure - Kyle Schielack

Managing Director

Higginbotham - Marcus Eagan

Managing Director

Higginbotham - Matt Hoskinson

SVP Gross sales, Business Strains

AssuredPartners - Nick Brewe

SVP Gross sales, Private Strains

AssuredPartners - Wealthy Hallet

Accomplice

C3 Danger & Insurance coverage Providers - Robert Foote

Danger Advisor

Acrisure - Ryan Von Haden

Accomplice/Vice President

TRICOR Insurance coverage - Shantelle Cabir

Senior Vice President/Enterprise Insurance coverage Dealer

Newfront - Stephen Leist

Senior Vice President/Producer

AssuredPartners - Tim Powers

Vice President

MGI Danger Advisors - Tim Spear

Consumer Advisor, Accomplice

Acrisure - Wess Peterson

President

Triumph Insurance coverage Group - Zachary Fanberg

Managing Director

Higginbotham

Platinum Retail Brokers

- Brian Johnson

Senior Govt Vice President

Fisher Brown Bottrell, a Marsh McLennan Company - Chase Carlisle

Power Follow Chief/Consumer Advisor

Acrisure - David Garcia

President

Rancho Mesa - David Jacobson

Accomplice

Acrisure - Fred Zutel

President of Property and Casualty

Lockton - Gregory Havemeier

Consumer Advisor and Accomplice

Acrisure - Jack Carra

Govt Vice President

AssuredPartners - Jeff Williams

President

AWA Insurance coverage - Justin Failoni

Senior Vice President

Acrisure - Marcus Eagan

Managing Director

Higginbotham - Robert Foote

Danger Advisor

Acrisure

Now in its eleventh 12 months, Insurance coverage Enterprise America’s High Retail Brokers record (previously generally known as High Producers) celebrates the highest-performing retail insurance coverage professionals throughout the nation.

In February, IBA opened nominations for the 2025 record, inviting retail brokers and brokers to use. To be eligible, nominees wanted to generate a minimum of $1 million in premium income in 2024, with a minimal of fifty % coming from business P&C enterprise, and present year-over-year development from 2023.

Nominees had been requested to submit detailed enterprise metrics as a part of the analysis course of. Those that reported over $4 million in premium income for 2024 earned the celebrated title of Platinum Retail Dealer.