Understanding How Your Property Insurance coverage Case Will get Settled

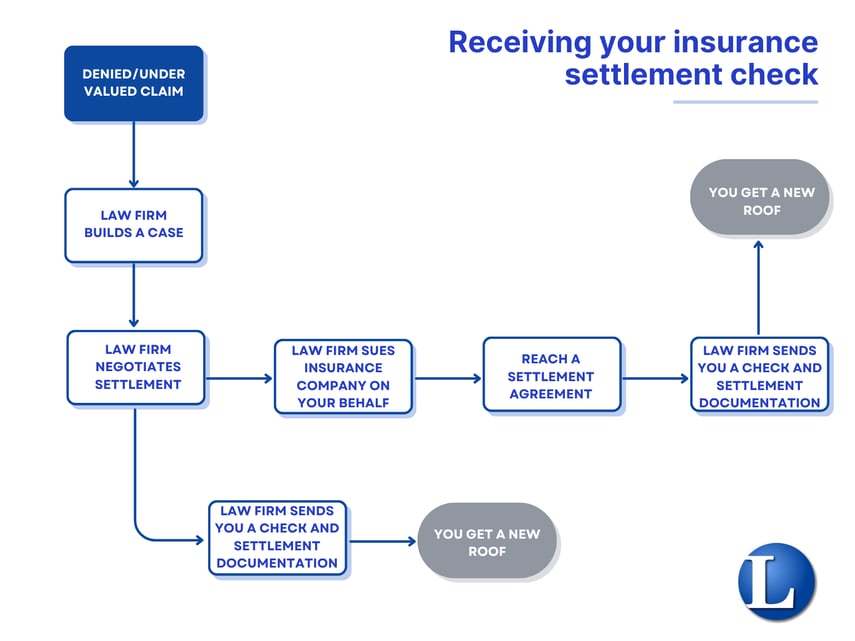

When your property insurance coverage declare is denied otherwise you obtain an underpaid insurance coverage payout, it will possibly really feel like the method is over, however it’s simply getting began.

With assist from an skilled insurance coverage legal professional, you possibly can problem your insurer’s resolution and pursue the total compensation you deserve. From a denied owners insurance coverage declare to receiving a good settlement, right here’s how the property insurance coverage case settlement course of works from begin to end.

1. Denied or Underpaid Declare

The property insurance coverage case settlement course of typically begins when your insurer denies your declare or gives a payout that doesn’t cowl your full damages. That is frequent after roof injury, water leaks, or extreme storms. When your declare is denied or underpaid, that is the place an skilled insurance coverage legal professional steps in to evaluation your coverage, assess your losses, and decide in case your insurer acted in dangerous religion.

2. Legislation Agency Builds Your Case

When you rent an legal professional, their staff begins gathering proof, reviewing your insurance coverage coverage, documenting damages, and acquiring restore estimates. This ensures your case is absolutely supported and positions you for a profitable consequence within the property insurance coverage case settlement course of.

3. Negotiating a Settlement

The subsequent step within the insurance coverage case settlement course of is negotiation. Throughout negotiations, your legal professional will current documentation, estimates, and knowledgeable opinions to reveal the true worth of your losses. The objective is to safe a good and well timed settlement without having to go to courtroom.

4. Submitting a Lawsuit

If the insurance coverage firm refuses to make a good settlement provide or would not make one in any respect, your legal professional could transfer ahead with submitting a lawsuit in your behalf.

Insurance coverage firms could refuse to accept a number of causes, together with:

- The house owner beforehand acquired fee for roof repairs however didn’t full the work.

- The prior house owner acquired an insurance coverage payout for roof injury however didn’t use it for repairs (this problem can nonetheless be challenged in courtroom).

- The insurer claims the roof injury resulted from regular put on and tear, mechanical points, fraud, or that no injury exists.

It is necessary to notice that the size of the settlement course of after submitting swimsuit is dependent upon many elements, such because the insurance coverage firm’s response time and the main points of your unique declare communications.

5. Receiving Your Insurance coverage Settlement Verify

As soon as a settlement is reached by negotiation or courtroom, your insurance coverage firm sends the test to your legal professional. Your legal professional will make sure the insurance coverage payout is right and can ship you the test. This confirms your funds are prepared to make use of for residence repairs, finishing the ultimate steps of the property insurance coverage case settlement course of.

6. You Get a New Roof

Lastly, you possibly can put your settlement funds to work, whether or not which means changing your roof, repairing storm injury, or rebuilding a part of your own home.

Why Work With an Insurance coverage Legal professional?

The house insurance coverage case settlement course of can really feel overwhelming, however with an skilled legal professional guiding you, you’ll perceive each step. Whether or not your declare settles early or goes to courtroom, The Lane Legislation Agency is right here to assist Texas owners get the total compensation they deserve.