If the rising value of house owners insurance coverage have been factored into the US Client Value Index — a key metric of inflation — it might have added 80 foundation factors, or about 0.8%, to final yr’s CPI improve of three.4%, in accordance with an evaluation from Bloomberg Intelligence.

By not together with house insurance coverage, the CPI “ignores local weather prices,” writes BI senior analyst Andrew Stevenson in his April 9 word.

Owners insurance coverage prices within the US hit roughly $175 billion in 2023, up 21% over the earlier yr, in accordance with insurance coverage brokerage Policygenius. The rise is largely because of local weather change, which is driving extra excessive fires, floods and storms. The US endured a file 28 climate and local weather disasters that brought on at the least $1 billion in harm final yr. As insurers incur larger prices, owners are going through larger premiums. Inflation itself can be making it costlier to pay out claims.

The Dangerous Economics of ‘Going Naked’ With out Owners Insurance coverage

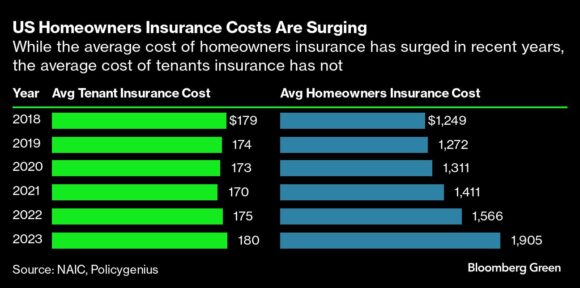

The common value of insuring a US house final yr was $1,905 — 50% larger than the common of $1,272 in 2019, in accordance with the Nationwide Affiliation of Insurance coverage Commissioners and Policygenius.

Calculated by the US Bureau of Labor Statistics, CPI measures the common change in costs paid by city customers for numerous items and companies, together with each meals and gas. (“Core CPI” excludes meals and vitality.) CPI contains the class “tenants and family insurance coverage,” however that is extra colloquially often known as renters insurance coverage. Final yr, the common renters insurance coverage value within the US was $180, up 3% from a yr earlier.

Stevenson checked out what would occur if the $1,905 common for house insurance coverage got the identical CPI weight as “tenants and family insurance coverage,” which accounted for simply 0.01% of the general improve in CPI final yr. He discovered that the 21% improve in house insurance coverage might have contributed as a lot as “84 bps to the index vs a 1-bp acquire realized by the three% rise in tenant and house owner insurance coverage prices.” (A foundation level is the same as 0.01 proportion level.)

Simply 5 years in the past, owners insurance coverage and renters insurance coverage have been growing at related charges yr over yr. However whereas house insurance coverage prices have since surged, renters insurance coverage has largely held regular. The distinction “is perhaps significant sufficient” for federal officers to “rethink” the inclusion of house owners insurance coverage within the CPI basket, Stevenson writes.

“We’re unable to supply any perception into customized calculations created outdoors BLS,” Gerald Perrins, a BLS part chief engaged on the CPI, informed Bloomberg Inexperienced.

The price of US owners insurance coverage stands to continue to grow, with common premiums within the US predicted to hit a possible file of $2,552 by the top of 2024, in accordance with Insurify. Researchers on the Massachusetts-based insurance-comparison platform attribute the anticipated improve to intensifying climate disasters, rising reinsurance charges and excessive house restore charges.

{Photograph}: A destroyed home following Hurricane Ian in Fort Myers Seashore, Florida, US, on Tuesday, Oct. 4, 2022. Photograph credit score: Eva Marie Uzcategui/Bloomberg

Associated:

Copyright 2024 Bloomberg.

Matters

Tendencies

USA

Owners

Fascinated about Owners?

Get computerized alerts for this subject.