The rising adoption of sensible house know-how is enabling shoppers to each spot harm early and cut back its impression by integrating these superior options into their properties. Insurers are more and more recognising the worth of sensible house units and are starting to include them into their insurance policies. For instance, US insurer Nationwide has launched an initiative in collaboration with water options supplier Phyn to supply discounted leak detection options to its policyholders. Nonetheless, client uptake of sensible units similar to water leak detection units stays restricted.

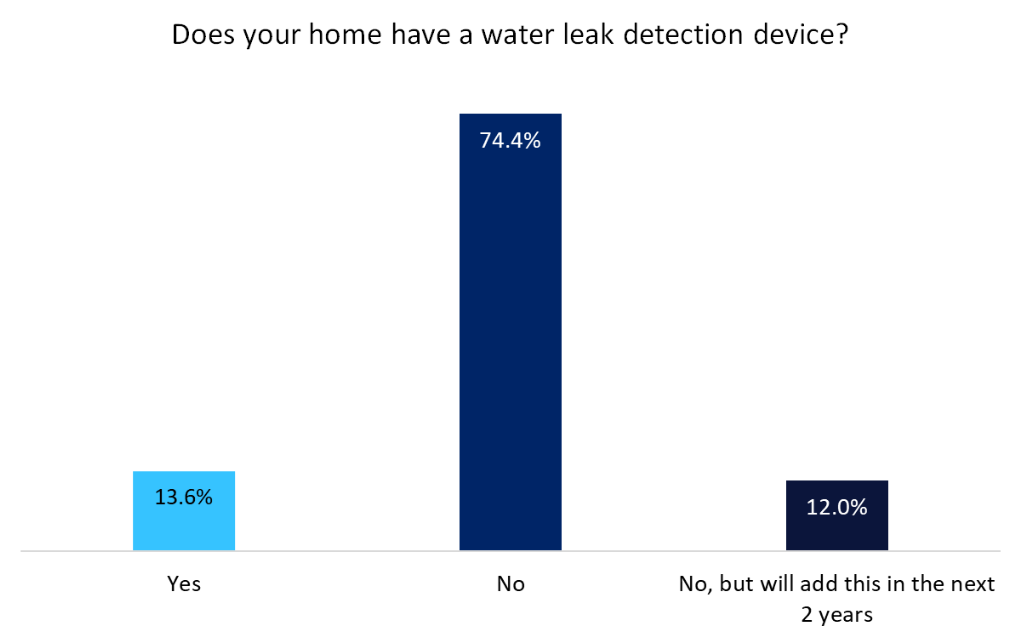

As per GlobalData’s 2024 Rising Developments Insurance coverage Shopper Survey, simply 13.6% of respondents reported having a water leak detection machine put in of their house, with a further 12% expressing the intention so as to add one throughout the subsequent two years. This low uptake is especially alarming given the potential for important harm attributable to leaking or burst pipes.

Water leak detection techniques play an important position in figuring out broken pipes early, thereby stopping intensive water harm, mould progress, and damp circumstances in properties. In keeping with the Affiliation of British Insurers (ABI), with out these techniques in place, it will probably take weeks and even months to detect leaks, resulting in pricey repairs and intensive harm. The ABI emphasizes that implementing water leak detection techniques is a win-win state of affairs for each insurers and shoppers. By proactively addressing leaks, insurers can cut back the frequency and severity of claims, whereas owners can shield their properties from the devastating results of water harm.

In keeping with a examine by Phyn, properties outfitted with water leak detection units are 99% much less prone to expertise non-weather-related leak claims. By its partnership with Phyn, Nationwide affords its clients a 15% low cost on these modern merchandise. This collaboration will assist improve danger administration for owners, whereas doubtlessly decreasing the chance of pricey claims associated to water harm for insurers. Going ahead, it’s doubtless that extra insurers will search to undertake comparable sensible house know-how initiatives to boost danger administration and enhance total buyer satisfaction.

Entry probably the most complete Firm Profiles

available on the market, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we wish you to take advantage of

useful

choice for your corporation, so we provide a free pattern you can obtain by

submitting the under type

By GlobalData