South Korea is a well-liked vacationer and buying vacation spot for Hong Kong residents. Kwiksure will clarify the applying course of for South Korea’s digital entry system, SeS automated clearance, and airport self-service tax refund, making certain a clean and uninterrupted journey from entry to exit.

South Korea’s new digital entry rules

Beginning January 1, 2026, South Korea will absolutely implement digital entry procedures, changing paper entry playing cards. All vacationers can be required to submit their entry purposes on-line inside 72 hours of arriving in South Korea.

Tutorial on making use of for the South Korean digital entry declaration card

Required paperwork

- Legitimate passport

- Flight quantity

- Lodging tackle in South Korea

- E mail tackle

South Korea E-Arrival Declaration Card Software Steps

- Click on “Declare” below “Private Digital Entry Declaration” on the Digital Entry Declaration Card Webpage inside 72 hours of arrival

- Comply with all phrases of assortment and use of private information, fill within the e-mail tackle and click on “Affirm”; candidates below the age of 14 will need to have their mother and father or guardians fill within the kind on their behalf.

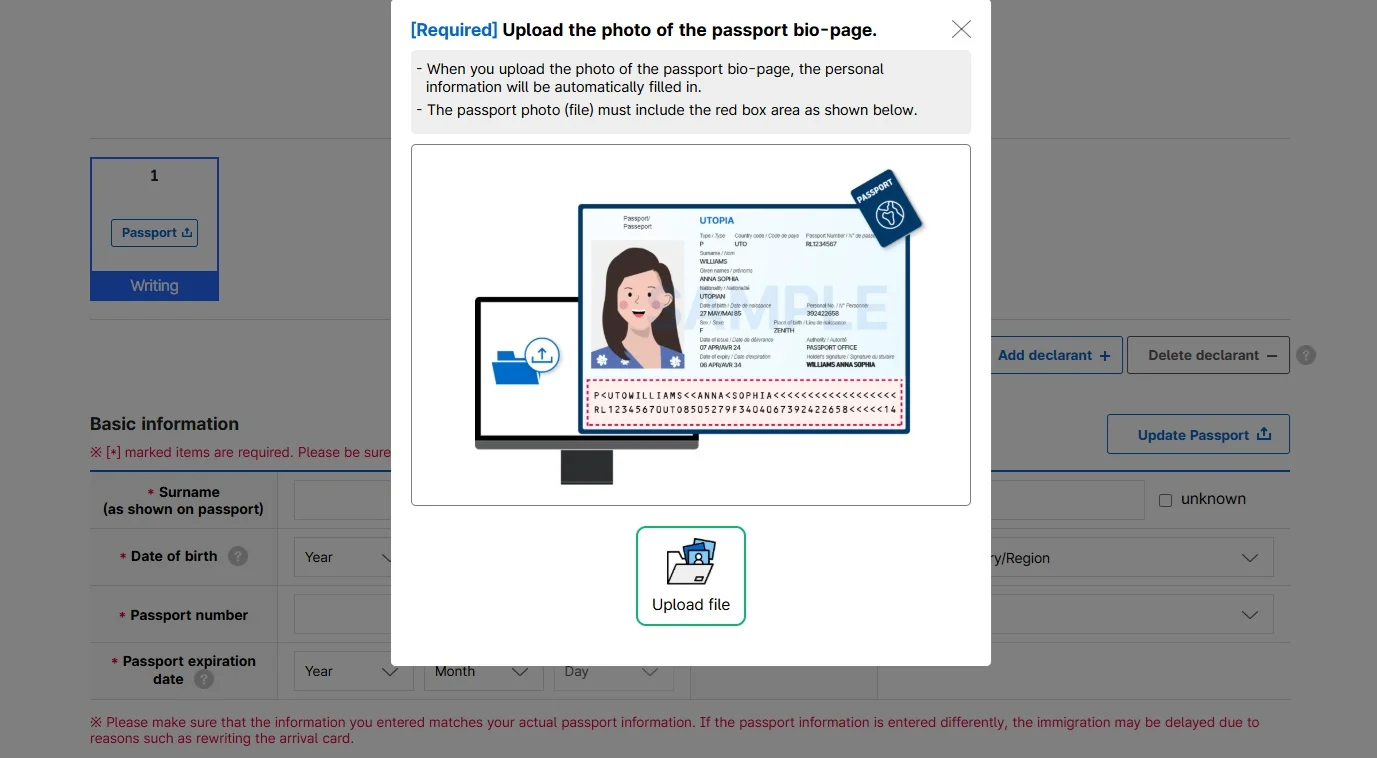

- Add a photograph of your passport’s private data web page and journey data, together with arrival and departure flight particulars, function of entry, lodging tackle, and occupation, and submit an software kind.

After submitting the applying, candidates can instantly obtain the PDF file or save a screenshot of the arrival card for reference. There is no such thing as a ready interval for approval or any charges concerned. If there are any adjustments to the knowledge, they have to be reported on the Internet web page earlier than immigration. Upon arrival in South Korea, merely scan your passport for entry; no software kind is required.

Exempt from declaration

The next people are exempt from submitting an digital arrival card:

- Holding a Korean Alien Registration Card (akin to a everlasting resident card or work visa).

- Passengers holding a legitimate Ok-ETA (Digital Journey Authorization).

- Passengers utilizing the SES digital clearance system

- Airline crew members

SeS Computerized Customs Clearance Software Tutorial

When getting into South Korea, you can even apply for the “Korea E-Channel” SeS (Good Entry Service) to enter by automated gates that learn your passport. Hong Kong SAR passport holders can apply for it totally free at designated areas within the airport. After finishing the applying, they are going to be exempt from submitting an digital arrival card.

SeS Automated Customs Clearance Software Eligibility

- Holders of visa-free chip passports

- Should be 17 years of age or older

- The Passport have to be legitimate for no less than 6 months.

- No legal file in South Korea

SeS Self-Service Immigration Software Steps

- On the software middle, take a ready quantity as instructed by the workers and wait to be known as.

- File your fingerprints and take pictures as required by workers.

- Fill in your cellphone quantity (Hong Kong cellphone numbers are acceptable).

The method takes about 5 minutes, however vacationers who plan to use at immigration ought to permit extra time to keep away from delays affecting their immigration preparations.

SeS Self-Service Immigration Software Location

Incheon Airport T1

Location: In entrance of Part H of the departure constructing on the third flooring

Service hours: 07:00-18:00

Busan Gimhae Worldwide Airport

Location: 2nd Ground, Departure Affairs Part (출국사무과)

Service hours: Monday to Friday, 09:00-18:00

Jeju Worldwide Airport

Location: In entrance of the VIP lounge on the third flooring

Service hours: Monday to Friday, 09:00-18:00

Along with main airports, you’ll be able to examine the opposite areas all through the Hello Korea Official Web site.

SES validity interval

The SeS is legitimate till the passport expires, and a brand new software have to be submitted after the passport is renewed.

South Korea Tax Refund | Two Methods to Get a Tax Refund

Even when vacationers journey to completely different areas of South Korea, they’ll apply for a tax refund collectively so long as they meet the eligibility necessities. Along with counter companies, self-service tax refund machines can be found for vacationers at in style vacationer locations, giant shops, and airports in South Korea, the place they’ll select to obtain a refund in money or by bank card.

South Korea Tax Refund | Responsibility Free VS. Tax Refund

In South Korea, most shops supply tax-free or tax-refund choices. When buying, you need to take note of whether or not the value charged by the service provider is tax-free.

|

Responsibility Free

|

Tax Refund

|

|

|

Retailer Sort

|

Supermarkets, shops, and drugstores taking part within the tax refund program, akin to Lotte Mart, E-mart, and Olive Younger, and so forth.

|

Displaying a Tax Free or Tax Refund signal

|

|

Items tax

|

Taxes have been deducted from the vacationer’s fee.

|

Cost can be made at checkout, together with tax.

|

|

Cost strategies

|

It’s essential to present your passport to show your international standing when testing.

|

|

|

Tax refund procedures

|

No tax refund process required

|

It’s essential to preserve the receipt for tax refund procedures.

|

South Korea Tax Refund | South Korea Tax Refund Eligibility

These eligible for a tax refund should meet the next circumstances:

- Staying in South Korea for not more than 6 months

- Departure inside 3 months of buy

- Spend 15,000 Korean Received or extra in a single transaction at taking part shops to obtain a tax refund.

- Maintain a tax refund kind from the shop that claims “TAXFREE”.

- When departing the nation, carry your tax refund receipts, buying receipts, and unopened and unused tax-inclusive items.

South Korea Tax Refund | Airport Self-Service Tax Refund Machine Quantity Restrict

Though there isn’t any restrict to the quantity you’ll be able to spend for a tax refund in South Korea, the self-service tax refund machines have a most refund quantity. When you exceed this restrict, you will want to go to the customs counter to course of your refund.

- A single tax refund exceeding 75,000 Korean received

- It’s essential to go to the customs tax refund counter to course of it; the products have to be inspected and stamped by customs earlier than they are often checked in as baggage.

- For single tax refunds of lower than 75,000 Korean received

- Tax refunds may be processed at self-service kiosks, and baggage may be checked in straight throughout check-in.

South Korea Tax Refund | Airport Self-Service Tax Refund Machine Procedures

1. Separate your baggage in response to the quantity of tax refund.

The self-service tax refund machine can solely course of receipts with a single refund quantity of lower than 75,000 Korean received. For quantities exceeding this, you will want to go to the counter and bear customs inspection.

2. Proceed to the self-service machine to scan your passport and tax refund kind.

First, choose your language, then scan your passport’s data web page on the self-service machine, and eventually scan all of your tax refund kinds. Eligible kinds will show an “O” within the “Customs Affirmation” area; if an “X” seems, you need to carry the unopened and unused bought items to the customs declaration counter for processing. If the kinds can’t be scanned, you might have already obtained your refund.

3. Accumulate your refund after leaving the nation as instructed.

Passengers can select to obtain fee by bank card or money, and should proceed to the tax refund counter or machine after departure to gather the money or refund to their card, as displayed on the machine.

4. Examine-in and baggage drop-off

Baggage for which a tax refund was efficiently processed on the self-service machine may be checked in straight in the course of the check-in course of.

South Korea Tax Refund | Location of Self-Service Tax Refund Machines at Incheon Airport

Incheon Airport – Terminal 1

- Earlier than leaving the nation

- Subsequent to counters B, E, J, and L on the third flooring

- After leaving the nation

- The duty-free space is positioned on the third flooring close to gate 28, subsequent to the central pharmacy on the third flooring of the terminal constructing.

- Enterprise hours: 24 hours

- Contact quantity: 032-743-1009

Incheon Airport – Terminal 2

- Earlier than leaving the nation

- Close to the check-in counters D/E on the third flooring

- After leaving the nation

- The duty-free space is on the third flooring, reverse gate 250, close to gate 253.

- Enterprise hours: 24 hours

- Contact quantity: 032-743-0647

*Info is for reference solely. The precise location of the machine is topic to alter. Please examine the placement on the Incheon Airport web site.

South Korea Tax Refund | Necessary Notes on South Korea Tax Refund

1. Permit time

As a result of giant variety of folks processing tax refunds and boarding, please permit extra time on the airport to finish the tax refund procedures and examine your baggage, in order to not miss your flight as a result of lengthy queues or not have time to course of the tax refund.

2. Accumulate all tax refund paperwork and course of them in a single go.

Receipts that meet the tax refund standards may have the phrase “TAXFREE” on them. When buying, vacationers can preserve all their tax refund receipts in a single place for handy processing and to avoid wasting time.

3. Don’t open or use tax-refunded items.

Items eligible for tax refunds in South Korea can’t be opened or used throughout the nation. Customs may even conduct random checks on duty-free items. Vacationers must preserve the tax-refund items protected till they’ve accomplished the tax refund procedures and left the nation earlier than they can be utilized.

Continuously Requested Questions

If my passport has beforehand been registered with a SeS (Safety Standing) card, do I must fill out an digital entry declaration card when getting into South Korea?

No. Profitable candidates for SeS are exempt from filling out the digital entry declaration card. Nonetheless, upon renewing their passports, they might want to reapply for SeS or fill out the digital entry declaration card to enter the nation.

Can I open and use the products that I’ve obtained a tax refund for in South Korea throughout the nation?

No. Items eligible for tax refunds in South Korea have to be unpacked and used solely after departure from the nation.

Can South Korean tax refunds be mixed into one calculation?

In South Korea, tax refunds are calculated primarily based on every buy. So long as the tax refund necessities are met on the identical receipt, even when a number of purchases are made at completely different shops, a tax refund may be processed collectively.