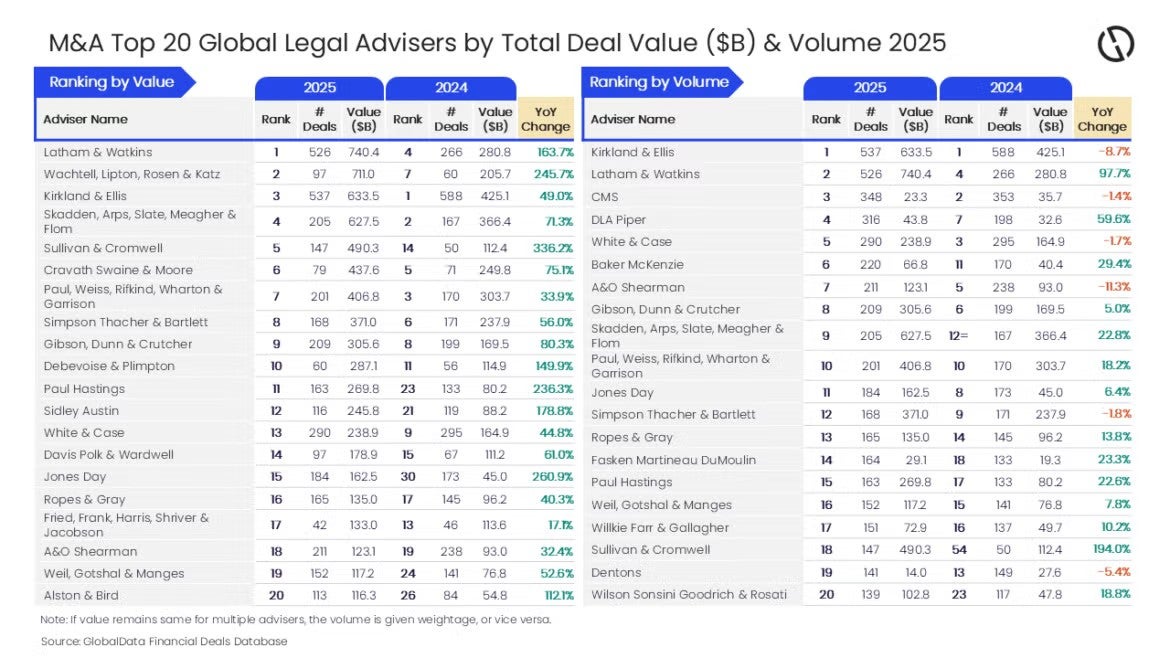

Latham & Watkins and Kirkland & Ellis have topped the authorized adviser charts for international mergers and acquisitions in 2025, primarily based on information from GlobalData’s newest Authorized Advisers League Desk.

As per GlobalData’s Monetary Offers Database, Latham & Watkins led by worth with advisory on offers valued at $740.4bn.

Entry deeper trade intelligence

Expertise unmatched readability with a single platform that mixes distinctive information, AI, and human experience.

Kirkland & Ellis offered authorized counsel on 537 offers over the previous 12 months, topping the quantity chart.

The rankings present Wachtell, Lipton, Rosen & Katz within the second spot by worth, with advisory on offers value $711bn.

Kirkland & Ellis was ranked third by way of worth by providing recommendation on $633.5bn value of offers.

Skadden, Arps, Slate, Meagher & Flom and Sullivan & Cromwell accomplished the highest 5 by worth, with $627.5bn and $490.3bn respectively.

When it comes to deal quantity, Latham & Watkins took the second spot with 526 offers, adopted by CMS within the third place with involvement in 348 transactions.

DLA Piper and White & Case rounded out the highest 5 by quantity, with advisory on 316 and 290 offers respectively.

GlobalData lead analyst Aurojyoti Bose stated: “Kirkland & Ellis was the highest adviser in 2024 by quantity and managed to retain its management place in 2025 as properly however confronted shut competitors from Latham & Watkins. Each the legislation corporations had been the one two advisers with greater than 500 offers throughout 2025. Whereas Kirkland & Ellis led with 537 offers, Latham & Watkins adopted intently to occupy the second spot with 526 offers.

“Of the 526 offers suggested by Latham & Watkins throughout 2025, 108 had been billion-dollar offers that additionally included 17 mega offers valued at or greater than $10bn. The involvement in these big-ticket offers helped Latham & Watkins prime the desk by worth in 2025.”

GlobalData’s league tables are primarily based on the real-time monitoring of hundreds of firm web sites, advisory agency web sites and different dependable sources accessible on the secondary area. A devoted group of analysts displays all these sources to collect in-depth particulars for every deal, together with adviser names.

To make sure additional robustness to the information, the corporate additionally seeks submissions of offers from main advisers.