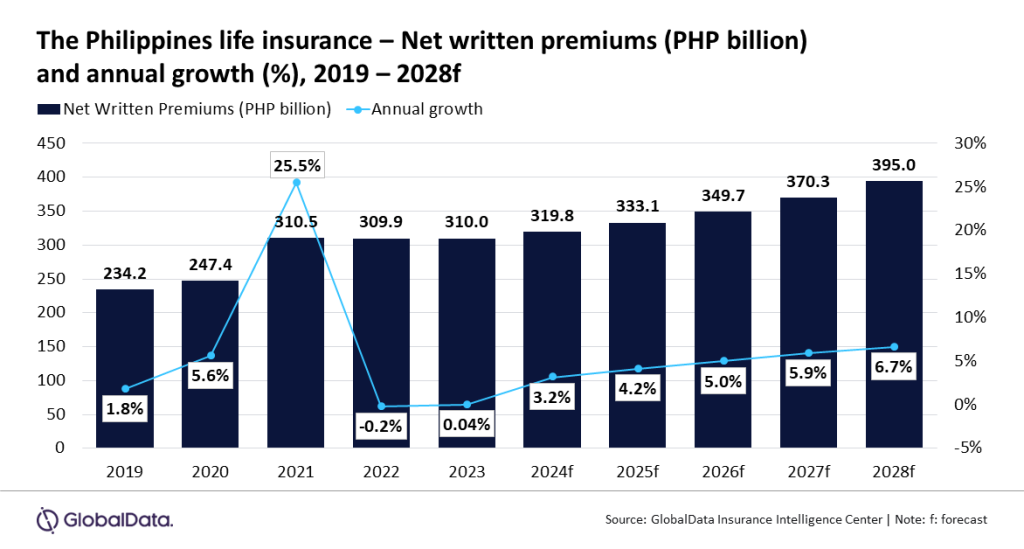

The life insurance coverage business within the Philippines is predicted to develop at a compound annual progress charge (CAGR) of 5.4% from PHP319.8bn ($5.8bn) in 2024 to PHP395bn ($7.1bn) in 2028, when it comes to internet written premiums (NWP).

That is based on GlobalData which additionally forecast that the life insurance coverage sector within the Philippines is anticipated to file an annual progress charge of three% in 2024.

As well as, this can be pushed by financial restoration and the nation’s demographic development of an getting old inhabitants which can be gaining a rising life expectancy.

Prasanth Katam, insurance coverage analyst at GlobalData, mentioned: “The actual GDP within the Philippines grew by 5.6% in 2023, pushed by strong client spending, a powerful labor market, and a restoration in tourism and monetary providers actions. The GDP is additional anticipated to develop by 6.1% in 2024 and 6.3% in 2025, which is able to assist the expansion of life insurance coverage.”

Moreover, the nation’s getting old inhabitants with a rising life expectancy may even result in a rise within the demand for varied life insurance coverage and pension merchandise. GlobalData has forecast that the share of the inhabitants aged 65 and above is about to extend to six.1% in 2028 from 5.4% in 2023.

The expansion of the life insurance coverage sector within the Philippines may also be attributed to favorable regulatory developments and authorities assist.

Entry essentially the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Achieve aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e-mail will arrive shortly

We’re assured in regards to the

distinctive

high quality of our Firm Profiles. Nevertheless, we wish you to take advantage of

useful

determination for your enterprise, so we provide a free pattern you could obtain by

submitting the under type

By GlobalData

In April 2024, the Cebu provincial authorities authorised the Sugbo Segurado plan, an accident and life insurance coverage plan designed to cowl a variety of presidency officers and employees. The plan goals to supply monetary safety to provincial authorities staff in Cebu province and promote insurance coverage penetration.

Katam continued: “Digital transformation can also be propelling the enlargement of the life insurance coverage business within the Philippines. Insurers are investing closely in expertise to streamline operations, improve buyer expertise, and enhance coverage distribution.”