When Pam McClure realized she’d save almost $4,000 on her prescribed drugs subsequent yr, she stated, “it sounded too good to be true.” She and her husband are each retired and reside on a “very strict” funds in central North Dakota.

By the tip of this yr, she can have spent virtually $6,000 for her drugs, together with a drug to manage her diabetes.

McClure, 70, is one among about 3.2 million folks with Medicare prescription drug insurance coverage whose out-of-pocket medicine prices will probably be capped at $2,000 in 2025 due to the Biden administration’s 2022 Inflation Discount Act, based on an Avalere/AARP examine.

“It’s fantastic — oh my gosh. We’d truly be capable of reside,” McClure stated. “I’d be capable of afford contemporary fruit within the wintertime.”

The IRA, a local weather and well being care regulation that President Joe Biden and Vice President Kamala Harris promote on the marketing campaign path as one among their administration’s biggest accomplishments, radically redesigned Medicare’s drug profit, known as Half D, which serves about 53 million folks 65 and older or with disabilities. The administration estimates that about 18.7 million folks will save about $7.4 billion subsequent yr alone as a result of cap on out-of-pocket spending and fewer publicized adjustments.

The annual enrollment interval for Medicare beneficiaries to renew or change drug protection or to decide on a Medicare Benefit plan started Oct. 15 and runs by Dec. 7. Medicare Benefit is the industrial different to conventional government-run Medicare and covers medical care and sometimes prescribed drugs. Medicare’s stand-alone drug plans, which cowl medicines sometimes taken at house, are additionally administered by personal insurance coverage firms.

“We at all times encourage beneficiaries to essentially take a look at the plans and select the best choice for them,” Chiquita Brooks-LaSure, who heads the Facilities for Medicare & Medicaid Providers, informed KFF Well being Information. “And this yr particularly it’s vital to do this as a result of the profit has modified a lot.”

Enhancements to Medicare drug protection required by the IRA are essentially the most sweeping adjustments since Congress added the profit in 2003, however most voters don’t learn about them, KFF surveys have discovered. And a few beneficiaries could also be shocked by a draw back: premium will increase for some plans.

CMS stated Sept. 27 that nationwide the typical Medicare drug plan premium fell about $1.63 a month — about 4% — from final yr. “Individuals enrolled in a Medicare Half D plan will proceed to see secure premiums and can have ample decisions of reasonably priced Half D plans,” CMS stated in a press release.

Nonetheless, an evaluation by KFF, a well being info nonprofit that features KFF Well being Information, discovered that “many insurers are growing premiums” and that giant insurers together with UnitedHealthcare and Aetna additionally decreased the variety of plans they provide.

Many Half D insurers’ preliminary 2025 premium proposals have been even larger. To cushion the worth shock, the Biden administration created what it calls an indication program to pay insurers $15 additional a month per beneficiary in the event that they agreed to restrict premium will increase to not more than $35.

“Within the absence of this demonstration, premium will increase will surely have been bigger,” Juliette Cubanski, deputy director of the Program on Medicare Coverage at KFF, wrote in her Oct. 3 evaluation.

Practically each Half D insurer agreed to the association. Republicans have criticized it, questioning CMS’ authority to make the additional funds and calling them a political ploy in an election yr. CMS officers say the federal government has taken related measures when implementing different Medicare adjustments, together with below President George W. Bush, a Republican.

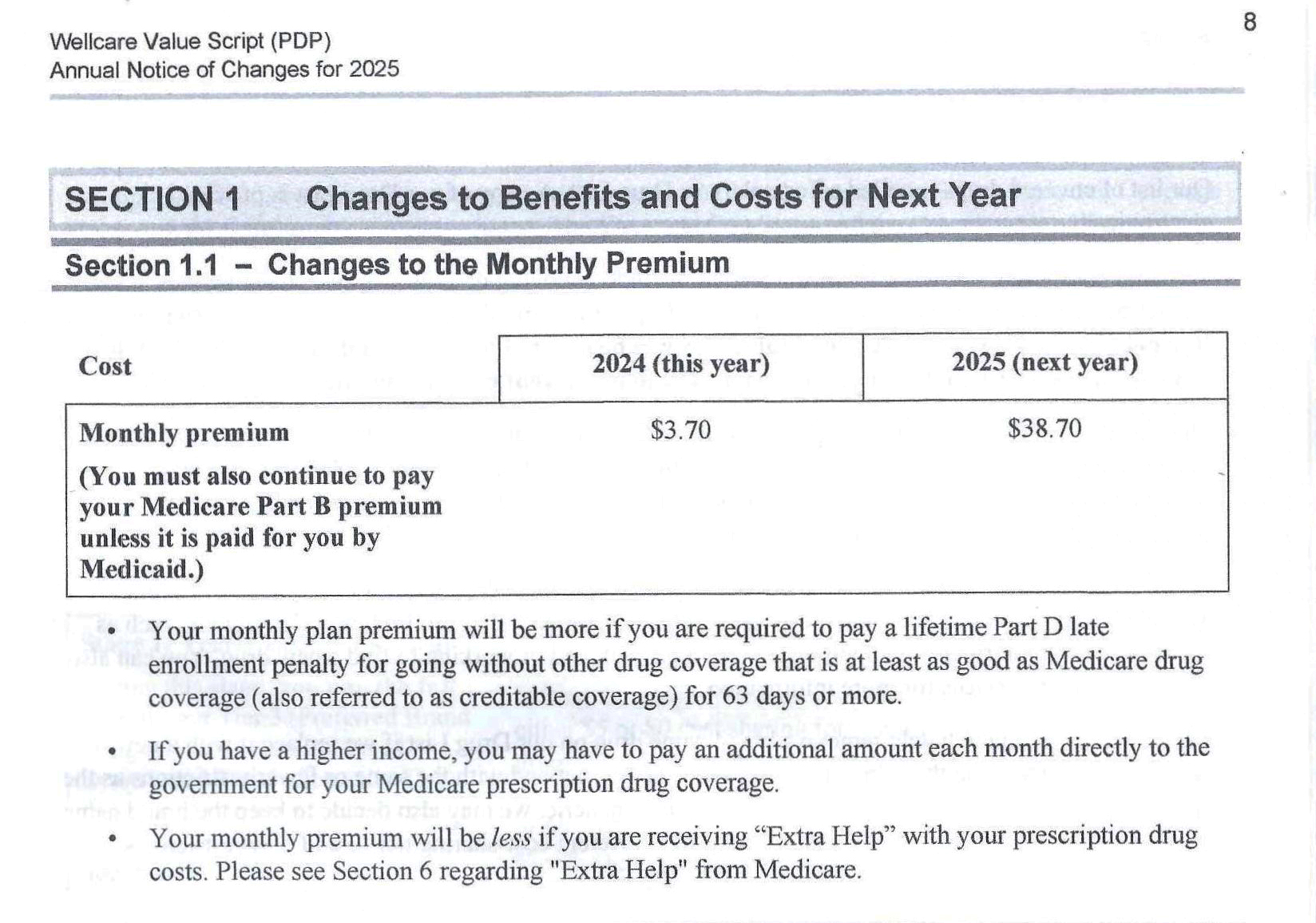

In California, for instance, Wellcare’s common Worth Script plan went from 40 cents a month to $17.40. The Worth Script plan in New York went from $3.70 a month to $38.70, a greater than tenfold hike — and exactly a $35 improve.

Cubanski recognized eight plans in California that raised their premiums precisely $35 a month. KFF Well being Information discovered that premiums went up for no less than 70% of drug plans supplied in California, Texas, and New York and for about half of plans in Florida and Pennsylvania — the 5 states with essentially the most Medicare beneficiaries.

Spokespeople for Wellcare and its mother or father firm, Centene Corp., didn’t reply to requests for remark. In a press release this month, Centene’s senior vp of scientific and specialty companies, Sarah Baiocchi, stated Wellcare would provide the Worth Script plan with no premium in 43 states.

Along with the $2,000 drug spending restrict, the IRA caps Medicare copayments for many insulin merchandise at not more than $35 a month and permits Medicare to barter costs of among the costliest medicine straight with pharmaceutical firms.

It should additionally eradicate one of many drug profit’s most irritating options, a spot referred to as the “donut gap,” which suspends protection simply as folks face rising drug prices, forcing them to pay the plan’s full worth for medicine out-of-pocket till they attain a spending threshold that adjustments from yr to yr.

The regulation additionally expands eligibility for “additional assist” subsidies for about 17 million low-income folks in Medicare drug plans and will increase the quantity of the subsidy. Drug firms will probably be required to chip in to assist pay for it.

Beginning Jan. 1, the redesigned drug profit will function extra like different personal insurance coverage insurance policies. Protection begins after sufferers pay a deductible, which will probably be not more than $590 subsequent yr. Some plans provide a smaller or no deductible, or exclude sure medicine, often cheap generics, from the deductible.

After beneficiaries spend $2,000 on deductibles and copayments, the remainder of their Half D medicine are free.

That’s as a result of the IRA raises the share of the invoice picked up by insurers and pharmaceutical firms. The regulation additionally makes an attempt to tamp down future drug worth hikes by limiting will increase to the patron worth inflation charge, which was 3.4% in 2023. If costs rise sooner than inflation, drugmakers must pay Medicare the distinction.

“Earlier than the redesign, Half D incentivized drug worth will increase,” stated Gina Upchurch, a pharmacist and the manager director of Senior PharmAssist, a Durham, North Carolina, nonprofit that counsels Medicare beneficiaries. “The way in which it’s designed now locations extra monetary obligations on the plans and producers, pressuring them to assist management costs.”

One other provision of the regulation permits beneficiaries to pay for medicine on an installment plan, as a substitute of getting to pay a hefty invoice over a brief time period. Insurers are presupposed to do the mathematics and ship policyholders a month-to-month invoice, which will probably be adjusted if medicine are added or dropped.

Together with huge adjustments introduced by the IRA, Medicare beneficiaries ought to put together for the inevitable surprises that come when insurers revise their plans for a brand new yr. Along with elevating premiums, insurers can drop lined medicine and eradicate pharmacies, docs, or different companies from the supplier networks beneficiaries should use.

Lacking the chance to modify plans means protection will renew robotically, even when it prices extra or not covers wanted medicine or most well-liked pharmacies. Most beneficiaries are locked into Medicare drug and Benefit plans for the yr except CMS offers them a “particular enrollment interval.”

“We do have a system that’s run by personal well being plans,” CMS chief Brooks-LaSure stated. However she famous that beneficiaries “have the power to alter their plans.”

However many don’t take the time to match dozens of plans that may cowl totally different medicine at totally different costs from totally different pharmacies — even when the trouble might save them cash. In 2021, solely 18% of Medicare Benefit drug plan enrollees and 31% of stand-alone drug plan members checked their plan’s advantages and prices towards rivals’, KFF researchers discovered.

Totally free, unbiased assist choosing drug protection, contact the State Well being Insurance coverage Help Program at shiphelp.org or 1-877-839-2675.