World customers unanimously acknowledge the advantages of deploying synthetic intelligence (AI) instruments in insurance coverage but are sceptical about their industrial rollout, as per a GlobalData survey. Whereas satisfaction is excessive when interacting with AI-powered instruments, insurers might want to construct buyer belief because the know-how turns into extra ingrained in operations.

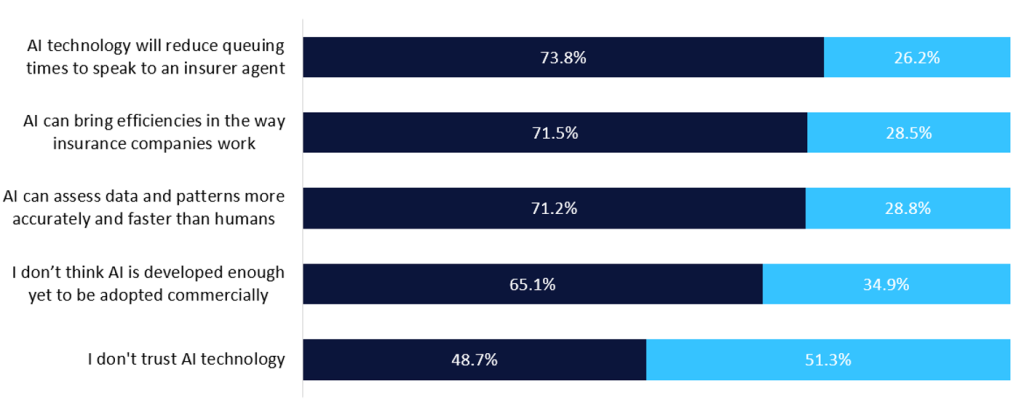

In keeping with GlobalData’s 2024 Rising Tendencies Insurance coverage Shopper Survey, there’s a robust perception that AI can cut back queuing occasions to talk to insurance coverage brokers, as cited by 73.8% of customers. In the meantime, a barely decrease proportion of customers imagine the usage of AI may end up in operational efficiencies (71.5%), whereas additionally citing the know-how is best at sample recognition than people (71.2%).

Do you agree or disagree with the next statements? 2024

However, there are challenges that insurers should deal with to make sure customers will fortunately use the AI instruments they’re investing in and deploying, as most discover that the know-how will not be sufficiently developed to be adopted at scale, eroding their belief. Guaranteeing transparency in AI-driven selections shall be key to overcoming belief points, and this shall be of utmost significance amongst those that understand that such instruments are programmed with a bias, comparable to offering destructive declare outcomes. Others could have issues over information privateness or may favor interacting with a human, or not less than favor having the chance to take action if interacting with automated instruments is irritating them. As such, it’s crucial for insurers to be current throughout all channels so that buyers don’t understand that they’re pushed to make use of on-line or automated channels, with help over the telephone or nose to nose supplied if desired. Regardless of scepticism surrounding the usage of AI instruments at a industrial scale, and maybe even reluctancy, satisfaction ranges amongst clients utilizing such instruments are excessive. Additional findings from GlobalData’s survey reveal that 74.5% of consumers utilizing insurance coverage chatbots had been both happy or very happy by the expertise. This has been additional echoed by claims made by Lemonade, an insurtech relying completely on AI to course of claims with none enter by any means of human brokers. At a keynote speech on the 2025 Insurtech Insights Europe convention, Lemonade’s founder proclaimed to have seen its buyer satisfaction ranges improve each time duties are moved from people to AI.

Most definitely, the usage of AI will remodel the insurance coverage trade in a number of methods and also will drive operational efficiencies and value reductions. As an illustration, the supply of AI instruments brings a brand new paradigm in that help or buyer assist could be supplied 24/7, whereas the automation of claims processing resulting in diminished settlement occasions will naturally be seen favourably by customers. On the similar time, the velocity and precision of AI in sample recognition signifies that dangers could be quantified extra precisely and insurance policies priced extra pretty, whereas fraud detection could be improved. Whereas all in all, AI has the potential of significantly enhancing satisfaction charges in insurance coverage, the necessity for the human contact and empathy in engagements proceed to restrict its full potential. Higher communication surrounding AI’s capabilities and nuances will in the end result in improved adoption charges.