Over the previous 12 months, motor insurance coverage premiums have seen a notable decline. Whereas trade insiders anticipated that motor insurance coverage charges would improve greater than these for journey, pet, personal medical, and life insurance coverage in 2024, the precise outcomes have diverged from these expectations.

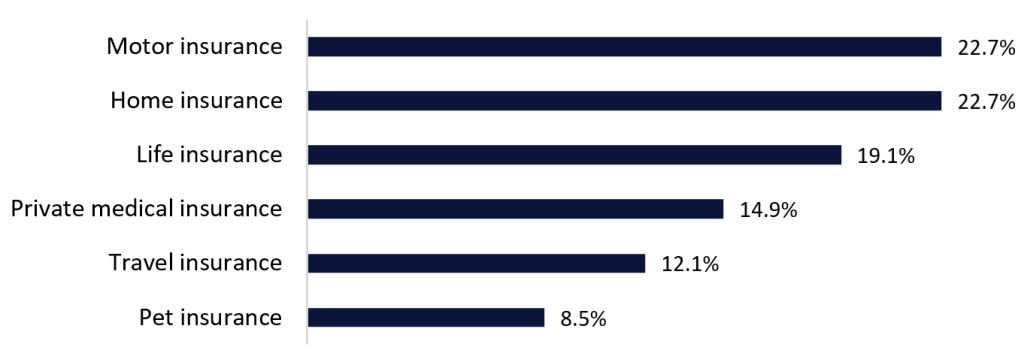

A GlobalData ballot carried out on Verdict Media websites in Q2 2024 revealed that 22.7% of trade professionals recognized motor and residential insurance coverage because the sectors more likely to expertise essentially the most substantial premium will increase within the coming 12 months. This outlook was influenced by an inflationary setting characterised by rising restore prices, provide chain disruptions, and an uptick in each the frequency and severity of claims. Components equivalent to excessive inflation driving up claims settlement prices and sharp will increase in car components and restore bills as a consequence of international provide shortages contributed to this sentiment.

Which insurance coverage line will see premiums rise essentially the most within the subsequent 12 months? 2024

Nevertheless, the newest basic insurance coverage value index from Pearson Ham Group signifies a distinction to those earlier predictions. The index exhibits that the typical quoted motor insurance coverage premium has really decreased by 17% over the previous 12 months, marking a major reversal in development.

This decline in motor insurance coverage premiums might be attributed to a number of components, together with a discount in inflation and heightened competitors throughout the trade, resulting in aggressive pricing methods. Regardless of the drop in premiums, the trade nonetheless grapples with elevated claims prices, with a 13% improve in claims paid in 2024 in comparison with the earlier 12 months, in response to the ABI.

On this difficult financial local weather, insurers could also be specializing in buyer retention by decreasing premiums to keep up or broaden their market share. In the end, the disparity between expectations and actuality underscores the volatility of the motor insurance coverage market and the intricate relationship between financial circumstances, claims tendencies, and aggressive dynamics.