GlobalData’s latest survey highlights a development amongst youthful generations in direction of a digital-first method in automobile insurance coverage. Conventional motor insurers are urged to adapt their practices to align with the expectations of youthful clients. In keeping with insights from insurtech firm Charles Taylor, insurers can meet these evolving calls for by leveraging new applied sciences comparable to gamification and AI.

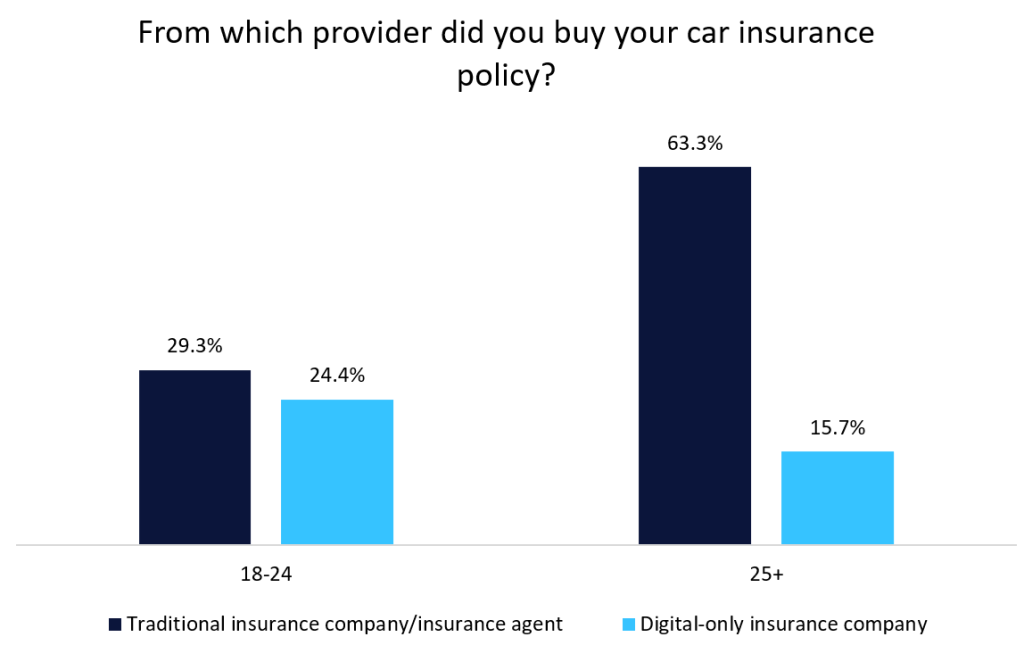

In keeping with GlobalData’s 2024 Rising Traits Insurance coverage Client Survey, there’s a notable generational shift in preferences concerning motor insurance coverage. Amongst these aged 25+, a considerable 63.3% selected conventional motor insurance coverage, whereas solely 15.7% opted for a digital-only insurance coverage supplier. In distinction, the youthful age group of 18–24 years displayed a unique development, with solely 29.3% deciding on conventional motor insurance coverage and 24.4% favouring digital-only choices.

This information highlights a big decline within the choice for conventional insurers amongst youthful customers, coupled with an increase within the adoption of digital-only insurance coverage corporations. Such developments ought to function a essential wake-up name for conventional insurers, indicating the urgency to adapt to the evolving market dynamics pushed by a youthful, tech-savvy client base that more and more favours digital options over standard strategies.

In keeping with Charles Taylor, Era Z prioritises comfort, transparency, and options that seamlessly combine into their digital existence. To fulfill these expectations, insurance coverage suppliers can leverage progressive applied sciences comparable to gamification and AI to create providers that resonate with youthful customers.

Gamification, which is quickly gaining traction, incentivises clients by permitting them to earn rewards, comparable to reductions, for demonstrating good driving habits. This method not solely engages youthful drivers but additionally encourages accountable behaviour on the street. Moreover, the usage of telematics permits insurers to supply decrease premiums to youthful drivers—a big problem for the insurance coverage business. Gadgets comparable to black packing containers monitor driving behaviour, permitting insurers to supply quotes that replicate particular person driving patterns, thereby encouraging a way of accountability amongst clients.

Insurers can additional improve their enchantment to youthful customers by adopting AI-powered claims programs. These programs streamline the claims course of and supply higher transparency, which aligns with the expectations of tech-savvy clients. By utilising AI, insurers can present a extra environment friendly and user-friendly service, making the insurance coverage expertise extra interesting to the youthful demographic.

Entry probably the most complete Firm Profiles

in the marketplace, powered by GlobalData. Save hours of analysis. Acquire aggressive edge.

Firm Profile – free

pattern

Thanks!

Your obtain e mail will arrive shortly

We’re assured concerning the

distinctive

high quality of our Firm Profiles. Nonetheless, we would like you to take advantage of

useful

determination for what you are promoting, so we provide a free pattern that you would be able to obtain by

submitting the under kind

By GlobalData

To stay aggressive in opposition to insurtechs and meet the evolving calls for of recent customers, conventional motor insurers should endure important technological transformations. Embracing digital options and progressive applied sciences is important for these insurers to maintain tempo with the expectations of youthful generations and to thrive in a quickly altering market.