GlobalData surveying has discovered that almost 1 / 4 of small- to medium-sized enterprises (SMEs) bought a cyber insurance coverage coverage as a consequence of a rise in distant working. In the meantime, Marks & Spencer (M&S) has skilled a serious cyberattack that wiped round £700m ($932.5m) off its market worth; elevating considerations that distant entry could have created the entry level cybercriminals wanted to breach the retailers’ digital defences.

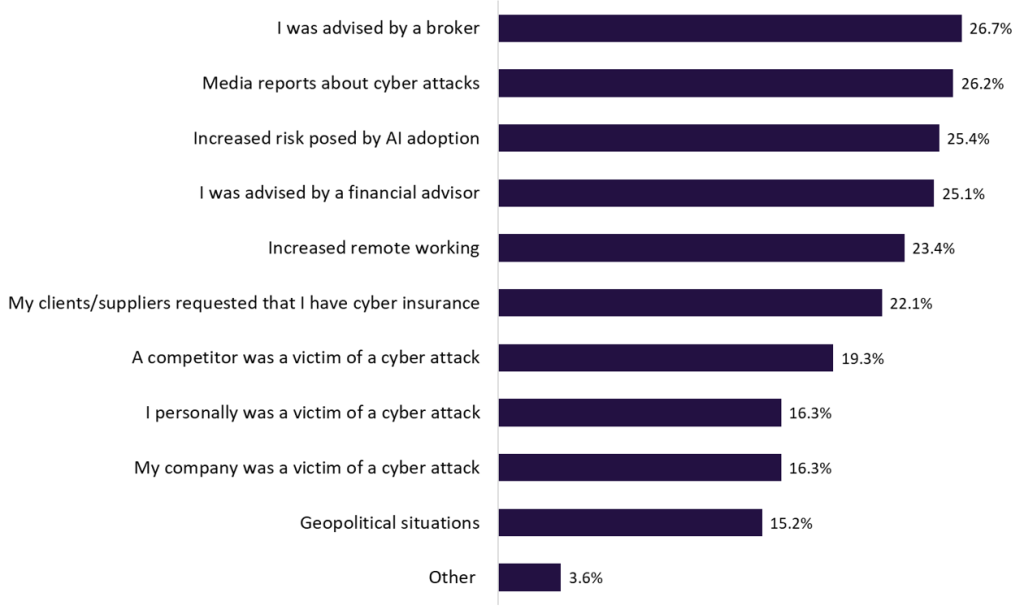

In line with GlobalData’s 2025 SME Insurance coverage Survey, 23.4% of SMEs stated they bought cyber insurance coverage as a consequence of elevated distant working. The current cyberattack on M&S reinforces this concern. Whereas the retailer has not formally blamed distant entry for the breach, its choice to disable digital non-public networks (VPNs) utilized by home-based employees suggests inner fears that distant entry could have been a weak level. This displays a broader development that hybrid working fashions proceed to introduce dangers by way of poorly-secured dwelling networks, outdated private gadgets, and fragmented oversight—vulnerabilities that cybercriminals are more and more exploiting.

What was the set off for buying cyber insurance coverage? 2025

In the meantime, 26.2% of SMEs cited media stories on cyberattacks as a cause for buying cyber cowl and the M&S breach is prone to amplify that affect. As one of many UK’s most-recognised retailers, M&S’s extremely publicised lack of practically £700m in market worth is predicted to intensify consciousness of cyber threats throughout the SME sector. With widespread information protection and public scrutiny, this incident could drive extra companies to reassess their publicity and take preventative steps, together with taking out or upgrading cyber insurance coverage insurance policies. General, the M&S cyberattack highlights the necessity for stronger cyber resilience within the age of hybrid working. As high-profile breaches increase consciousness amongst SMEs, insurers have a chance to reply with tailor-made cyber merchandise and proactive assist that addresses these threats. Brokers could also be greatest positioned to drive this variation, with GlobalData’s 2025 SME Insurance coverage Survey exhibiting that recommendation from brokers (26.7%) is the main issue influencing SME cyber insurance coverage uptake.