People are in search of to alter their insurance coverage protection extra regularly than prior to now, after a surge in premiums that’s squeezed family budgets, a brand new trade report reveals.

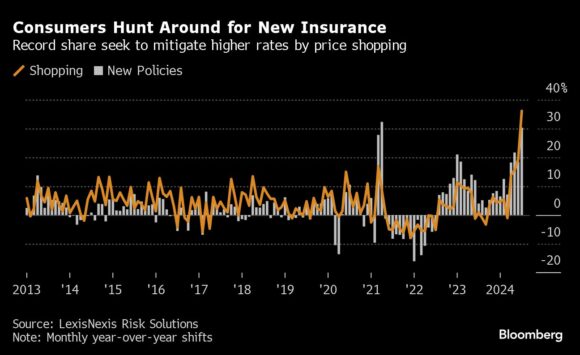

For automotive insurance coverage, so-called coverage procuring charges — primarily the share of individuals with insurance coverage who looked for quotes from a supplier — jumped a mean 16% from a 12 months earlier within the second quarter of 2024, in line with LexisNexis Threat Options, a clearing home for insurance coverage information with entry to greater than 95% of the auto coverage market. The determine climbed even increased in July, exceeding 30%.

The hunt for money-saving options displays a fast run-up in insurance coverage premiums in recent times, pushed partly by the rising value of automotive components and repairs. Whereas the general value of dwelling has climbed some 20% because the begin of the pandemic in 2020, auto insurance coverage payments have jumped by nearly 50%.

Costs are “completely” driving the procuring exercise out there proper now, mentioned Chris Rice, an govt at LexisNexis, in an interview. That’s a change from previous patterns, when it was often some form of life occasion like transferring home, shopping for a brand new automotive or including a teen to a coverage that precipitated customers to buy insurance coverage, he mentioned.

It’s not simply the auto coverage market that’s seen an enormous shift. Patrons of dwelling insurance coverage have been hit by rising prices and in addition adjustments in protection that led suppliers to drop some clients.

In California, for instance, greater than 50% of house owners mentioned they or the realm they stay in has seen insurance coverage costs improve from a 12 months earlier, in line with a survey performed by Redfin within the spring. In Florida the speed was even increased, at 70%, whereas 12% of respondents reported being dropped by their insurance coverage firm.

One motive would be the rising risk posed by excessive climate and different climate-related dangers.

“Mounting insurance coverage prices and pure disasters are prompting some folks to relocate,” in line with the Redfin examine. It discovered that Floridans who plan to maneuver home within the subsequent 12 months have been twice as possible as People general to quote the upper worth of insurance coverage as a motive.

Rice mentioned that latest will increase in insurance coverage premiums are “unprecedented” for the trade. He mentioned the LexisNexis information reveals that middle-aged and older People are particularly prone to be purchasing for different insurance policies, doubtlessly an indication of monetary stresses amongst these age cohorts.

“We’ve positively seen a marked improve amongst older folks” that’s “outpacing the opposite age profiles,” he mentioned.

Photograph: Photographer: David Paul Morris/Bloomberg

Copyright 2024 Bloomberg.

Crucial insurance coverage information,in your inbox each enterprise day.

Get the insurance coverage trade’s trusted publication