Latest investigative reporting by CBS’s 60 Minutes, famous in CBS 60 Minutes Exposes Alleged Insurance coverage Firm Fraud: Adjusters Reveal Altered Hurricane Injury Estimates by Claims Administration, has uncovered alleged widespread underpayments of claims and unethical claims practices in Florida’s property insurance coverage trade. This exposé raises critical questions concerning the effectiveness of state insurance coverage regulators, notably the Florida Division of Monetary Providers (DFS) and Workplace of Insurance coverage Regulation (OIR), in detecting and stopping systemic unhealthy religion practices by insurers. As an lawyer who has spent many years representing policyholders in opposition to insurance coverage firms, I’ve lengthy noticed the constraints of regulatory oversight on this area. The 60 Minutes report confirms what many people within the subject have suspected – that state insurance coverage departments usually lack the sophistication, assets, and maybe even the need to uncover deeply entrenched patterns of wrongdoing by insurers.

The CBS 60 Minutes Bombshell

The 60 Minutes investigation featured whistleblowers alleging that a number of Florida insurance coverage carriers, together with Heritage Insurance coverage, systematically altered harm reviews to drastically cut back payouts to policyholders after Hurricane Ian. One insurance coverage firm adjuster claimed that 44 out of 46 of his Hurricane Ian reviews for Heritage have been adjusted to offer policyholders much less cash, with one estimate slashed from $488,000 to simply $13,051.

These allegations level to a possible sample of deliberate underpayment of claims on an enormous scale. If true, such practices would represent egregious unhealthy religion conduct by insurers. But regardless of the gravity of those claims, Florida’s insurance coverage regulators seem to have been caught flat-footed, with no indication they have been conscious of or investigating such widespread malfeasance previous to the 60 Minutes report.

Regulatory Incompetence or Willful Blindness?

The failure of the Florida DFS and OIR to detect these alleged fraudulent practices raises troubling questions concerning the competence and effectiveness of insurance coverage regulators. As I famous in a latest weblog put up, Florida’s Insurance coverage Firm Fraud Investigations: A Disaster of Public Belief (With a Facet of Absurdity), there are critical issues concerning the means of those businesses to correctly examine wrongdoing.

In a single virtually comical instance of regulatory ineptitude, I discovered myself having to offer DFS investigators with the mobile phone numbers of whistleblowers they claimed they may not find – regardless of these people having given sworn testimony to the Florida legislature. If state regulators and their investigators can not even carry out primary investigative duties like finding key witnesses, how can we count on them to unravel advanced insurance coverage fraud schemes? Do they know what they’re doing and find out how to generate proof of wrongful claims processes? Do they even know what a wrongful claims course of is as a result of they’ve by no means been educated about this subject?

This incompetence seems to increase past simply investigative capabilities. In a weird incident, the Chief of the Bureau of Investigation for the DFS Division of Insurance coverage Agent & Company Providers filed a bar criticism in opposition to me, alleging I didn’t have a Florida license to apply legislation. As somebody who has been a member of the Florida Bar since 1983 and has practiced insurance coverage legislation within the state for 4 many years, was appointed to the Residents Insurance coverage Firm Overview Job Drive as a lawyer representing policyholders, testified in quite a few Florida legislative hearings and publicly have been scripting this weblog for almost 20 years, I discovered this accusation each baffling and deeply regarding. It speaks to a elementary lack of primary fact-checking, due diligence and maintaining with the occasions and delicate points inside Florida’s insurance coverage market.

Are trustworthy regulators passionate and educated sufficient to ferret out wrongful claims practices by insurance coverage firms which have very refined processes to cowl up the sham of excellent religion claims conduct?

Lack of Sophistication in Uncovering Unhealthy Religion Practices

The obvious lack of ability of insurance coverage regulators to detect the sort of systemic fraud alleged within the 60 Minutes report factors to a broader lack of sophistication in how these businesses strategy investigations. Our legislation agency usually litigates unhealthy religion instances in opposition to insurers throughout the nation, and we’re intimately conversant in the advanced and sometimes opaque methods wherein insurance coverage firms have interaction in unethical practices. So are the insurance coverage protection attorneys who attempt to maintain these practices as commerce secrets and techniques.

Uncovering unhealthy religion conduct sometimes requires a deep understanding of insurance coverage firm operations, claims dealing with procedures, and inside incentive constructions. It calls for rigorous evaluation of claims knowledge, thorough examination of inside paperwork and communications, and expert interviewing of firm personnel. Primarily based on my expertise, many state insurance coverage departments merely lack the experience and assets to conduct this stage of in-depth investigation. The place do they go to discover ways to do that? What’s their motivation to take action?

This deficiency is clear within the varieties of discovery requests and investigative methods employed by regulators. In our apply, we now have developed in depth lists of doc requests, interrogatories, and deposition questions particularly tailor-made to reveal unhealthy religion practices. These embody calls for for:

- Full claims recordsdata, together with adjuster notes and communications

- Claims dealing with manuals and coaching supplies

- Inside emails and different communications associated to claims objectives, directives, and tradition

- Data on claims reserves, how they’re set and causes for change, together with inside dialogue with offshore reinsurance claims executives about find out how to decrease funds

- Personnel recordsdata of claims handlers and their supervisors, which embody claims division objectives and the evaluation of how departments and people are performing

- Paperwork associated to efficiency evaluations and compensation constructions, particularly for claims and firm executives

State regulators, against this, usually depend on rather more restricted and superficial data gathering. They could assessment a small pattern of claims recordsdata or conduct cursory interviews with firm representatives however hardly ever dig deep sufficient to uncover systemic points or deliberate misconduct.

The Heritage CEO gave a laughable inside survey suggesting that that they had uncovered every little thing and that the one-million-dollar positive was a penalty for what had occurred prior to now and had been corrected. If they need the reality, regulatory officers and the Heritage Board of Administrators ought to audit this assertion and the survey whereas permitting some third get together like me to do an actual survey of what’s going on.

The Drawback of Regulatory Seize

Past mere incompetence or lack of assets, there are additionally respectable issues about whether or not insurance coverage regulators have turn out to be too cozy with the trade they’re meant to supervise. This phenomenon, generally known as “regulatory seize,” may end up in authorities businesses and politicians prioritizing trade pursuits over shopper safety.

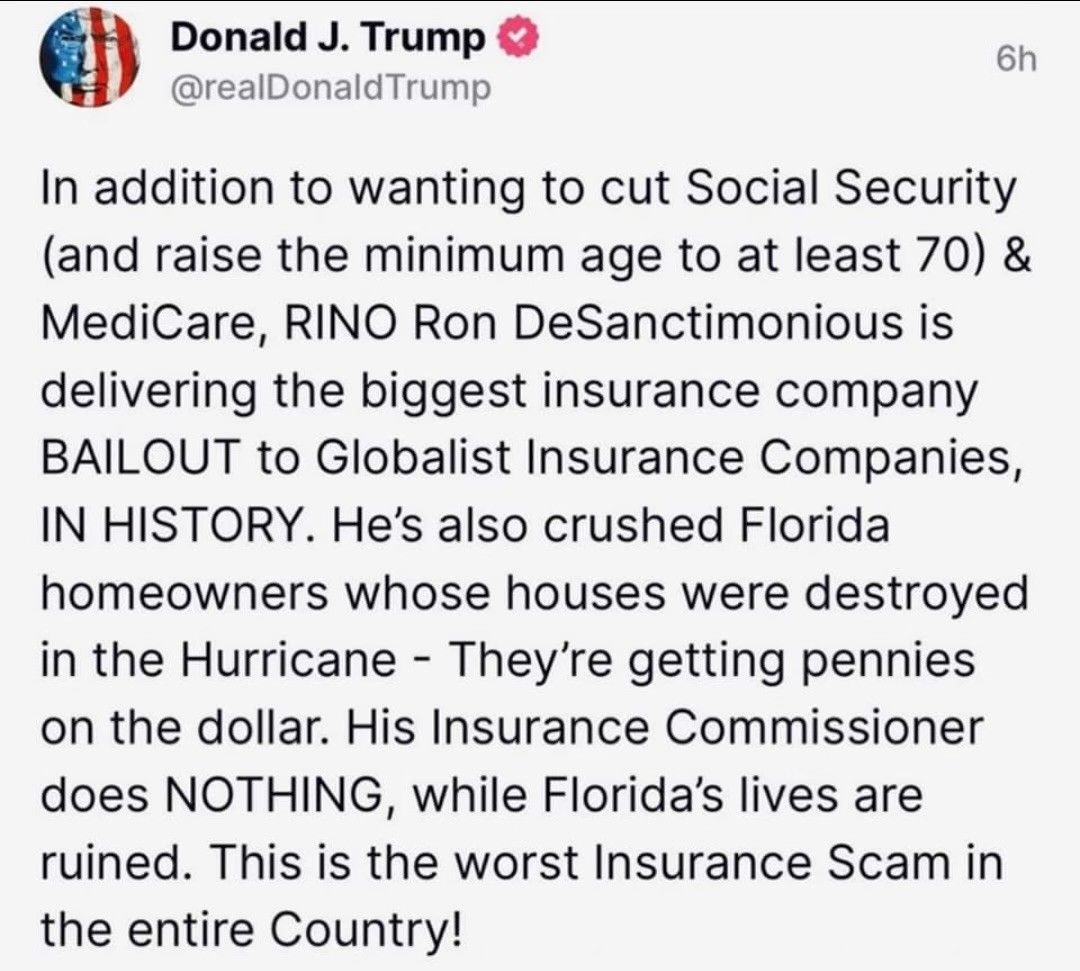

In Florida, there have been troubling indications of an excessively shut relationship between regulators and insurers. As an illustration, the state’s new Insurance coverage Commissioner, Michael Yaworsky, should reply questions on his ties to the insurance coverage trade and whether or not he can be an efficient advocate for shoppers as a result of most Floridians now see his two bosses, Jimmy Patronis and Ron DeSantis, as in being in mattress with the insurance coverage trade. Even the primary Republican in your complete nation, Donald Trump, has known as out DeSantis and Florida’s political management for being in mattress with insurance coverage lobbyists.

As famous in Donald Trump and Chip Merlin Agree—Ron DeSantis and Florida Republican Management Have Bought Out to Insurance coverage Firm Lobbyists, this quote by Trump after the Florida legislature wrote legal guidelines to guard insurance coverage firms, which DeSantis nonetheless tries to defend as being for policyholders, proves what many consider—that Florida politicians are in mattress with insurance coverage firms and their lobbyists to the detriment of the voters:

This Republican Management/Insurance coverage Business coziness might assist clarify why regulators appear reluctant to aggressively examine allegations of wrongdoing or impose significant penalties when violations are discovered. It might additionally contribute to a tradition of secrecy round unhealthy religion practices, with regulators too usually accepting insurers’ claims of commerce secrets and techniques or confidentiality to defend doubtlessly damaging data from public scrutiny.

The Significance of Efficient and Completely different Market Conduct Exams

One key device that insurance coverage regulators have at their disposal however usually underutilize is the market conduct examination. These exams enable regulators to conduct in-depth evaluations of an insurer’s practices to make sure compliance with state legal guidelines and rules. When correctly executed, market conduct exams might be extremely efficient in uncovering systemic points and unhealthy religion practices.

Nevertheless, as we famous in a weblog put up, The Case of the Lacking Market Conduct Exams, many states have didn’t constantly conduct and publish these essential examinations. Whereas some market conduct exams have been carried out in Florida, they usually appear to lead to comparatively minor fines or corrective motion plans that do little to basically change insurer habits. If an insurer saves $100 million by underpaying claims and pays a $1 million positive, why not simply “pay the ticket” relatively than change the habits?

The failure to usually conduct rigorous market conduct exams represents a significant missed alternative for regulators to detect and deal with the sort of widespread fraud alleged within the 60 Minutes report. It additionally deprives the general public and policyholders of helpful details about insurer conduct that would inform their selections and assist maintain firms accountable. I attempted to make clear this in Understanding the Implications of the Heritage Market Conduct Examine and $1 Million Consent Order Penalty.

The Want for Reform and Enhanced Regulatory Capabilities

The revelations from the 60 Minutes investigation, coupled with the obvious lack of ability of Florida’s insurance coverage regulators to detect these alleged wrongful claims practices leading to systemic underpayment of claims, spotlight the pressing want for reform and enhanced regulatory capabilities. Some key areas for enchancment embody:

- Elevated funding and staffing: State insurance coverage departments want considerably extra assets to draw and retain expert investigators, knowledge analysts, and trade specialists able to uncovering advanced fraud schemes.

- Enhanced coaching: Regulators ought to obtain ongoing coaching on the most recent trade practices, expertise, and investigative methods to maintain tempo with evolving unhealthy religion ways. How do you uncover claims practices when you don’t perceive the sphere or methods of how insurance coverage claims administration accomplishes these?

- Better transparency: Market conduct exams, investigation outcomes, and different regulatory actions needs to be made available to the general public to extend accountability, and the way of the evaluations needs to be topic to criticism by policyholders and the general public. Folks ought to perceive {that a} main insurance coverage advisor firm made the present standards to defend its insurer shoppers from vital assessment of insurance coverage wrongful claims practices, as famous in “What’s the Historical past of Market Conduct Research?”

- Stronger whistleblower protections: Regulators ought to set up sturdy channels for trade insiders to report misconduct with out worry of retaliation. It needs to be unlawful for any insurance coverage firm or unbiased insurance coverage firm to penalize or maintain secret any worker who believes a claims apply or act is unethical. Impartial and firm adjusters are sometimes threatened with sanctions and penalties once they whistle blow or make clear wrongful claims conduct. Any contract that means this needs to be unlawful and prison. The secrecy is what drives the wrongful claims conduct.

- Harder Unfair Claims Observe Legal guidelines and Penalties: The victims ought to be capable to carry go well with to cease the wrongful claims apply. Civil penalties, fines and different penalties for unhealthy religion practices needs to be considerably elevated to create a real deterrent impact. The victims, relatively than the federal government, ought to be capable to do that.

The Path Ahead

The CBS 60 Minutes exposé has laid naked the evident inadequacies of our present insurance coverage regulatory system, notably in Florida. State insurance coverage departments, as at the moment constituted, lack the sophistication, assets, and maybe even the motivation to successfully uncover and fight systemic unhealthy religion practices by insurers.

The insurance coverage trade performs an important function in our economic system and society, nevertheless it have to be held to the very best requirements of moral conduct. When regulators fail to offer satisfactory oversight, it’s finally shoppers who are suffering. We deserve higher.

We should demand higher from our insurance coverage regulators. This implies not solely pushing for the reforms outlined above but additionally sustaining fixed vigilance and stress on each the trade and people tasked with overseeing it. Solely by way of a concerted effort to boost regulatory capabilities and improve transparency can we hope to create an insurance coverage market that genuinely serves the pursuits of policyholders.

The 60 Minutes report ought to function a wake-up name – not simply to regulators and policymakers however to all of us who consider within the significance of a good and trustworthy insurance coverage system. The time for significant reform is now. The query is, will our regulators and elected officers heed the decision, or will they proceed to show a blind eye to the systemic abuses occurring proper below their noses?

Thought For The Day

One of many truest exams of integrity is its blunt refusal to be compromised.

—Chinua Achebe

An Previous Track For A Day After All The Flooding From Helene

A Newer Model Of The Track