As property/casualty insurers improve their deal with predicting and stopping expensive injury that drives up claims and premiums, telematics know-how has come to play an growing position. From video doorbells that cut back theft and vandalism to “sensible plumbing” options that detect leaks and shut off water earlier than in-home flooding can happen, these applied sciences clearly supply worth to owners and insurers.

However how a lot worth?

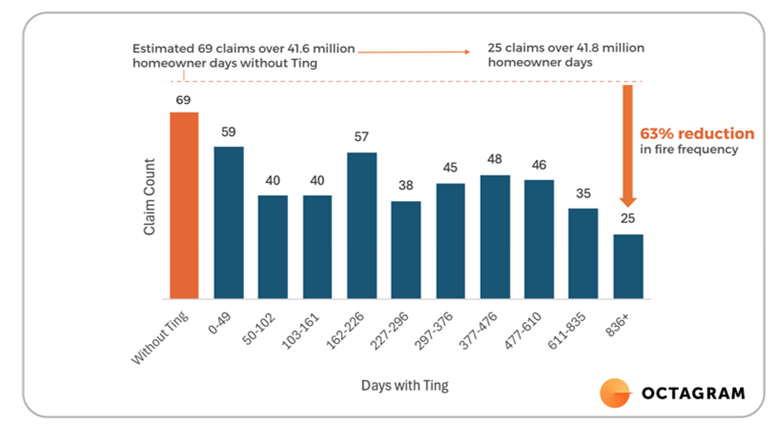

Whisker Labs – maker of the Ting residence hearth prevention answer – has taken on the problem of quantifying its product’s efficacy and return on funding. In a analysis partnership with Octagram Analytics for impartial knowledge evaluation and modeling and Triple-I for its insurance coverage business experience and perception, Whisker Labs discovered that Ting decreased hearth claims inside the examine pattern by an estimated 63 %, leading to 0.39 fewer electrical hearth claims per 1,000 residence years of expertise, within the third 12 months after set up. This interprets into a fireplace claims discount advantage of $81 per buyer.

“This examine offers concrete proof of the worth that telematics know-how can ship,” stated Patrick Schmid, chief insurance coverage officer at Triple-I. “Whereas IoT options are gaining traction with many success tales, rigorous evaluation of claims discount has been tougher to search out till now. This evaluation clearly exhibits Ting reduces claims and offers a constructive return on funding for insurers.”

The analysis could be learn right here.

How Ting works

Ting helps defend properties from electrical fires through the use of superior AI to detect arcing, the precursor to {most electrical} fires. As soon as linked to a single outlet, Ting analyzes 30 million measurements per second, analyzing voltage at excessive frequencies to detect tiny electrical anomalies and energy high quality issues. These hazards can originate from wiring within the residence, linked units and home equipment, and even the ability coming in from the utility. On common, Ting detects and mitigates hearth hazards in 1 out of each 60 properties it protects.

“Ting is about saving lives and houses – that’s all the time been our mission,” stated Bob Marshall, CEO and cofounder of Whisker Labs. “By analyzing verified claims knowledge over time, this evaluation exhibits that what’s finest for households additionally delivers a powerful monetary return for insurers. Prevention is healthier for everybody.”

Whisker Labs works with a rising neighborhood of 30 insurers who present Ting to their clients totally free. Multiple million Tings are deployed in the USA, and roughly 50,000 new Tings are put in every month.

Along with monitoring voltage and options of voltage at excessive frequencies to detect arcing that’s indicative of fireside hazards, Ting has a temperature sensor that displays the temperature inside the residence.

“When the temperature drops beneath 42 levels, an alert is issued,” Marshall stated. “Thus, Ting detects and warns about situations that can lead to frozen and burst pipes and alerts the house owner to appropriate the state of affairs earlier than injury happens. Over the previous three years, we’ve got issued low-temperature warnings to about 1 in 560 clients per 12 months.”

Measuring the worth

Like Ting, different peril-based IoT options problem alerts and warnings when a hazard is detected. 1000’s of hazards are detected and alerts despatched, however how are you aware that this reduces claims? How do you estimate the return on funding for these units? How will you show that the dangerous factor, a loss and a declare, didn’t happen?

“We developed a strategy to do that in the actual world with current clients and expertise knowledge,” stated Whisker Labs Chief Scientist Stan Heckman.

Whisker Labs and Octagram needed to overcome challenges associated to restricted knowledge and sampling bias. To deal with these, a self-controlled examine was developed that assesses claims over time in properties with Ting in place. (See paper for a fuller clarification of the methodology).

The chart beneath exhibits how the variety of hearth claims in Ting-equipped properties declines over time. The claims frequencies noticed and related % discount in claims are extremely depending on the definition of the pattern of non-cat hearth claims supplied by carriers that participated within the evaluation. Nevertheless, this doesn’t have an effect on the noticed absolute discount.

Utilizing knowledge from Triple-I and Verisk, Whisker Labs decided that Ting offers a loss-prevention advantage of $81 per residence per 12 months. (See paper for particulars).

“Add in advantages related to discount in water-related losses from frozen pipes and failing sump pumps and water heaters,” and the advantages are possible considerably larger, Marshall stated. Insurers who present Ting to their policyholders additionally might get pleasure from enhancements in buyer retention.

Study Extra:

Human Wants Drive Insurance coverage and Ought to Drive Tech Options

JIF 2024: What Resilience Success Appears Like

Evolving Dangers Demand Built-in Approaches

Triple-I City Corridor Amplified Calls to Assault Local weather Danger