By Lewis Nibbelin, Analysis Author, Triple-I

Jamaica will obtain a $150 million payout following devastation from Hurricane Melissa from its parametric disaster coverage. Although one of many largest such payouts lately, the loss “had little or no influence” on traders within the bonds backing the coverage.

Traders in insurance-linked securities (ILS) “perceive that these dangers are a part of what they cowl,” stated Jean-Louis Monnier, head of ILS Different Capital Companions at Swiss Re.

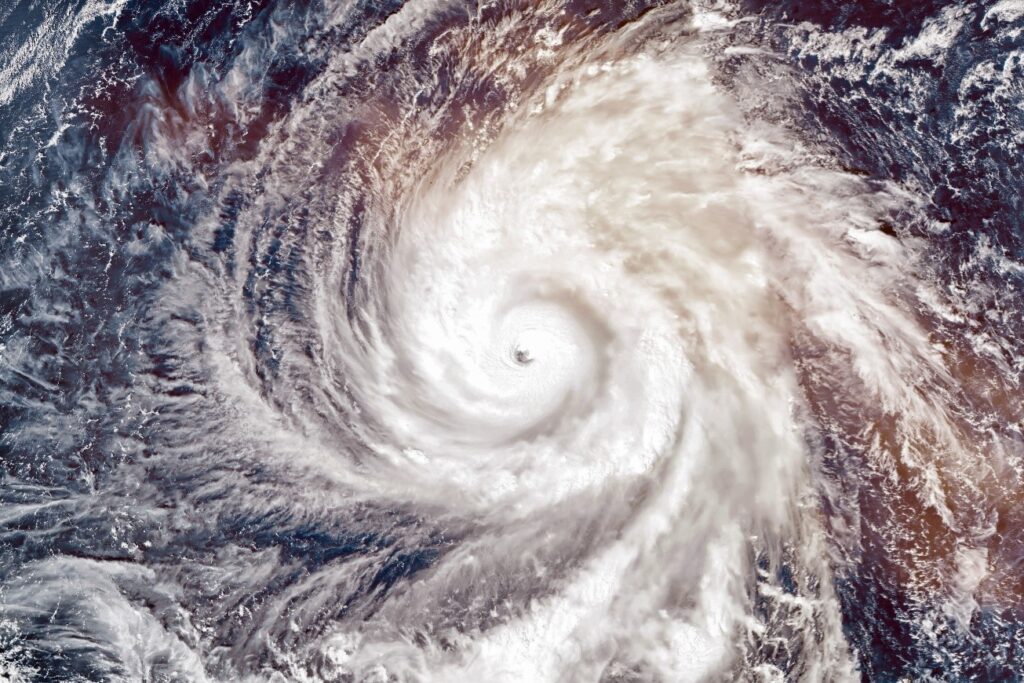

Among the many strongest Atlantic hurricanes ever recorded, Hurricane Melissa turned essentially the most highly effective cyclone to make landfall within the island’s historical past, inflicting an estimated $6 billion to $7 billion in damages and at the very least 75 deaths throughout the Caribbean. With a minimal central stress of 892 millibars, the storm met the parametric thresholds for a full payout. The coverage was backed by a bond issued in 2024 by the World Financial institution via its Worldwide Financial institution for Reconstruction and Growth (IBRD) and structured by Aon Securities and Swiss Re Capital Markets.

Not like conventional indemnity insurance coverage, parametric insurance coverage covers dangers with out sending adjusters to guage post-catastrophe harm. Slightly than paying for damages incurred, insurance policies pay out if sure circumstances are met – for instance, if wind speeds or rainfall measurements meet a longtime threshold. Pace of cost and diminished administration prices can ease the burden on insurers whereas expediting restoration for policyholders.

Figuring out applicable parametric triggers is not any simple activity. Only a 12 months earlier, the identical coverage didn’t pay out after air stress ranges narrowly missed the predefined minimal throughout Hurricane Beryl, regardless of widespread destruction. The following backlash generated better public and trade scrutiny over parametric protection, together with an intergovernmental “examination” into the ILS market broadly.

Monnier defined that this particular bond was designed to answer bigger occasions like Melissa, as a part of the nation’s in depth danger administration technique that encompasses many layers of safety. Parametric protection from Skyline Companions and Munich Re, as an example, provided a partial payout after Beryl, as did the Caribbean Disaster Danger Insurance coverage Facility Segregated Portfolio Firm, which issued its largest single payout in historical past at $70.8 million after Melissa.

In a press launch on the payout, World Financial institution vice chairman and treasurer Jorge Acquainted emphasised the “proactive strategy” of Jamaica’s catastrophe danger administration, noting it might “function a mannequin for nations going through comparable threats and searching for to strengthen their monetary resilience to pure disasters.”

Estimated to succeed in $34.4 billion by 2033, the worldwide parametric insurance coverage market is rising at a fast tempo, pushed by more and more extreme local weather and weather-related dangers. But many trade leaders establish parametric buildings as much less complete – and due to this fact not an alternative choice to – conventional indemnity danger transfers. By design, parametric insurance coverage correlates to measurable occasions slightly than precise damages, resulting in an innate foundation danger when the 2 don’t completely align.

Whereas indemnity protection is “usually preferable,” parametric buildings can “complement different types of insurance coverage” and are significantly useful for sovereigns, which are likely to lack the granular knowledge wanted to tell underwriting and pricing of indemnity disaster bonds, based on Monnier.

“Many nations use each devices, and they are often very complementary,” Monnier concluded. “There’s a massive world safety hole, and Swiss Re advocates for lowering that hole, whether or not via conventional reinsurance or by structuring capital-market options.”

Study Extra:

Parametric Insurance coverage Positive factors Traction Throughout U.S.

Hurricane Delta Triggered Coral Reef Parametric Insurance coverage

Mangrove Insurance coverage: Parametric + Indemnity Could Support Coastal Resilience