By William Nibbelin, Senior Analysis Actuary, Triple-I

In line with a brand new research by the Insurance coverage Analysis Council (IRC), the speed submitting course of for private auto insurance coverage has turn out to be extra inefficient and ineffective, taking longer to attain fee approval with increased incidence of accredited fee impression decrease than filed fee impression and a bigger disparity between the speed impression accredited and the speed impression filed.

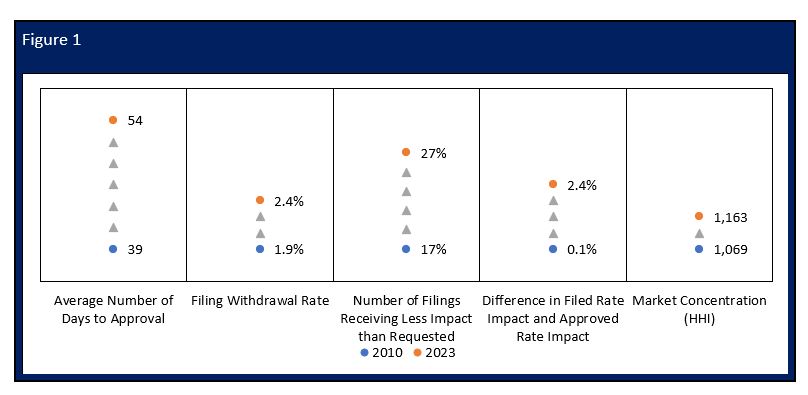

The report, Charge Regulation in Private Auto Insurance coverage: A Comparability of State Programs, analyzes Private Auto Insurance coverage trade knowledge from 2010 by means of 2023 throughout all states and the District of Columbia. Key findings:

- There have been roughly 10,200 fee filings every year with out a lot variance throughout the interval.

- The common variety of days to approval grew from 39 to 54 days.

- The variety of filings withdrawn elevated from 1,900 to three,200.

- The proportion of filings receiving much less fee impression than requested grew 10 factors.

- The disparity in accredited fee impression grew by greater than 2 factors.

- Market focus (as measured by the Herfindahl-Hirschman Index, or HHI) elevated by 9 %.

- A powerful-to-moderate correlation exists between internet underwriting losses and premium shortfalls inside states and throughout time.

- Submitting course of measures and market outcomes differ by regulatory techniques.

Throughout this identical interval from 2010 by means of 2023, the non-public auto insurance coverage trade skilled a direct mixed ratio over 100 in 11 of the 14 years. Mixed ratio is a key measure of underwriting profitability for insurance coverage carriers, calculated as losses and bills divided by earned premium plus working bills divided by written premium. A mixed ratio over 100 represents an underwriting loss. The report consists of the willpower of a robust correlation between underwriting loss and premium shortfalls, outlined because the potential greenback distinction between the efficient filed fee impression and accredited fee impression.

Overview of Charge Regulation

Insurance coverage is regulated by the states. This method of regulation stems from the McCarran-Ferguson Act of 1945, which describes state regulation and taxation of the trade as being in “the general public curiosity” and clearly provides it preeminence over federal legislation.

Whereas the regulatory processes in every state differ, three rules information each state’s fee regulation system (Regulation | III): that charges be sufficient (to keep up insurance coverage firm solvency) however not extreme (not so excessive as to result in exorbitant earnings) nor unfairly discriminatory (value variations should replicate anticipated declare and expense variations).

In line with the NAIC (NAIC Auto Insurance coverage Database Report, p. 193), the first regulatory approaches embody:

- Prior Approval System: Insurance coverage corporations should file their charges and get approval from the state insurance coverage division earlier than utilizing them.

- Flex Score: States enable insurers to alter charges inside a pre-established vary (typically a share enhance or lower) without having approval. Bigger adjustments, nevertheless, require prior approval.

- File-and-Use System: Insurers can file charges with the state and start utilizing them instantly or after a set interval. The charges can nonetheless be reviewed by regulators, however they don’t require prior approval.

- Use-and-File System: Insurers can implement new charges with out prior approval however should file them with the state inside a sure interval after they begin getting used. Regulators can evaluation and doubtlessly disapprove them later.

- No Submitting: In some states, insurers shouldn’t have to file charges for sure traces of insurance coverage. The concept is that competitors amongst insurers will preserve charges in examine. Nevertheless, regulators nonetheless have authority to intervene if charges are deemed unreasonable.

Regulatory Programs

IRC used Nationwide Affiliation of Insurance coverage Commissioners (NAIC) definitions to section states into 4 regulatory techniques: Prior Approval, File and Use, Use and File (together with No Submitting states), and a further section, Charge Cap, for Flex Score states and any state with an specific fee impression cap on fee filings per state rules.

The report then highlights key findings and different market outcomes throughout these 4 regulatory atmosphere techniques. For instance, the research decided underwriting profitability in private auto insurance coverage was weakest in Charge Cap states throughout the interval from 2010 by means of 2023 with the best common direct mixed ratio of any regulatory atmosphere system in 2023. Prior Approval states had the second highest.

Under are a few of the outcomes of this research for California private auto, which performs worse on a number of key fee submitting course of measures.

California

California has an specific fee cap of seven % (California Insurance coverage Code Article 161.05) and is subsequently labeled as a Charge Cap regulatory atmosphere system within the IRC research. California solely rivals Colorado for the best common variety of days to approval over the previous seven years and has the best common variety of days to approval for 2023 at 246 in comparison with the following highest, Colorado, at 167.

California additionally has the best common withdrawn fee throughout all states at 14.1 % from 2010 to 2023. From 2010 to 2023, California achieved a Direct Mixed Ratio beneath 100 4 occasions, and the newest three-year direct mixed ratio is 110.4, in comparison with the countrywide 106.4. The residual market has grown in California from 0.01 % in 2010 to 0.09 % in 2021 which is increased than the countrywide common of 0.07 %.