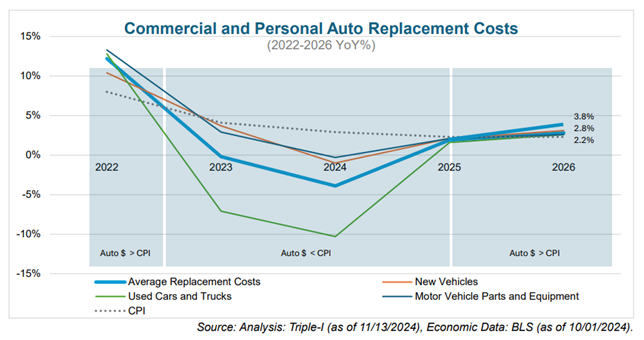

Triple-I expects the tempo of improve in common property/casualty insurance coverage alternative prices to exceed will increase within the shopper worth index in 2025 and past as auto alternative prices rise for the primary time since 2022 and CPI continues to say no.

Triple-I’s alternative price index for private and industrial auto tracks adjustments within the worth of autos, components, and gear that make up the alternative prices dealing with insurance coverage carriers offering collision insurance coverage for each private and industrial motor autos. These prices – which have elevated by as a lot as 30 % over the previous 5 years – are anticipated to extend by 2.8 % in 2025.

The index combines alternative prices information for motor autos by age and for components and gear from the CPI for All City Customers. These price drivers have been chosen from a wider collection of U.S. authorities sources, together with the Bureau of Labor Statistics, Bureau of Financial Evaluation, Federal Reserve, Census Bureau, and the Departments of Labor, Transportation, and Power.

“Whereas we count on the financial drivers of P/C insurance coverage efficiency to proceed enhancing 2025, efficiency will probably be constrained by alternative price will increase, rising pure disaster losses, and geopolitical uncertainty,” mentioned Triple-I Chief Economist Dr. Michel Léonard.